The vast majority of high-net-worth (HNW) buyers wish to make a distinction—even when they received’t get a tax break for it. Research present that the majority of those buyers—sometimes outlined as these with a internet price of at the very least $5 million—view charitable giving as intertwined with their total wealth technique and never as an exercise motivated by tax advantages. In case you have a tendency to emphasise the tax implications of varied gifting methods upfront, you might wish to change the way you method charitable planning conversations with HNW purchasers.

By trying into the various ways in which new HNW purchasers can provide to a trigger they care about, you’ve got a possibility to get to know what issues to them at the beginning of the connection whereas serving to them take a holistic view of how their philanthropy is tied to their wealth planning.

Some buyers will come to those talks with particular causes in thoughts, typically due to a private connection (corresponding to their alma mater, a household sickness, or a neighborhood group). Others will need assist determining what ought to matter to them at the moment of their life.

To satisfy them the place they’re, let’s focus on how HNW buyers typically method charitable giving and how one can assist them be strategic of their philanthropy efforts.

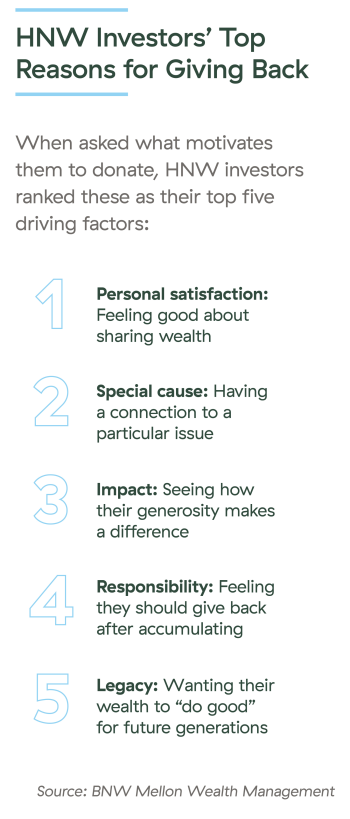

What Motivates Philanthropic HNW Buyers?

Generally, charitable giving is a prime precedence for this group of buyers, whereas tax planning is towards the underside of the checklist. In a 2022 BNY Mellon Wealth Administration survey of 200 HNW buyers, 91 % of respondents mentioned they embrace a charitable giving technique of their total wealth technique.

In one other examine of prosperous buyers performed by Financial institution of America and Indiana College, 72.1 % mentioned their charitable giving would keep the identical even when the earnings tax deduction had been eradicated, and 73.3 % mentioned their giving wouldn’t change if the property tax had been eradicated. The survey additionally reported that 88 % of prosperous households gave to charity in 2020, with a median of $43,195 given towards an excellent trigger that 12 months.

Nonetheless, some HNW buyers are cautious of being too philanthropic—within the BofA survey, 30.9 % of prosperous people mentioned they prioritize the wants of their household first. One more reason is that some buyers don’t know the place to provide or how finest to go about it.

All of those traits present alternatives to current concepts and sources, alongside together with your experience, when first assembly with HNW purchasers.

Being Strategic with How HNW Buyers Give Again

There’s a lot to contemplate main as much as a dialog about charitable planning. The next steps might help you assist purchasers by guiding them towards causes that match their pursuits, values, and total monetary image.

Get to know the shopper. Citing the subject of charitable giving early on within the relationship can reveal lots about your purchasers’ passions and priorities. What sort of mark do they wish to depart behind? How a lot of their wealth do they wish to dedicate to giving again versus leaving a legacy to their heirs? By asking the proper questions, you’ll be able to assist them decide or slender down the problems that matter most to them, corresponding to:

-

What sort of causes are most significant to you?

-

What organizations do you assist 12 months after 12 months, and why?

-

Have you ever needed to get behind a specific trigger however are not sure which group might make the best affect?

Assets like Constancy Charitable instruments might help purchasers suppose by means of their choices. The positioning affords worksheets for figuring out why and the place to provide again, questions they may ask nonprofits, and calculators to estimate tax financial savings.

Be their philanthropy useful resource. In keeping with the BofA examine, practically half of buyers (46.6 %) contemplate themselves novices in the case of charitable giving data, and solely 5 % view themselves as consultants. You possibly can fill this hole by being acquainted with each sources and charitable planning automobiles, together with personal foundations, donor-advised funds (DAFs), charitable funds, and direct presents.

To go additional and make philanthropy a cornerstone of your observe, begin with acquiring the Chartered Advisor in Philanthropy (CAP®) designation by means of the American School. Throughout three on-line programs, individuals study integrating property planning with charitable planning, evaluating charitable tax methods and instruments, and understanding how nonprofits are structured and ruled.

Assist them strategize. Most of the time, donors use money to provide again, and most don’t use a giving car. That is the place you’ll be able to carry up extra strategic, tax-efficient giving, like donating appreciated or complicated belongings (e.g., funding belongings or carefully held enterprise pursuits, actual property, or collectibles). In such circumstances, purchasers can sometimes decrease their capital beneficial properties publicity and deduct the complete market worth of the belongings they’re donating (in the event that they itemize).

For a shopper who prioritizes philanthropy and desires to go away a legacy to members of the family, a DAF could be a becoming solution to meet each wants. By doubtlessly eliminating capital beneficial properties taxes and permitting for an earnings tax deduction, it’s a tax-efficient solution to assist a favourite charity whereas encouraging heirs to hold on the custom of philanthropy by naming them as successor advisors.

Establishing a charitable the rest belief might facilitate the sale of an appreciated asset, with the tax legal responsibility unfold out over time. Your purchasers might retain an ongoing earnings stream, for a time frame or for all times, and take a charitable contribution deduction. Any remaining belongings on this irrevocable, tax-exempt belief could be distributed to charity.

Even when taxes are usually not prime of thoughts, you’ll should be prepared to clarify the tax impacts of reward giving. Your function is to assist purchasers house in on their ardour whilst you discover probably the most environment friendly methods to couple their ardour with their planning. By so doing, your purchasers can have a big affect on a trigger they care about whereas making certain that their generosity doesn’t undermine their monetary future.

Beginning the Proper Dialog

Advisors and HNW buyers might initially come on the matter of charitable giving from completely different angles. By attending to know your HNW purchasers’ primary motivations and values, you’ll be able to assist them meet their objectives—whether or not they wish to make an affect, depart one thing behind for future generations, or handle extra quick monetary wants.

FREE DOWNLOAD

Philanthropic Giving for Excessive-Web-Value Shoppers

Understanding your purchasers’ charitable giving preferences might help you higher anticipate their wants and assist them obtain their objectives.

Please seek the advice of your member agency’s insurance policies and procure prior approval for any designations you wish to use.