Thrilling information! The Chase Sapphire Most well-liked card has quickly elevated its sign-up bonus. This card is a favourite of each my husband and me, and it’s excellent for anybody trying to dive into the world of journey rewards and factors. Right here’s why:

- Wonderful restricted time welcome bonus

- 2x factors factors on all journey purchases

- 3x factors on eating places, on-line groceries, and choose streaming providers.

- 5x factors on journey booked via Chase’s portal

- $50 annual Chase Journey resort credit score when bought via Chase journey

- Redeem your factors in so some ways (you’re not restricted like different playing cards).

- Journey safety perks comparable to journey cancellation insurance coverage, bag delay insurance coverage, rental automotive collision safety, and misplaced baggage reimbursement

Proper now you’ll be able to earn 75,000 bonus factors once you spend $4,000 on purchases within the first 3 months of opening your Chase Sapphire Most well-liked Card. When you’re new to utilizing factors to journey for practically free, then this is perhaps the cardboard for you!

Take a look at the 15-minute video beneath the place I break down the way to journey subsequent to nothing due to bank card factors.

How The Bonus Works

Alright, let’s break down how this superior bonus works with the Chase Sapphire Most well-liked card. Think about this: you join the cardboard, and should you spend $4,000 on purchases throughout the first 3 months, voila! You earn a beneficiant 75,000 bonus factors.

When my husband and I had been planning our household journey to Canada a number of years in the past, we would have liked a solution to make our journey funds stretch. That’s the place our Chase Sapphire Most well-liked card shined! Right here’s my husband and I standing in entrance of the gorgeous Lake Louise.

We had been in a position to e-book spherical journey tickets for our household of 4 for subsequent to nothing! And let me let you know, seeing the youngsters’ faces mild up as we explored Banff Nationwide Park and noticed a grizzly bear for the primary time made each level value it.

Now, right here’s one of the best half: these 75,000 bonus factors? They’re value over $900 once you redeem them via the Chase Journey portal.

So whether or not you’re dreaming of a weekend getaway, a cross-country street journey, or an epic worldwide journey, these bonus factors will help make it occur.

Redeeming Your Factors

Whether or not you’re a frequent traveler or somebody who enjoys distinctive experiences, there are many methods you need to use your 75,000 bonus factors.

Flights

Let’s begin with flights, as a result of who doesn’t dream of flying away to an thrilling new vacation spot? With the Chase Sapphire Most well-liked card, your factors can take you additional.

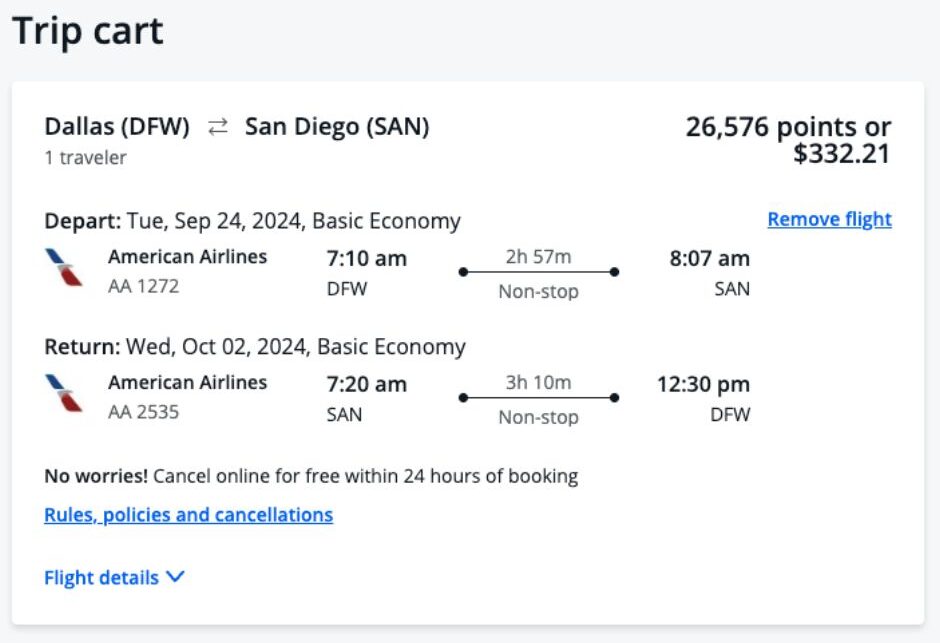

As an example, these 75,000 bonus factors you’ve simply earned may probably cowl a round-trip ticket from Dallas to San Diego, California for 2 individuals for simply 26,576 factors per particular person. This leaves you with further factors to spare!

Need to discover New York Metropolis? I discovered spherical journey flights from Dallas to La Guardia (NYC) for under 13,841 factors per particular person! This implies you can take a household of 4 to NYC along with your welcome bonus!

When redeemed via Chase Journey℠, your factors acquire 25% extra worth, making every level value about 1.25 cents. It’s like turning these 75,000 factors into $937.50!

Our household personally racks up factors to assist cowl the price of flights for household holidays. As an example, we lately booked 4 home spherical journey flights on Southwest Airways and solely needed to pay $44.80 in charges!

Resorts

Subsequent up, accommodations. Top-of-the-line methods to get probably the most worth in your factors is to switch your Final Rewards factors to your World of Hyatt account. Then, you’ll be able to e-book your resort keep utilizing your Hyatt factors!

As an example, you’ll be able to keep the night time on the Hyatt Place in downtown Nashville for simply 20,000 factors every night time.

Experiences

If distinctive experiences are what you’re after, then you definitely’ll love this card. Think about utilizing your factors to safe tickets to a Broadway present, a serious sports activities occasion, or a personal eating expertise.

Money Again

Favor to maintain it easy? Your factors will also be redeemed for money again, supplying you with direct deposits into most U.S. checking and financial savings accounts, or you’ll be able to go for an announcement credit score.

I’ve recognized individuals personally who save up their bank card factors all 12 months and use them to cowl all of their vacation buying in December. That’s flexibility at its most interesting!

Journey Companions

I personally like that with the Chase Sapphire Most well-liked card you switch your factors at a 1:1 ratio to a number of airways and accommodations. That is one other approach to verify your factors stretch additional.

Airline companions embody:

- Aer Lingus

- Air Canada

- British Airways

- Emirates

- Air France KLM

- Iberia

- JetBlue

- Singapore Airways

- Southwest

- United Airways

- Virgin Atlantic

Resort companions embody:

- IHG Resorts & Resorts

- Marriott Bonvoy

- Hyatt

The Chase Sapphire Most well-liked affords so some ways to redeem factors (which is why I personally love the cardboard). Which means that you might be caught utilizing these factors to solely fly on one airline. Are you able to inform I like this card and its perks a lot?!

Chase Sapphire Most well-liked Card: Different Perks

The Chase Sapphire Most well-liked card is filled with perks that make it a wonderful alternative for vacationers and on a regular basis spenders alike. Listed below are among the options that make this card my favourite.

Journey Safety

The Chase Sapphire Most well-liked card comes with an extended record of journey safety advantages that offer you peace of thoughts whereas in your subsequent journey:

- Journey Cancellation Insurance coverage: If illness, extreme climate, or different coated conditions have an effect on your journey plans, you might be reimbursed as much as $10,000 per particular person and $20,000 per journey for pay as you go, non-refundable bills.

- Baggage Delay Insurance coverage: For bags delays over six hours, get reimbursed for important purchases like toiletries and clothes as much as $100 a day for 5 days.

- Auto Rental Collision Injury Waiver: Decline the rental firm’s collision insurance coverage and cost the complete rental value to your card to get major protection for theft and collision injury for many leases within the U.S. and overseas.

- Journey Delay Reimbursement: Delays greater than 12 hours or requiring an in a single day keep are coated for unreimbursed bills comparable to meals and lodging, as much as $500 per ticket.

- Misplaced Baggage Reimbursement: Protection as much as $3,000 per passenger should you or a right away member of the family’s baggage is misplaced or broken by the service.

5X Factors on Journey

Earn large once you e-book your journey via Chase Journey. With the Chase Sapphire Most well-liked, you get 5x factors on journey purchases, together with flights, accommodations, cruise strains, and automotive leases. That is an incredible solution to (actually) multiply your factors.

3X Factors on Eating places

Foodies will rejoice with the Chase Sapphire Most well-liked card! You earn 3x factors on all eating bills, whether or not you’re making an attempt out a brand new native restaurant or ordering in. This contains every part from fancy sit-down eating places to your favourite takeout and supply providers.

I attempt to completely use this card any time we seize takeout or exit to dinner as a result of I do know it means I’m racking up factors for my subsequent trip quicker!

3X Groceries On-line

In right now’s digital age, increasingly individuals are choosing the comfort of on-line grocery buying. With the Chase Sapphire Most well-liked, you earn 3x factors on on-line grocery purchases. Word that this excludes purchases made at Goal®, Walmart®, and wholesale golf equipment, nevertheless it’s an effective way to rack up factors on an everyday expense.

$50 Journey Resort Credit score

Every account anniversary 12 months, you’ll be able to earn as much as $50 in assertion credit for resort stays bought via Chase Journey. This perk alone will help offset the cardboard’s $95 annual payment.

No International Transaction Charges

Journey internationally with out the additional prices. With no overseas transaction charges on purchases made exterior america, you get monetary savings that will in any other case be spent on charges. As an example, spending $5,000 internationally may usually incur about $150 in charges with different playing cards, however not with the Chase Sapphire Most well-liked.

The Annual Price

The Chase Sapphire Most well-liked card comes with an annual payment of $95. Whereas this payment may seem to be a further value, it’s vital to weigh it towards the worth you get from the cardboard.

For many customers, the advantages and potential financial savings simply outpace this value. Simply the $50 annual resort credit score and the dearth of overseas transaction charges can practically cowl the payment.

And once you add the worth of the factors you’ll be able to earn via common spending and particularly via bonus classes, the payment turns into a worthwhile funding for anybody critical about maximizing their journey rewards or on a regular basis spending.

The Backside Line

The Chase Sapphire Most well-liked card is my go-to card. With a $95 annual payment, it simply pays for itself should you’re like me—somebody who loves incomes rewards on journey and eating.

The sign-on bonus alone is a game-changer, providing a possible journey credit score value over $900. Whether or not it’s reserving flights, grabbing dinner out, or just buying on-line, this card turns on a regular basis actions into rewards that fund my subsequent journey.

When you’re trying to get critical about maximizing your rewards, the Chase Sapphire Most well-liked could possibly be the right match. It’s not nearly spending; it’s about making each greenback work in the direction of your subsequent large journey or objective. Why not let your on a regular basis spending take you someplace extraordinary?