Probably the most hanging options of the labor market restoration following the pandemic recession has been the surge in quits from 2021 to mid-2023. This surge, also known as the Nice Resignation, or the Nice Reshuffle, was uncommonly giant for an financial enlargement. On this submit, we name consideration to a associated labor market change that has not been beforehand highlighted—a persistent change in retirement expectations, with employees reporting a lot decrease expectations of working full-time past ages 62 and 67. This decline is especially notable for feminine employees and lower-income employees.

The Nice Resignation

After an preliminary decline within the stop price in the course of the pandemic recession, which noticed the unemployment price climb to 14.8 p.c in April 2020, the stop price rose sharply in 2021 and remained excessive into early 2023. Estimates of the precise magnitude of the wave of resignations fluctuate considerably throughout knowledge sources, with employer-provided knowledge on quits from the Job Openings and Labor Turnover Survey (JOLTS) displaying a lot larger will increase within the stop price than these computed utilizing knowledge from the Present Inhabitants Survey (CPS). Nonetheless, there’s broad settlement in regards to the nature of the resignations: Whereas there was a short lived surge in exits from the labor market, together with a rise in early retirements, a lot of the quits represented switches to different (presumably higher) jobs or transitions into self-employment. Moreover, a big fraction of the employees who dropped out of the workforce, together with a lot of those that retired early, subsequently reentered the labor market.

What precipitated this uncommon surge in quits? Questions stay about their relative significance, however contributing elements proposed by economists embody labor shortages and an elevated confidence about discovering new jobs; pandemic-related elements equivalent to well being issues, lack of childcare, stimulus funds, and moratoria on mortgage, hire, and pupil mortgage funds; and modifications in attitudes towards the aim and desirability of labor extra usually. Among the improve may additionally mirror pent-up resignations amongst those that postponed and held on to their jobs in the course of the early days of the pandemic.

An necessary function of the upswing in resignations is that it was significantly giant for low-skilled employees. A scarcity of employees, excessive job emptiness charges, and extra fiscal assist within the type of financial influence funds and forbearance packages allowed employees to be choosier about their subsequent job and to barter greater wage will increase with present and new employers. After years of relative wage stagnation, larger employee energy fueled an acceleration in wage progress, particularly amongst low-skilled employees.

The Publish-Pandemic Change in Retirement Expectations

On this submit, we doc an necessary associated improvement not beforehand highlighted—a post-pandemic change in retirement expectations. Our evaluation is predicated on knowledge from the Survey of Shopper Expectations’ (SCE) triannual Labor Market Survey. Over its decade-long life the SCE, a foundational dataset of the Middle for Microeconomic Information, has produced many useful insights into shopper expectations about a variety of financial behaviors and outcomes. The SCE is a nationally consultant, internet-based survey of a rotating panel of roughly 1,300 family heads. Respondents take part within the panel for as much as twelve months, with a roughly equal quantity rotating out and in of the panel every month. The SCE Labor Market Survey module, fielded triannually since March 2014, offers info on customers’ experiences and expectations concerning the labor market. Our evaluation on this submit is predicated on two particular questions within the survey. The primary asks respondents beneath age 62 “Eager about work generally and never simply your current job (when you at the moment work), what do you suppose is the p.c likelihood that you may be working full-time after you attain age 62?”. An identical second query is then requested about working full-time past age 67, to these youthful than age 67. The questions are much like these requested within the College of Michigan’s Well being and Retirement Research.

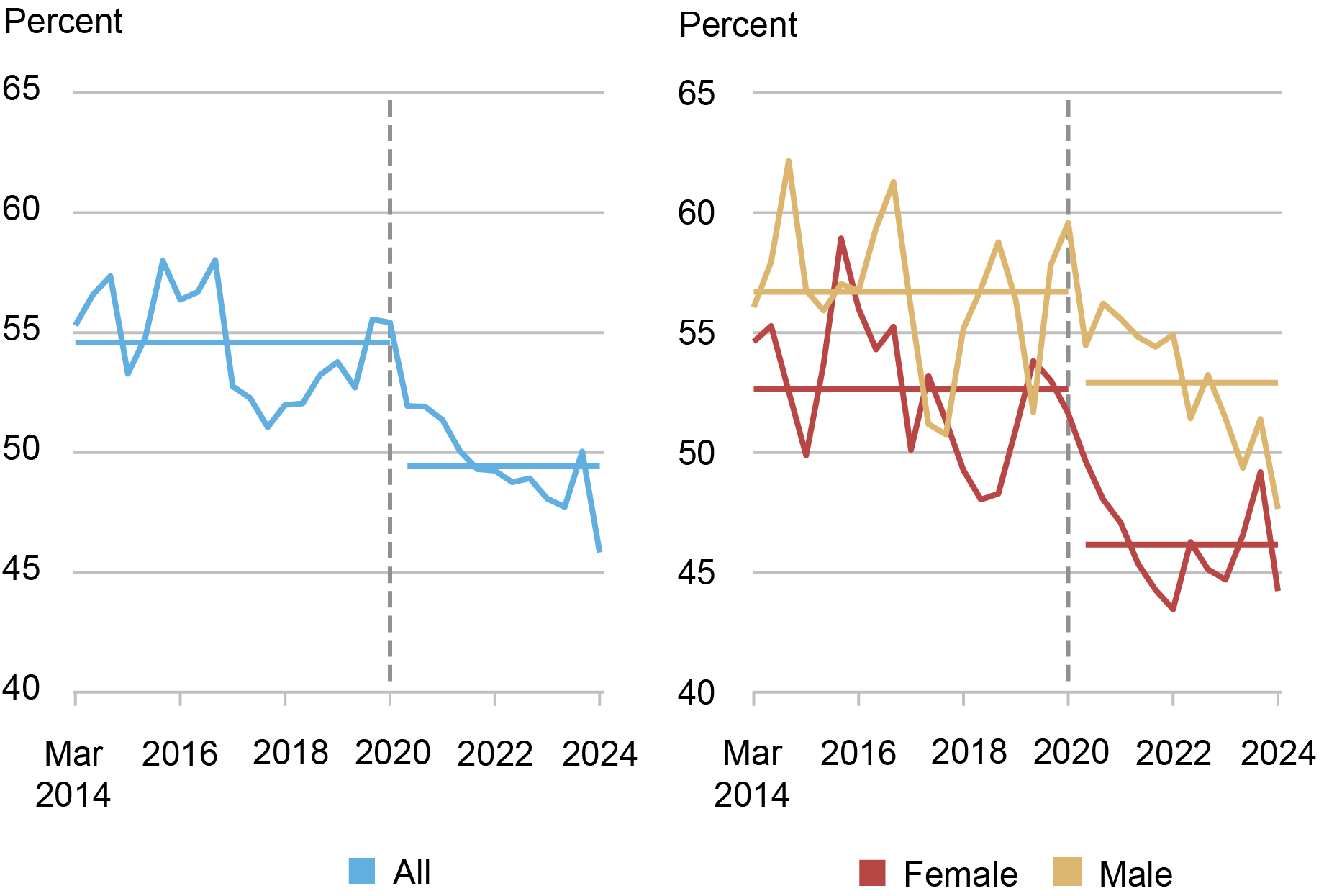

The left panel within the chart beneath shows retirement-age full-time employment expectations. As much as the eve of the pandemic, these expectations had been pretty steady. However beginning in March 2020 they started a persistent decline, with the March 2024 studying of the common chance of working full-time past age 62 representing a brand new collection low at 45.8 p.c. Whereas these expectations averaged 54.6 p.c over the six years main as much as the pandemic, they’ve averaged 49.4 p.c over the 4 years since, with the 5.2 share level decline equating to a 9.5 p.c lower in anticipated future full-time employment. The decline is broad-based throughout age, schooling, and earnings teams, with employees beneath age 45, with no faculty diploma, and with annual family incomes beneath $60,000 displaying barely bigger declines than their friends. Nonetheless, the decline within the common chance of working full-time past age 62 is rather more pronounced for feminine employees (6.5 share factors) than for male employees (3.8 share factors).

Common Probability of Working Full-Time Previous 62

Notes: The vertical dashed strains point out the beginning of the pandemic. Horizontal strains point out pre- and post-pandemic means.

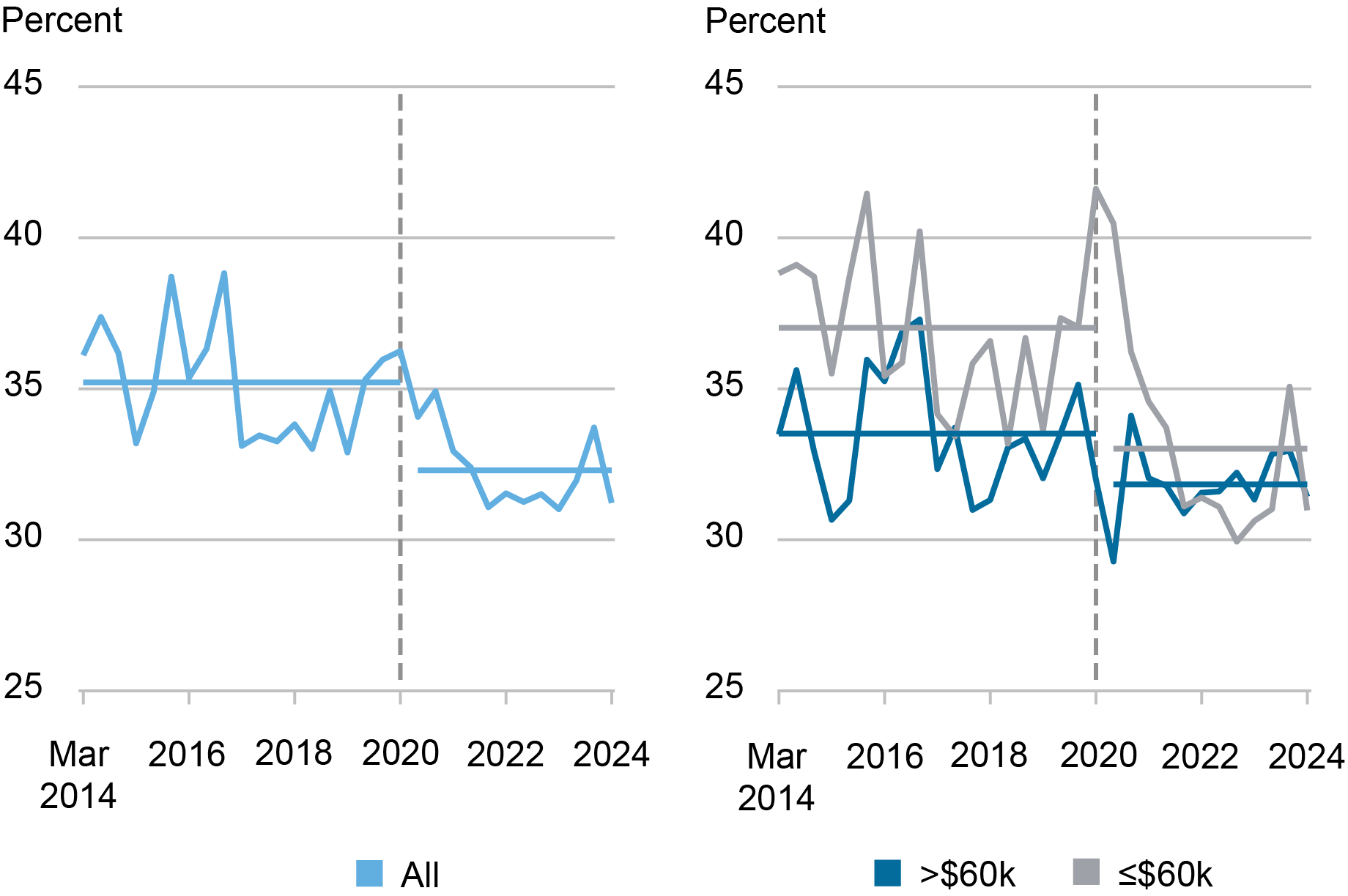

We discover related, although considerably extra attenuated, patterns for expectations about working full-time previous age 67, with declines in common possibilities falling by 2.9 share factors general (equating to an 8.2 p.c decline in future post-67 full-time employment). Once more, we discover bigger declines for feminine employees (3.8 share factors), and likewise for these with annual family incomes beneath $60,000 (4.0 share factors), with the distinction in declines between earnings teams being bigger than for expectations about working previous age 62.

Common Probability of Working Full-Time Previous 67

Notes: The proper panel exhibits the chance of working full-time previous age 67 for these with annual family incomes above (darkish blue line) and equal to or beneath (grey line) $60,000. The vertical dashed strains point out the beginning of the pandemic. Horizontal strains point out pre- and post-pandemic means.

Drivers and Implications

The pandemic and the pandemic-induced recession are behind us and the restoration of the U.S. economic system is constant, however longer-term results of this expertise linger. Though wage progress has begun to average, vacancies are down, and layoff and stop charges are again to pre-pandemic ranges, our survey responses reveal a persistent decline in expectations of working full-time past ages 62 and 67. Given enhancements in well being and will increase in life expectancy, this can be considerably shocking. It’s unclear what elements or mixture of things are driving this persistent decline: an elevated choice of part-time over full-time employment; a cultural shift characterised by a rethinking of the worth of labor; a mirrored image of elevated family web wealth; elevated confidence about future progress in earnings and earnings and future monetary well being; a larger optimism about reaching retirement saving objectives; or elevated uncertainty about life expectancy post-pandemic. This represents an necessary matter of future analysis.

The pandemic-induced change in retirement expectations could proceed to have an effect on the labor market in years to come back. It can also have necessary macroeconomic implications when customers act on their expectations in making consumption and saving selections. To the extent that these expectations sign precise future retirement conduct, additionally they have implications for future selections by customers in regards to the timing of claims for social safety advantages and the receipt of these advantages.

Our discovering of a post-pandemic shift in retirement expectations is a chief instance of the kind of new shopper insights the SCE has been offering over the past decade.

Felix Aidala is a analysis analyst in Family and Public Coverage within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Gizem Kosar is a analysis economist in Shopper Habits Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Wilbert van der Klaauw is the financial analysis advisor for Family and Public Coverage Analysis within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

How you can cite this submit:

Felix Aidala, Gizem Kosar, and Wilbert van der Klaauw, “The Publish‑Pandemic Shift in Retirement Expectations within the U.S.,” Federal Reserve Financial institution of New York Liberty Avenue Economics, Could 9, 2024, https://libertystreeteconomics.newyorkfed.org/2024/05/the-post-pandemic-shift-in-retirement-expectations-in-the-u-s/.

Disclaimer

The views expressed on this submit are these of the creator(s) and don’t essentially mirror the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the duty of the creator(s).