Within the aftermath of the COVID-19 pandemic, inflation rose nearly concurrently in most economies around the globe. After peaking in mid-2022, inflation then went into decline—a fall that was simply as common because the preliminary rise. On this submit, we discover the interrelation of inflation dynamics throughout OECD international locations by developing a measure of the persistence of worldwide inflation. We then research the extent to which the persistence of worldwide inflation displays broad-based swings, versus idiosyncratic country-level actions. Our principal discovering is that the spike and subsequent moderation in international inflation within the post-pandemic interval had been pushed by persistent actions. After we have a look at measures of inflation that embrace meals and power costs, many of the persistence seems to be broad-based, suggesting that worldwide oil and commodity costs performed an vital position in international inflation dynamics. Excluding meals and power costs within the evaluation nonetheless reveals a broad-based persistence, though with a considerable enhance within the position of country-specific elements.

A Measure of International Inflation Persistence

Our goal is to estimate the persistence and dynamics of inflation throughout international locations within the post-pandemic international financial system. We start by describing the information and strategies we use.

Our evaluation relies on month-to-month inflation information protecting 1980-2023 for sixteen OECD international locations: Austria, Belgium, Canada, Denmark, France, Germany, Eire, Italy, Japan, the Netherlands, Norway, Spain, Sweden, Switzerland, the UK, and america. From the OECD Important Financial Indicators database, we receive time sequence for every nation’s shopper value index (CPI), information which can be constant over time and comparable throughout international locations. We compute month-to-month annualized inflation charges for every nation primarily based on whole CPI and on the CPI excluding the meals and power classes. We refer to those as headline and core CPI inflation, respectively, noting that completely different international locations might outline the “core” combination in barely alternative ways. We apply a homogeneous definition throughout international locations as a result of our purpose is to characterize the evolution of inflation utilizing internationally comparable measures.

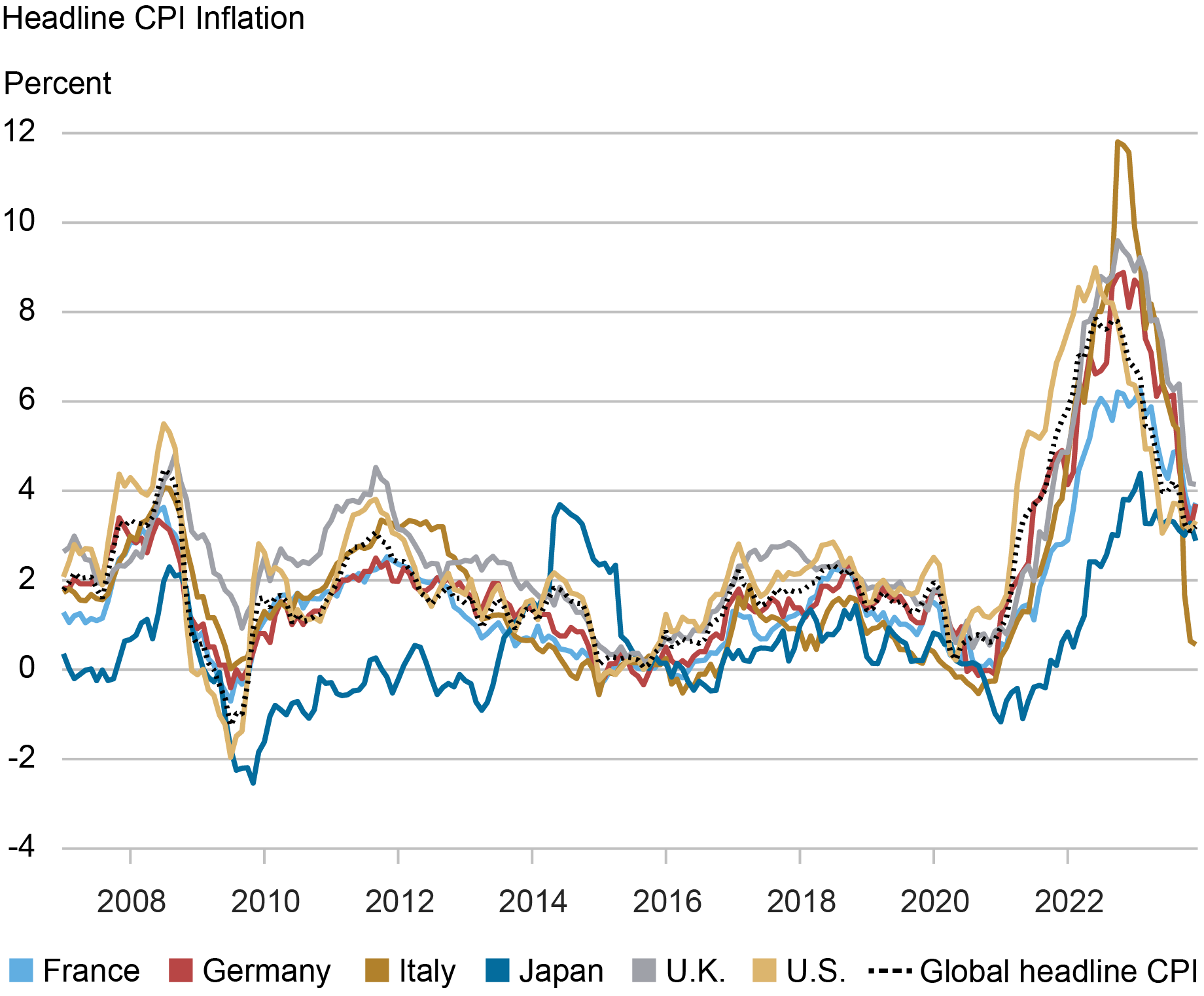

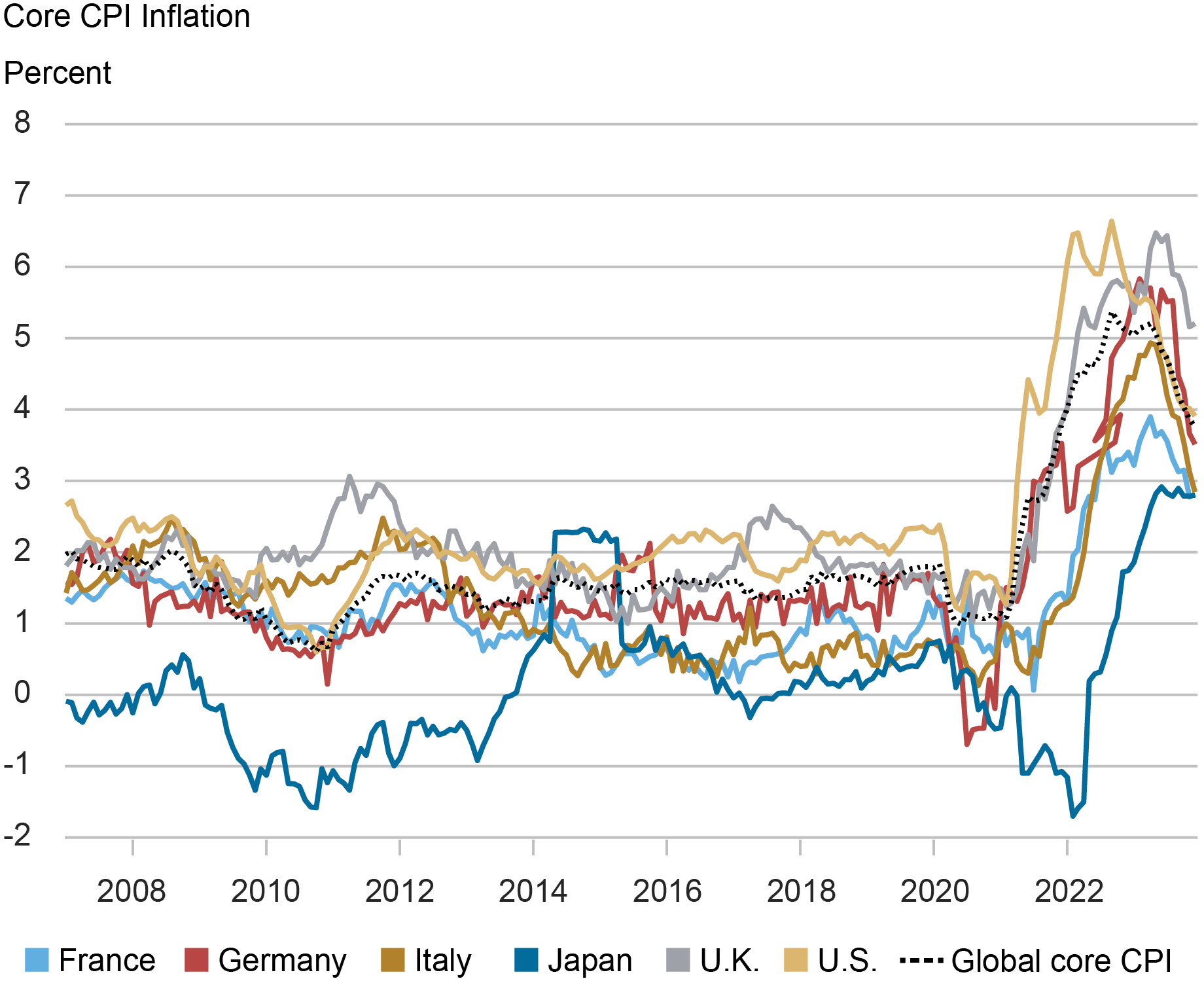

To assemble a worldwide inflation measure, we comply with the OECD observe of aggregating nationwide inflation charges utilizing weights primarily based on their share of personal closing consumption expenditures throughout households and non-profit establishments in buying energy parity phrases. We name this measure ”international,” though it refers solely to a subset of OECD economies. The next two charts show the current evolution of the twelve-month fee of headline and core CPI inflation for the worldwide measure and for a subset of nations. It’s clear within the figures that, though the extent of inflation might differ throughout international locations (for instance, it tends to be decrease in Japan than within the U.Okay.), cyclical actions are sometimes synchronized.

Headline CPI Inflation Co-Strikes Strongly throughout OECD Economies

Supply: OECD Important Financial Indicators database.

Core CPI Inflation Co-Strikes Strongly throughout OECD Economies

Supply: OECD Important Financial Indicators database.

The pure query is how a lot of the cyclical actions in inflation skilled by completely different economies are persistent. To reply this query, we apply a strategy that has been used efficiently to check the persistence of inflation throughout sectors of the identical financial system (see, for instance, right here for our personal software to the US financial system). To be extra particular, our technique fashions the month-to-month inflation fee of every nation because the sum of a persistent and a transitory element. Each persistent and transitory elements are additional decomposed into frequent and country-specific subcomponents. We outline international development inflation to be the mixture of the persistent elements (each frequent and country-specific) of the completely different international locations, every weighted by the share we mentioned above. This framework has two benefits. On the one hand, it permits us to filter out transitory variations in inflation which regularly replicate measurement error and outliers. On the opposite, it permits us to find out whether or not actions within the international development come from shocks that have an effect on particular person international locations (e.g., home coverage or demand adjustments) or all international locations on the similar time (e.g., adjustments within the worldwide value of oil or different commodities, or the worldwide spillover of coverage adjustments in giant economies).

How A lot of Present International Inflation Is Persistent?

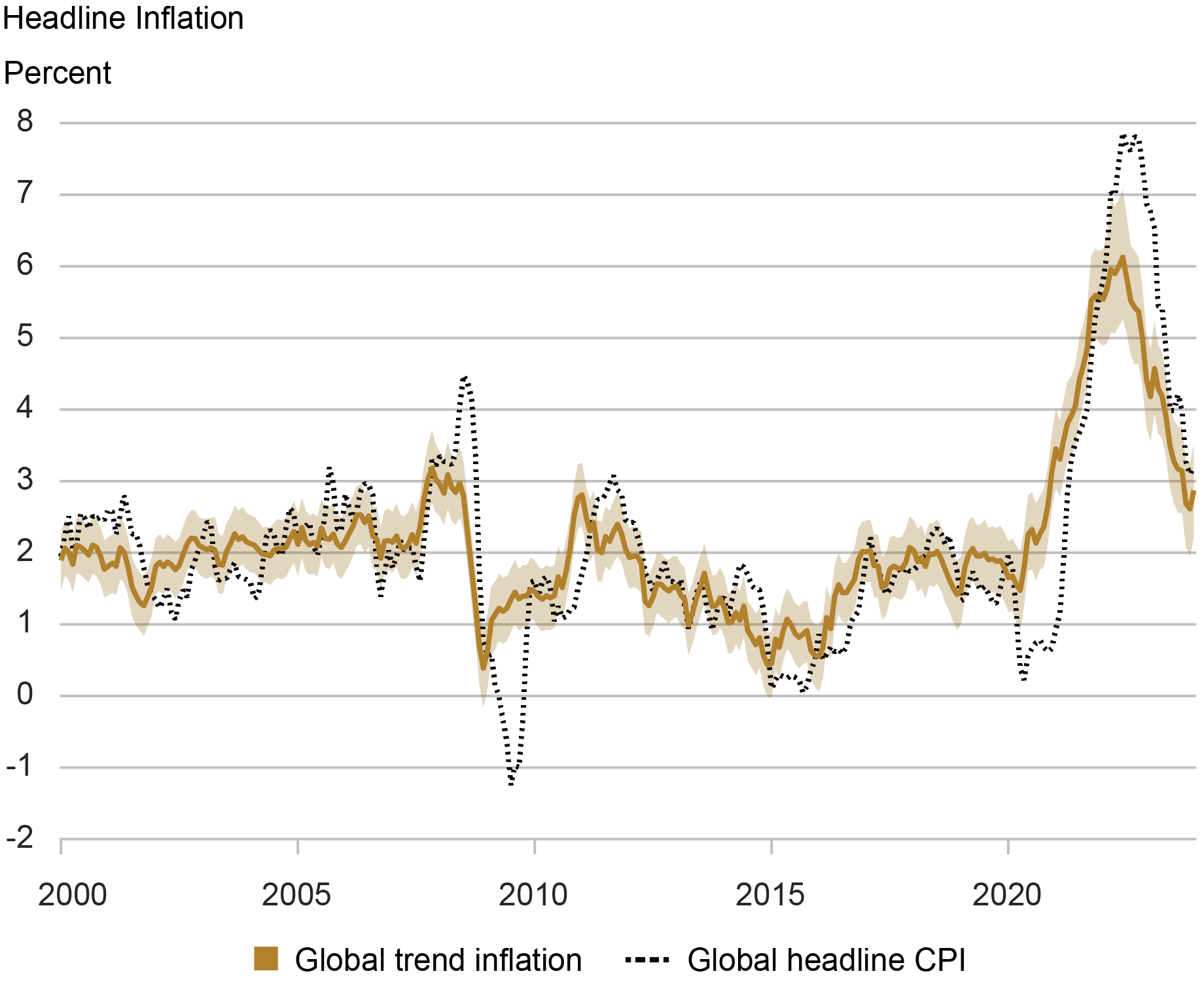

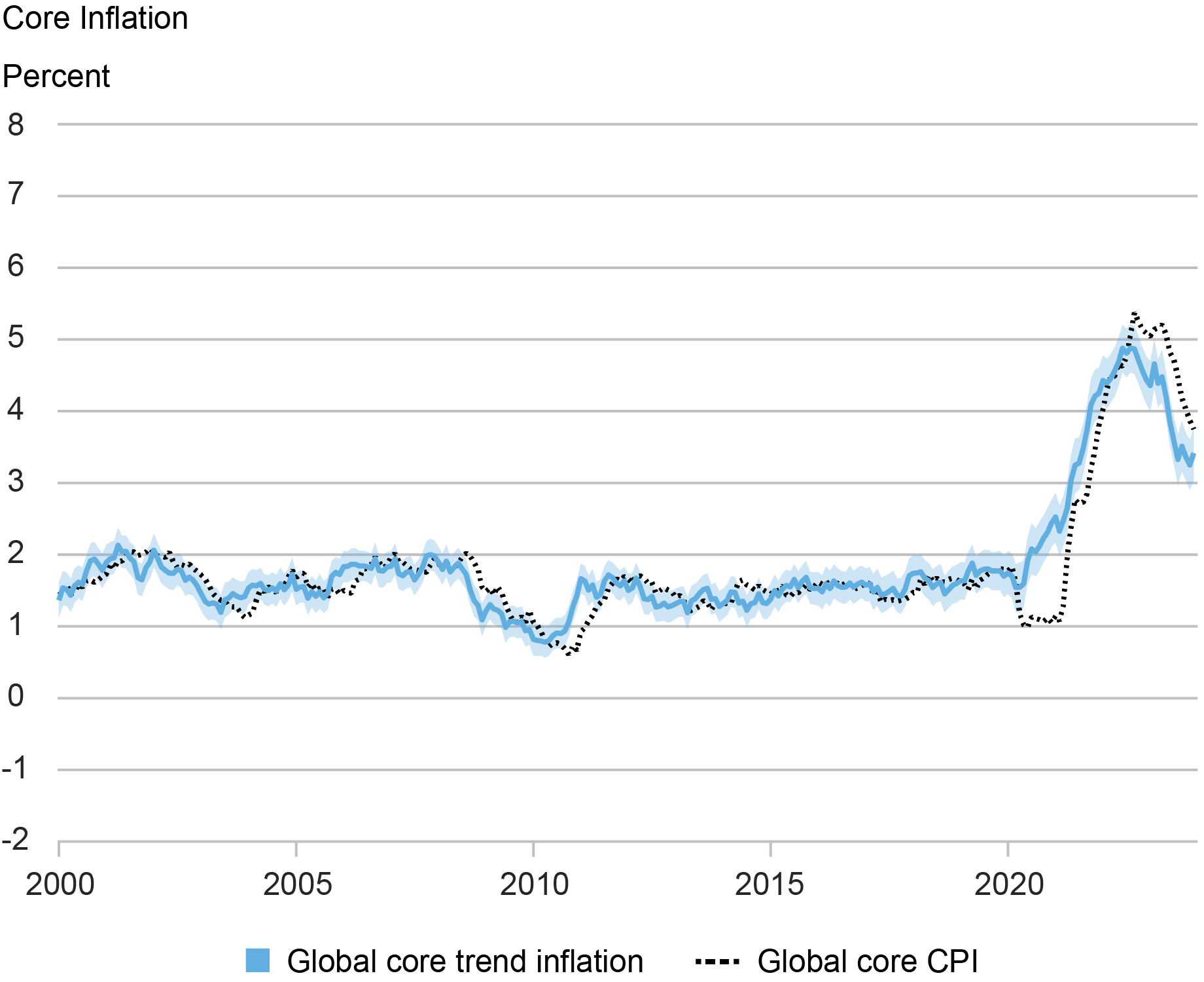

The next two charts current estimates for the worldwide tendencies in headline and core CPI inflation (stable traces), along with their reported twelve-month inflation charges (dotted traces) for reference. Shaded areas characterize 68 % chance bands for the development estimates. We spotlight two options. First, the worldwide development measures don’t show a number of the excessive swings that we see within the twelve-month charges (see, as an illustration, the Nice Recession and the COVID-19 pandemic durations within the chart for headline CPI). It is because our technique removes a part of the transitory shocks that drive these actions. In consequence, the extent of the peaks and troughs within the international development is often completely different from the twelve-month fee counterparts.

International Pattern Inflation in Headline and Core CPI Has Moderated since Mid-2022

Sources: OECD Important Financial Indicators database; authors’ estimates.

Sources: OECD Important Financial Indicators database; authors’ estimates.

The second characteristic to spotlight is that the development estimates typically transfer forward of the worldwide inflation measures. That is defined by the truth that our mannequin targets the development in month-to-month charges, not in 12-month charges, which leads to a much less backward-looking and timelier measure. Furthermore, the current evolution (by which the development lies beneath the twelve-month fee) suggests that there’s scope for additional disinflation within the quick time period in each the headline and core CPI measures.

One distinction between headline and core CPI is that the development is usually nearer to noticed inflation for the latter. This isn’t stunning, contemplating the upper sensitivity of headline inflation to meals and power costs which are usually risky. One other distinction is the relative significance of frequent versus country-specific elements which we analyze subsequent.

How A lot of Present Inflation Persistence Is Broad-Primarily based?

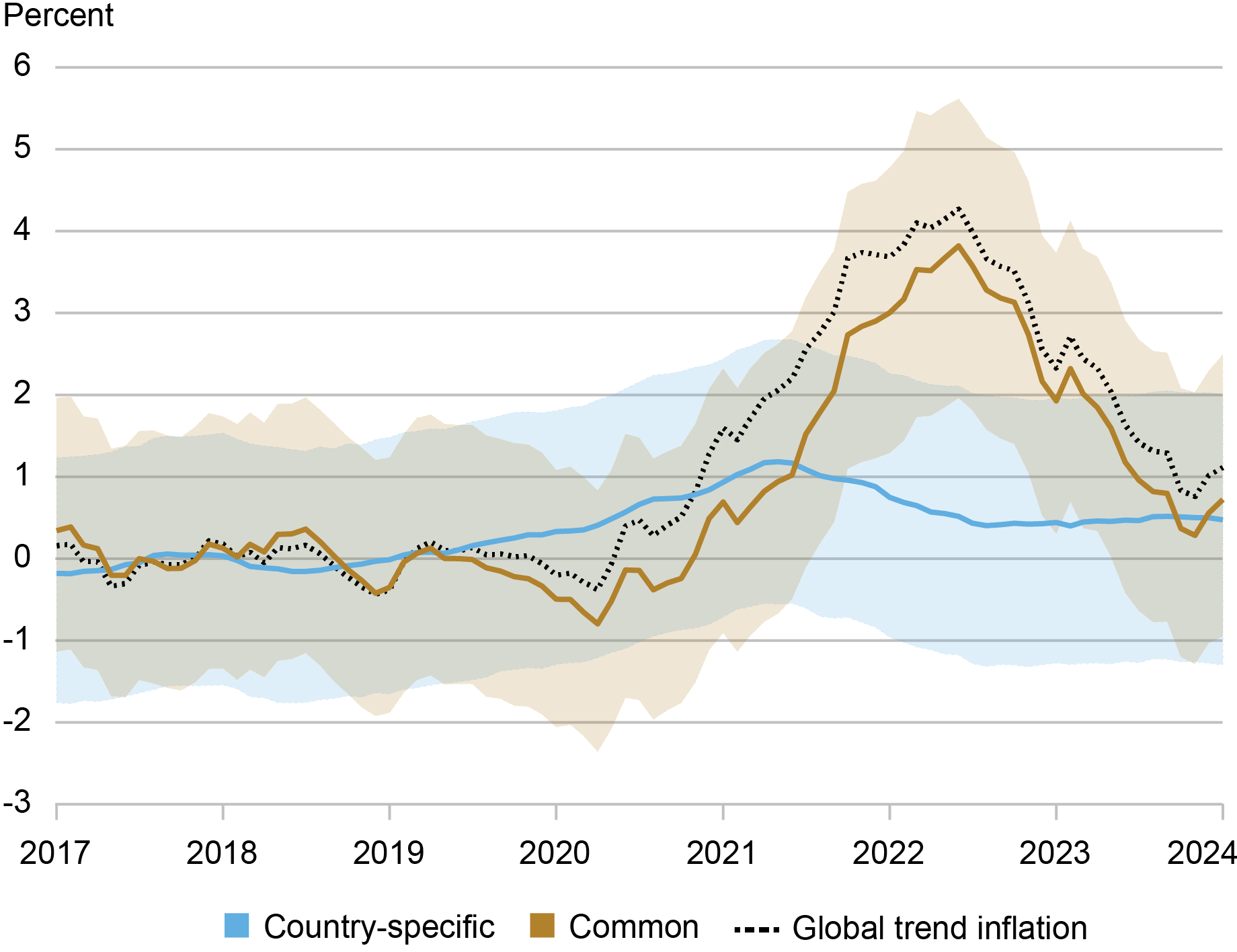

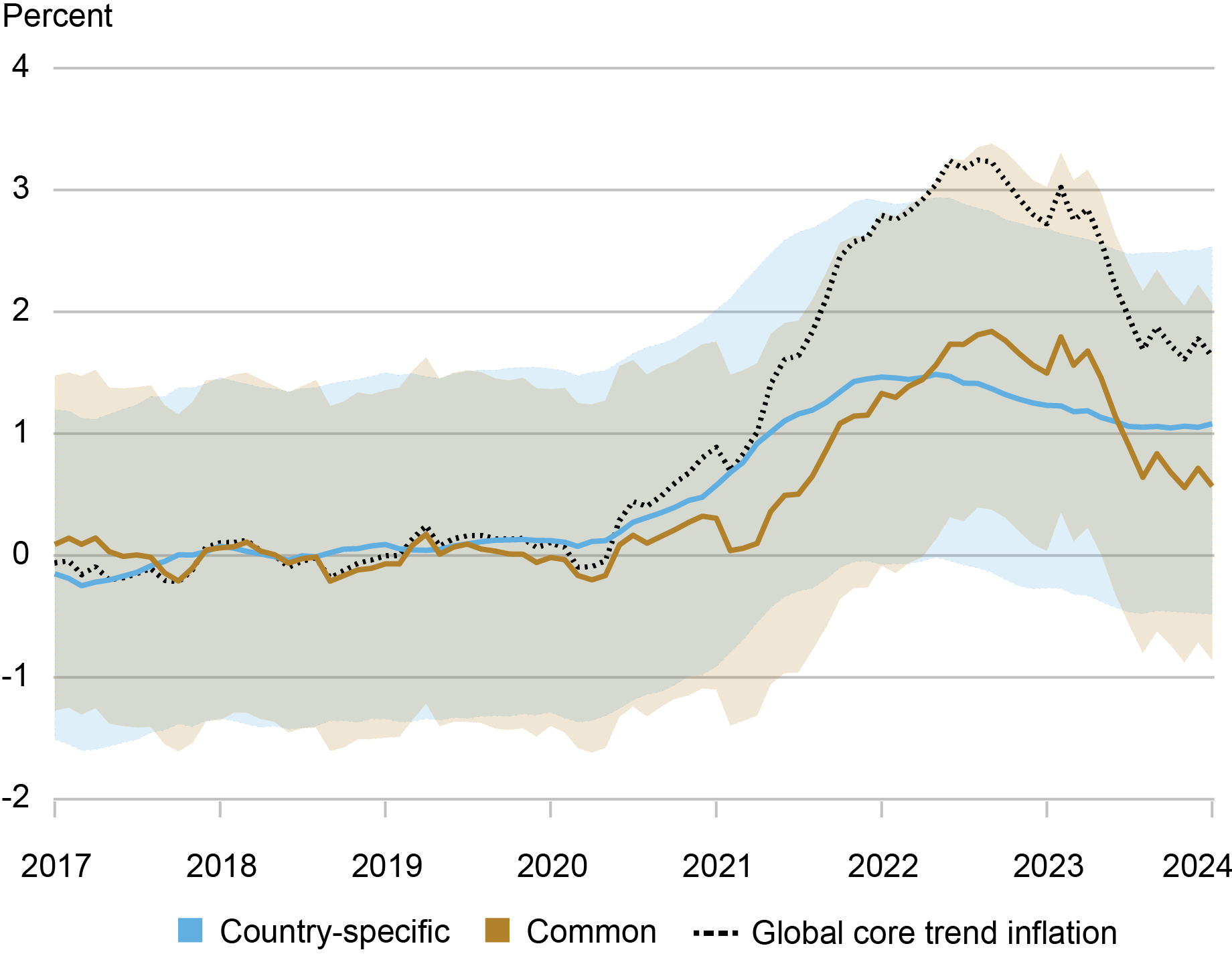

To quantify the significance of broad-based versus country-specific shocks in explaining the dynamics of the worldwide development we first normalize the whole, frequent and country-specific development elements by subtracting their common stage for the interval January-2017 to December-2019. That is equal to measuring the cumulative change within the international development for the reason that pre-pandemic interval. We subsequent ask what fraction of the cumulative change within the international inflation development is attributed to every element. The decomposition of the worldwide development between frequent and country-specific elements for each headline and core CPI is proven within the subsequent two charts.

Submit-Pandemic Actions in Headline CPI International Pattern Have been Principally Broad-Primarily based

Sources: OECD Important Financial Indicators database; authors’ estimates.

Word: All tendencies are normalized by subtracting their common stage between Jan-2017 and Dec-2019; shaded areas across the country-specific and customary areas characterize 68 % chance bands.

Nation-Particular Elements Contributed Considerably to the Core CPI International Pattern

Sources: OECD Important Financial Indicators database; authors’ estimates.

Word: All tendencies are normalized by subtracting their common stage between Jan-2017 and Dec-2019; shaded areas across the country-specific and customary areas characterize 68 % chance bands.

For headline CPI, the change within the development between the start of the COVID-19 pandemic and its peak in mid-2022 (roughly a 4-percentage level enhance) is nearly totally accounted for by the frequent element (roughly 90% of the rise). The identical might be mentioned of the moderation that passed off between mid-2022 and finish of 2023.

Turning to core CPI, the image is kind of completely different. First, slightly than a quick decline after mid-2022, the development in international core CPI inflation skilled a plateau that prolonged till early 2023. Second, the rise within the development between the start of the pandemic and this plateau amounted to barely above 3 proportion factors, lower than its headline counterpart. Lastly, the composition may be very completely different, with country-specific and customary persistence accounting every for about half of the cumulative change. Curiously, the moderation noticed for the reason that peak has been pushed principally by the frequent element, which means that there stay home elements inducing persistence in inflation.

Conclusion

To summarize, the spike and subsequent moderation in international inflation that passed off within the aftermath of the COVID-19 pandemic replicate a mixture of worldwide and home elements. After we estimate inflation persistence utilizing measures that embrace meals and power costs, many of the change in international inflation persistence is broad-based. In contrast, after we use core measures, about half of the rise (however lower than half of the lower for the reason that peak) originates in home, country-specific actions. This means that each giant actions within the worldwide value of oil and different commodities, in addition to home coverage and demand elements, performed an vital position within the current inflationary episode.

Analyzing extra disaggregated information by nation and sector and quantifying the position of particular worldwide and home elements (provide chains, financial and monetary insurance policies, and many others.) is an attention-grabbing avenue for future analysis.

Martín Almuzara is a analysis economist in Macroeconomic and Financial Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Babur Kocaoglu is a analysis analyst in Macroeconomic and Financial Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Argia Sbordone is the pinnacle of Macroeconomic and Financial Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Find out how to cite this submit:

Martín Almuzara, Babur Kocaoglu, and Argia Sbordone, “Is the Latest Inflationary Spike a International Phenomenon? ,” Federal Reserve Financial institution of New York Liberty Avenue Economics, Might 16, 2024, https://libertystreeteconomics.newyorkfed.org/2024/05/is-the-recent-inflationary-spike-a-global-phenomenon/.

Disclaimer

The views expressed on this submit are these of the creator(s) and don’t essentially replicate the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the accountability of the creator(s).