Final week, the SEC (lastly) gave its stamp of approval to identify bitcoin ETFs, with practically a dozen fund managers launching funds within the wake of the ruling.

This brings up a couple of questions:

- What’s a “spot” ETF?

- Wait, I believed there have been already bitcoin ETFs?

- Why is that this a giant deal?

- Is Monument utilizing bitcoin or bitcoin ETFs in my portfolio?

- The place else can I examine this?

What’s a “spot” ETF?

“Spot” merely signifies that a fund owns the underlying asset, versus possession in futures contracts or via another artificial means. For instance, S&P 500 ETFs personal the underlying S&P 500 shares and gold ETFs personal bodily gold. However many different commodity ETFs function as futures-based funds, together with those who spend money on issues like oil and agricultural commodities. Additionally price noting right here, there may be a futures-based bitcoin ETF, which launched in October 2021.

So, briefly which means that the spot ETF fund owns the precise bitcoin at at present’s worth, not bitcoin contracts at a future worth.

Wait, I believed there have been already bitcoin ETFs?

Sure. Kinda-sorta. However just one (exterior of the futures-based fund talked about within the earlier part).

For a very long time, when you needed to personal bitcoin with out going via a crypto trade, the one sport on the town was Grayscale’s bitcoin “belief.” Spot? Sure. Change-traded? Sure. An exchange-traded fund (ETF)? Technically, no.

The satan within the particulars resides on this final bit.

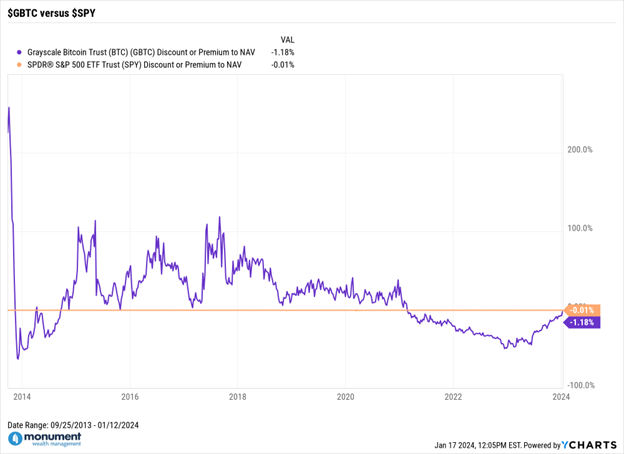

In the event you had a brokerage account, you possibly can purchase the Grayscale fund ($GBTC ) like every other inventory or ETF, and Grayscale would care for issues like custody, tax and different reporting necessities. After all, you couldn’t ship or obtain bitcoin for transaction functions, however you had a method to directionally take part within the worth of bitcoin. However as a result of the Grayscale fund didn’t have the normal ETF construction and “plumbing”, the connection was not 1-for-1, and wild mispricing would happen, as illustrated by the next graphic.

Very merely: if $GBTC held $100 price of bitcoin, the fund may commerce as if it held as a lot as $200, or as little as $50. As an investor, the previous could be enjoyable, and the latter could be hell. And all alongside, in case your aim was merely to trace the value of bitcoin, the expertise was a catastrophe. $GTBC in its authentic construction (technically a “closed finish fund”) was not nice at monitoring the underlying worth of bitcoin (see the purple squiggly line above). However once more, for conventional brokerage traders, this was actually the one method to take part earlier than final week’s rollout of spot ETFs.

To indicate how imperfectly the Graysale fund operated, I’ve overlayed the identical low cost/premium metric for the preferred S&P 500 ETF within the graphic above. The flat orange line illustrates that, over the identical time-frame, the ETF monitoring the underlying S&P 500 Index did so nearly completely. Owing to the distinctive creation/redemption course of accessible to open-ended, SEC-approved ETFs. And that’s what final week’s SEC ruling has made accessible to bitcoin funds, together with $GBTC, which transformed to the open-ended ETF construction. Going ahead, regardless of the worth of bitcoin does, one would anticipate the purple line for $GBTC and different “spot” funds to stay as shut as attainable to the zero line.

For these curious, listed here are the 11 funds that launched the day after the SEC’s ruling. Two issues: first, this isn’t an endorsement of any fund – you’ll want to THOROUGHLY analysis these for your self to find out their appropriateness in case you are contemplating a person buy. Second, this contains solely newly launched or transformed “spot” funds, together with $GBTC. Not included listed here are futures-based funds like ProShares $BITO, which – as famous earlier – launched in October 2021.

Why is that this a giant deal?

Large-spread adoption. This absolutely opens bitcoin (and doubtlessly different tokens) to a broader base of advisors and traders. Many believed that the Federal authorities needed to rid the world perpetually of crypto, particularly within the wake of the fraud that was uncovered in 2021 and 2022. Clearly, that didn’t occur, and now, anyone with a brokerage account can purchase bitcoin and never have to fret about wallets, storage (custody) or bizarre tax reporting.

You clearly can’t transact with bitcoin by proudly owning it in an ETF, however when you consider that it’s a retailer of worth or a superb speculative asset, then entry to those ETFs is a giant improvement. Oh, and with so many funds coming to market, charges are prone to come down in a rush. When $GBTC was the one brokerage product accessible, Grayscale might get away with 2.00% inner expense ratios. Because of the SEC’s ruling, new funds are coming to market with considerably cheaper bills, with some merchandise beginning at 0.20%. Once more, do your due diligence.

Is Monument utilizing bitcoin ETFs in my portfolio?

No, Monument doesn’t at present make the most of bitcoin in any capability, though we actually reserve the fitting to alter our minds. If and once we do, you’ll be able to anticipate considerable communication from us. Like several safety that will get added to one in every of our managed portfolios, we are going to have a look at the information vs. our emotional opinion.

The place else can I examine this?

The very best writing on this house belongs to Matt Levine at Bloomberg. In the event you learn nothing else about this subject, give this opinion piece a glance.