Within the second quarter of 2022, the homeownership price for white households was 75 p.c, in comparison with 45 p.c for Black households and 48 p.c for Hispanic households. One motive for these variations, just about unchanged in the previous couple of a long time, is uneven entry to credit score. Research have documented that minorities usually tend to be denied credit score, pay larger charges, be charged larger charges, and face longer turnaround instances in comparison with related non-minority debtors. On this put up, which relies on a associated Employees Report, we present that banks fluctuate considerably of their lending to minorities, and we doc an neglected issue on this distinction—the inequality aversion of banks’ stakeholders.

Substantial Variations in Banks’ Lending to Minorities

We use mortgage functions knowledge collected underneath the Residence Mortgage Disclosure Act to calculate banks’ lending to minorities. Our knowledge set consists of 114.3 million mortgage functions acquired by 838 banks from 1995 to 2019. For every financial institution and for every year, we calculate the financial institution approval ratio, outlined because the variety of mortgage functions accredited divided by the variety of mortgage functions acquired.

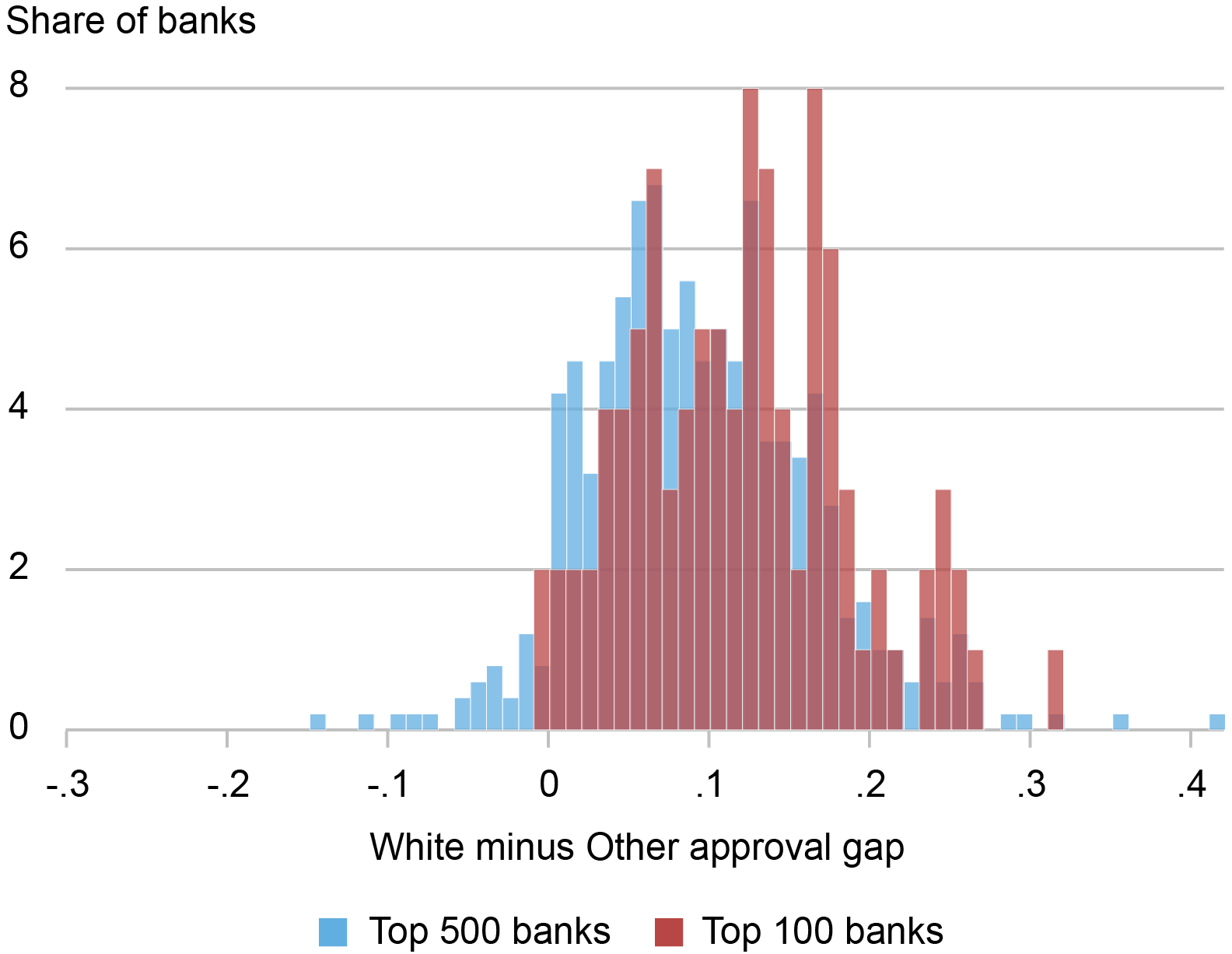

The distinction in lending to minorities throughout banks is sizable. The chart under reveals the distribution of banks’ “approval gaps”—outlined because the distinction within the approval ratios for mortgage functions made by minority and non-minority debtors. Such approval gaps are usually optimistic (in order that approvals are decrease for minority candidates) and heterogenous throughout banks. Crucially, this variation persists inside a slim geographical space (comparable to county or census tract), suggesting that banks with small approval gaps should not systematically positioned in areas of the nation the place minorities have a comparatively low credit score threat.

Banks’ Lending to Minorities Varies Considerably

Supply: Residence Mortgage Disclosure Act (HMDA) knowledge.

Notes: The chart reveals the distribution of approval gaps, outlined because the mortgage software approval ratio for white candidates (HMDA race code 5) minus the mortgage software approval ratio for different candidates (HMDA race codes 1-4). High 500 and high 100 banks are outlined primarily based on the variety of functions acquired. The pattern interval is 1995-2019.

An Ignored Think about Banks’ Lending to Minorities

Measuring stakeholders’ inequality aversion is difficult. It requires each a definition of stakeholders (which embody, for instance, depositors, debtors, staff, and executives) and a measure of their choice for equal outcomes, assets, and alternatives. Provided that financial institution stakeholders are largely native, we calculate financial institution inequality aversion utilizing a survey query on the specified degree of presidency help to minority households from the Basic Social Survey (GSS), a nationally consultant survey carried out since 1972 and extensively utilized in tutorial research.

Particularly, we use a survey query that asks whether or not “we’re spending an excessive amount of cash, too little cash, or about the proper amount of cash on help to Black households.” Survey respondents can select one in all these three choices, coded with the numbers 1, 2, and three. We then calculate, for every financial institution, the weighted common of those responses, utilizing the fraction of deposits that every financial institution has within the space the place the respondent is positioned as weights.

It’s vital to notice that our evaluation is just not primarily based on direct details about any financial institution’s depositors, board of administrators, or administration, or anything particular a couple of financial institution aside from the situation of its branches. Within the absence of details about banks’ precise stakeholders, we assume that the inequality aversion of the respondents who stay within the space the place a financial institution has a department presence is consultant of the preferences of its stakeholders.

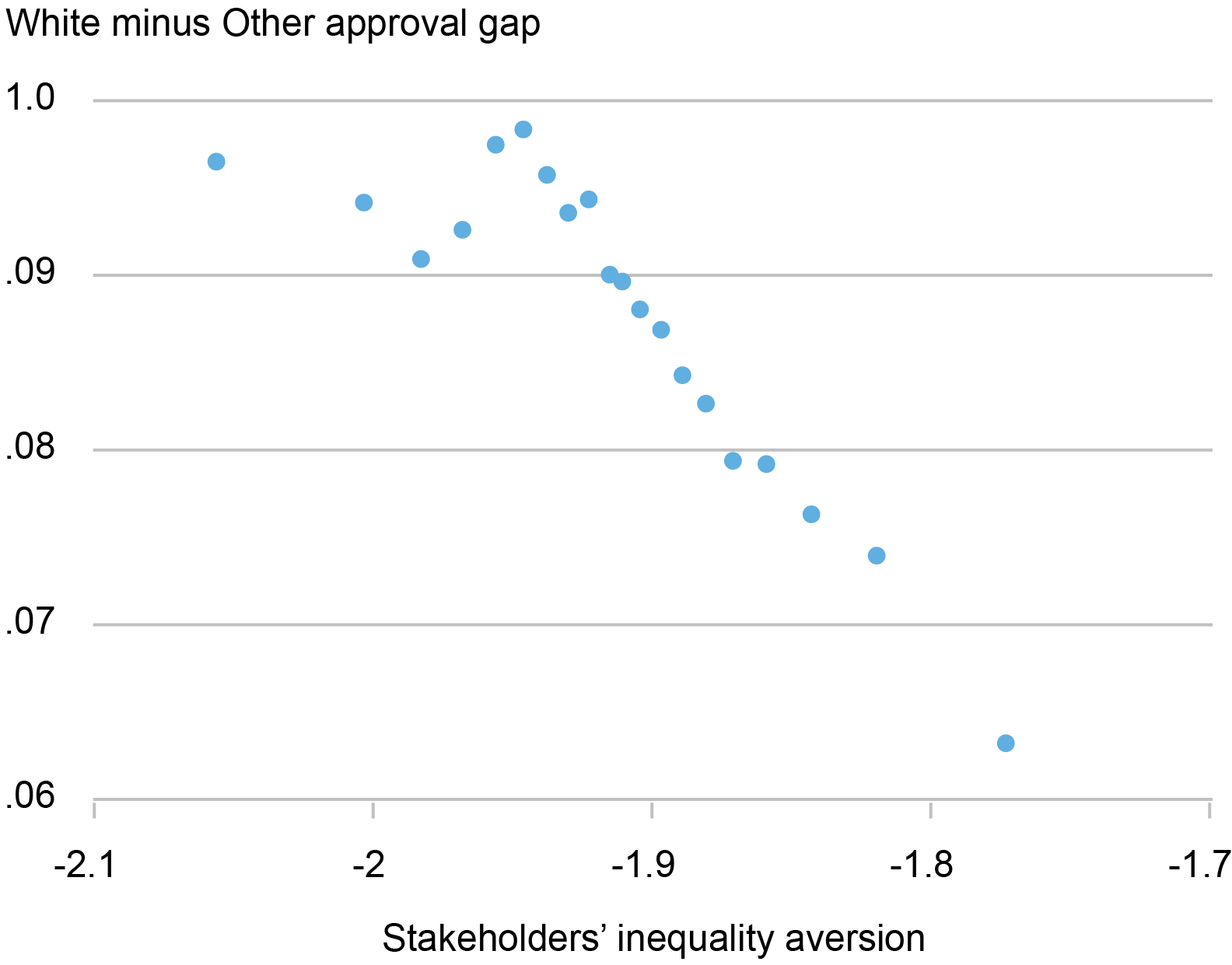

With these caveats in thoughts, we discover that banks with extra inequality-averse stakeholders by our measure are inclined to have smaller approval gaps, as proven within the chart under. The info are analyzed inside census tracts, thus ruling out that this detrimental correlation is fully because of banks with extra inequality-averse stakeholders working in areas the place minorities have a decrease credit score threat. Equally, inside census tracts, banks with extra inequality-averse stakeholders don’t systematically obtain functions from higher-income minority debtors, suggesting that minority debtors with decrease credit score threat don’t systematically apply for mortgages with extra inequality-averse banks.

Inequality-Averse Banks Lend Extra to Minorities

Sources: Residence Mortgage Disclosure Act (HMDA) knowledge; MIT Election Knowledge and Science Lab; FDIC abstract of deposits.

Notes: This binscatter plots banks’ non-minority minus minority approval gaps (the mortgage software approval ratio for white candidates (HMDA race code 5) minus the mortgage software approval ratio for different candidates (HMDA race codes 1-4)) on the y-axis towards stakeholders’ inequality aversion (multiplied by minus one) on the x-axis. The evaluation controls for census tract–yr fastened results. Banks are grouped in bins for readability.

How Would possibly Stakeholders Have an effect on Banks’ Lending?

So, how may an establishment’s stakeholders impression its lending choices? Seemingly not directly. A doable channel is that, of their lending choices, banks take into account the inequality aversion of the counties during which they function in order to draw and retain their (largely native) stakeholders. Per this mechanism, we discover that banks which have been hit with a Division of Justice (DOJ) case for discrimination in mortgage lending expertise a large drop in deposits, one that’s significantly pronounced in counties with excessive inequality aversion. This outcome, detailed in our Employees Report, is in keeping with current anecdotal proof on how stakeholders’ social concerns have an effect on monetary establishments.

Importantly, the upper lending to minorities of banks with inequality-averse stakeholders has a small and optimistic impact on efficiency, suggesting that it isn’t a manifestation of expensive “goodness.” Particularly, the narrowing in approval gaps between minority and non-minority debtors is adopted by a small enchancment in banks’ mortgage guide high quality and a small enhance in total financial institution profitability.

Ultimate Ideas

Our perception on the interplay between stakeholders’ inequality-aversion and banks’ lending to minorities is said to the discussions about lending discrimination and racial and ethnic disparities in housing. On the one hand, such inequality aversion may alleviate lending discrimination primarily based on race and neighborhood traits. Then again, it’d drive banks to specialise in totally different segments of the residential mortgage market. One attention-grabbing avenue of future analysis is knowing to what extent credit score entry for minorities may differ throughout the nation primarily based on the inequality aversion of native stakeholders.

Matteo Crosignani is a monetary analysis advisor in Non-Financial institution Monetary Establishment Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Hanh Le is an assistant professor of finance on the College of Illinois Chicago.

Find out how to cite this put up:

Matteo Crosignani and Hanh Le, “An Ignored Think about Banks’ Lending to Minorities,” Federal Reserve Financial institution of New York Liberty Road Economics, January 10, 2024, https://libertystreeteconomics.newyorkfed.org/2024/01/an-overlooked-factor-in-banks-lending-to-minorities/.

Disclaimer

The views expressed on this put up are these of the creator(s) and don’t essentially mirror the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the duty of the creator(s).