Editor’s word: Since this submit was first printed, the combination bank card utilization fee cited within the second paragraph has been corrected. (Might 14, 12:05pm)

This morning, the New York Fed’s Middle for Microeconomic Information launched the Quarterly Report on Family Debt and Credit score for the primary quarter of 2024. Family debt balances grew by $184 billion over the earlier quarter, barely lower than the reasonable progress seen within the fourth quarter of 2023. Housing debt balances grew by $206 billion. Auto loans noticed a $9 billion enhance, persevering with their regular progress because the second quarter of 2020, whereas balances on different non-housing money owed fell. Bank card balances fell by $14 billion, which is typical for the primary quarter. Nonetheless, an growing variety of debtors are behind on bank card funds. On this submit, we discover the connection between bank card delinquency and modifications in bank card “utilization charges.”

The nationwide mixture bank card utilization fee—that’s, what share of the combination credit score restrict is getting used—was about 23 % final quarter, on par with earlier quarters. Nonetheless, the utilization charges of people differ extensively: 52 % of debtors had been utilizing lower than 20 % of their accessible credit score within the first quarter, whereas 18 % of debtors had been utilizing a minimum of 90 % of their accessible credit score (19 % had been between 20 and 60 % utilization, and 11 % had been between 60 and 90 %). Right here, we concentrate on the share of debtors utilizing 90 % or extra of their credit score restrict, whom we check with as “maxed-out debtors,” and the way doubtless they’re to overlook bank card funds.

Rising Credit score Card Delinquencies

For all debt outdoors of scholar loans, delinquency has been steadily rising because the fourth quarter of 2021 after historic lows through the COVID-19 pandemic. Bank card delinquencies, particularly, have risen previous pre-pandemic ranges. Will this development proceed, or are we more likely to see a leveling off or perhaps a discount in bank card delinquencies?

Missed bank card funds are attributable to many elements, starting from forgetfulness to money movement constraints and earnings loss. Most of those are tough to foretell or observe in individual-level credit score knowledge; nonetheless, one observable issue that’s strongly correlated with future delinquencies is a excessive bank card utilization fee. Whereas debtors who had been present on all their playing cards within the first quarter of 2024 had a median utilization fee of 13 % within the earlier quarter, those that grew to become newly delinquent had a median fee of 90 %. This is smart, since utilizing virtually your whole accessible credit score may point out a good cash-flow state of affairs. Certainly, credit score utilization is a key enter in credit score scores, that are supposed to measure the chance of future default.

This sturdy correlation between utilization and delinquencies signifies that maxed-out debtors is beneficial for gaining some perception into the place new delinquencies are headed.

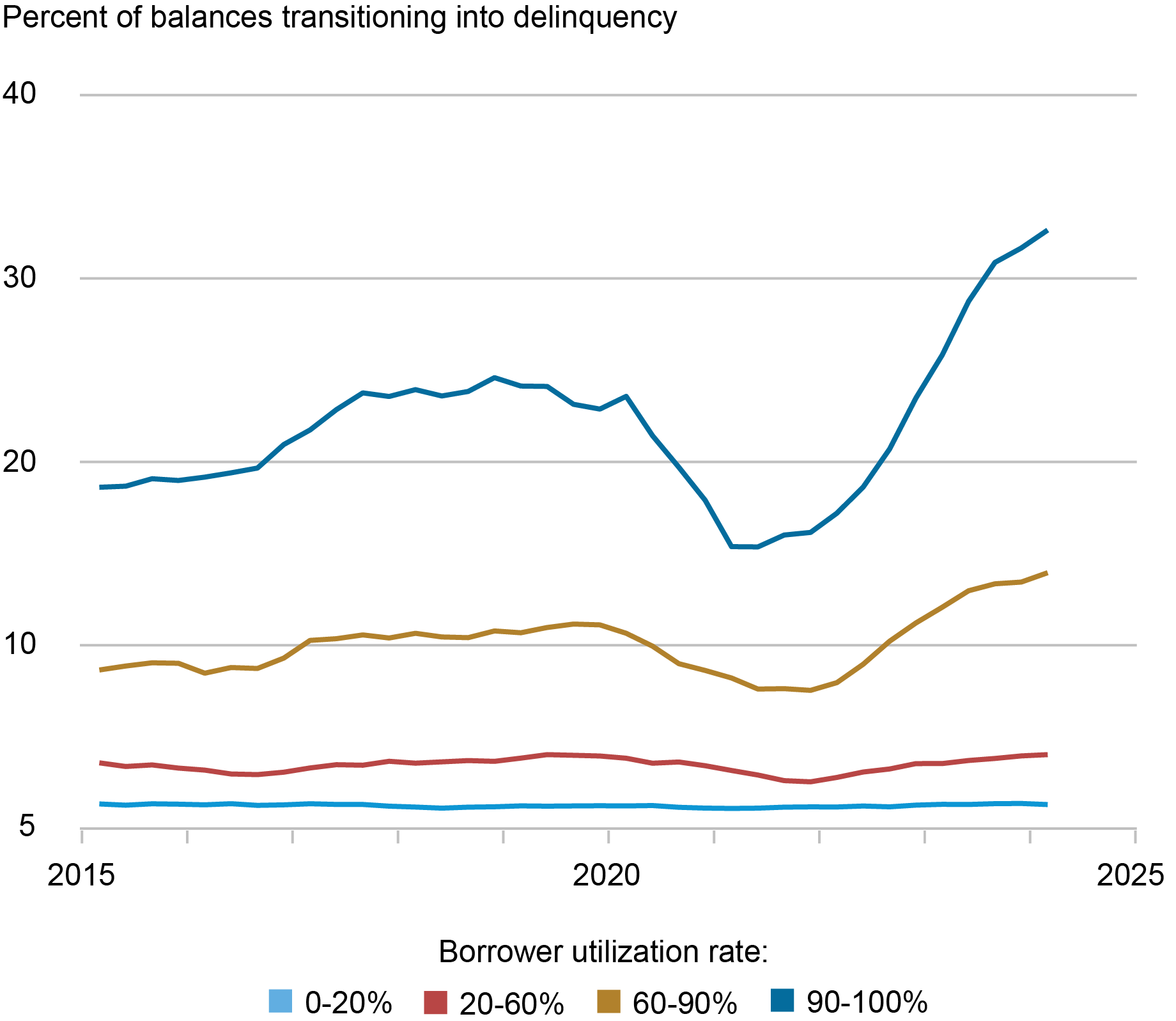

The chart under exhibits the proportion of bank card balances held by present debtors that’s newly transitioning to delinquency, damaged down by the borrower’s bank card utilization within the earlier quarter. Charges are smoothed as a four-quarter transferring sum to keep away from seasonality. The 2 lowest utilization teams have low charges of transition to delinquency all through the time sequence (1 % for the 0-20 % utilization group and 4 % for the 20-60 % group) and at the moment are at their pre-pandemic degree. Nonetheless, the transition charges for these with better than 60 % utilization have surpassed pre-pandemic ranges and proceed to rise, accounting for a lot of the will increase in total bank card delinquency charges. This enhance is very exceptional for the 90-One hundred pc utilization group; a couple of third of balances related to maxed-out debtors have gone delinquent within the final yr, in comparison with lower than 1 / 4 of balances per yr earlier than the pandemic.

Maxed-Out Debtors See Rising Delinquency

Notes: The chart exhibits balance-weighted transition to bank card delinquency amongst debtors who had been present on all bank card accounts within the earlier quarter. A borrower’s utilization group is set by their utilization within the earlier quarter. Information are smoothed as four-quarter transferring sums to account for seasonal developments.

It ought to be famous that bank card utilization is a operate of each stability and credit score restrict, and folks with decrease limits usually have greater utilization charges. Certainly, present debtors within the 90‑100 % utilization band had a median complete credit score restrict of $5,000 within the first quarter, lower than half of the median $10,050 restrict for the 60-90 % group and fewer than one-fourth of the 0‑20 % utilization group’s median restrict of $21,000. So, to some extent, utilization fee can also be a mirrored image of underlying credit score high quality and earnings as a result of greater credit score rating debtors with greater earnings usually have greater limits and decrease utilization charges.

The next desk exhibits median bank card balances and limits and the proportion share of maxed-out debtors for non-delinquent debtors within the first quarter of 2024. First, we take a look at the inputs to utilization by debtors’ neighborhood earnings (based mostly on Census block group). Debtors in higher-income areas are much less more likely to have excessive bank card utilization (partially due to variations in credit score limits—a median of $25,800 for the very best quartile vs $11,300 for the bottom), regardless of median balances being extra related throughout earnings teams. Observe that delinquent debtors are excluded from this desk since most of them are already maxed-out by both spending as much as the restrict or by the lender reducing the restrict to forestall additional spending.

Youthful Card Customers and Card Customers Dwelling in Low-Earnings Areas Are Extra Prone to Be Maxed-Out

| Median Steadiness | Median Credit score Restrict |

Proportion Maxed-Out |

||

| Earnings quartile | 1st (lowest) | $1,410 | $11,300 | 12.3% |

| 2nd | $1,597 | $15,000 | 10.2% | |

| third | $1,817 | $18,600 | 8.1% | |

| 4th (highest) | $2,099 | $25,800 | 5.5% | |

| Era | Gen Z | $760 | $4,500 | 15.3% |

| Millennials | $2,378 | $16,300 | 12.1% | |

| Gen X | $3,017 | $21,800 | 9.6% | |

| Child boomers | $1,599 | $22,000 | 4.8% |

Sources: New York Fed Shopper Credit score Panel/Equifax; American Group Survey.

Notes: A borrower’s earnings quartile relies on the median family earnings of their Census block group. A borrower’s technology relies on their birth-year. Child Boomers are these born between 1946 and 1964, Era X are 1965 to 1979, Millennials are 1980 to 1994, and Era Z are 1995 to 2011. Maxed-out denotes debtors who’ve 90 % or greater utilization throughout all bank cards.

We additionally separate bank card utilization fee by debtors’ birth-year technology. The incidence of high-utilization debtors appears to fall through the life cycle. Only a few Child Boomers are maxed-out, whereas 15.4 % of Era Z bank card customers make the most of over 90 % of their credit score restrict. Nonetheless, Gen Z debtors even have low median limits of $4,500, whereas median limits for older generations vary from $16,300 for Millennials to $22,000 for Child Boomers. A lot of this may be attributed to the shorter credit score histories, and thus decrease credit score rating, of the youngest technology, and to decrease earnings. Gen Z’s first bank card account is 4 years outdated on common, whereas a Millennial’s is eleven years outdated. As explored in our submit on the third-quarter 2023 Quarterly Report, Gen Z has the very best delinquency transition fee, however Millennials had been the one group whose delinquency exceeded their pre-pandemic fee.

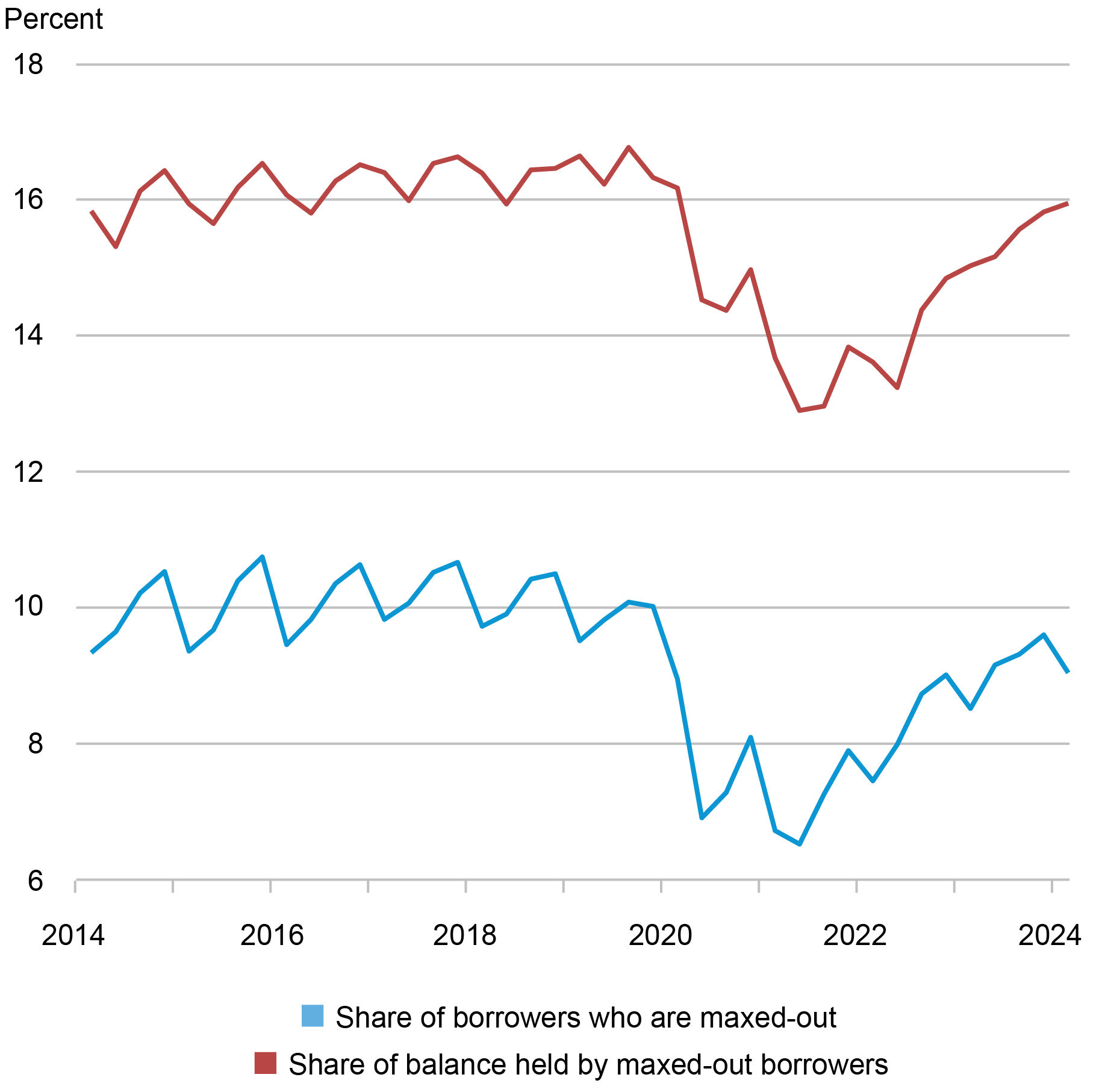

The chart under exhibits a time sequence of non-delinquent maxed-out debtors, with the blue line denoting their share amongst present debtors and the pink line exhibiting the share they maintain of mixture present balances. Bank card debtors made large paydowns on their playing cards in 2020 and 2021, a time throughout which earnings rose from pandemic transfers and help however consumption alternatives had been restricted, leading to a decline within the share of maxed-out debtors. Because the financial system reopened in 2022 and consumption was very sturdy in 2022 and 2023, bank card balances elevated once more, leading to an increase within the share of maxed-out debtors and their balances. These shares stay barely decrease than the pre-pandemic degree however are edging again up.

The Share of Maxed-Out Credit score Card Debtors Continues to Climb

Notes: Maxed-out denotes debtors who’ve 90 % or greater utilization throughout all bank cards. Delinquent debtors and balances are excluded. Information are usually not smoothed and mirror seasonal patterns.

Conclusion

We now have proven that new bank card delinquencies are disproportionately ascribable to maxed-out debtors and their balances. The share of maxed-out debtors has been growing from pandemic lows and is approaching pre-pandemic ranges, and the delinquency transition charges of those maxed-out debtors at the moment are noticeably greater than pre-pandemic, leading to greater transition charges into bank card delinquency total. For a optimistic enchancment in bank card delinquency, we would wish to see the delinquency transition fee amongst maxed-out debtors start to say no and/or the share of maxed-out debtors to fall. To date, the info present neither of those developments transferring in the appropriate course. If these developments proceed and different elements influencing delinquencies stay the identical, bank card delinquencies are more likely to proceed to rise. After all, macroeconomic circumstances can transfer these developments in both course, so we are going to proceed to watch the state of affairs within the coming quarters.

Andrew F. Haughwout is the director of Family and Public Coverage Analysis within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Donghoon Lee is an financial analysis advisor in Shopper Conduct Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Daniel Mangrum is a analysis economist in Equitable Development Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Joelle Scally is a regional financial principal within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Wilbert van der Klaauw is the financial analysis advisor for Family and Public Coverage Analysis within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Crystal Wang analysis analyst within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

cite this submit:

Andrew F. Haughwout, Donghoon Lee, Daniel Mangrum, Joelle Scally, Wilbert van der Klaauw, and Crystal Wang, “Delinquency Is More and more within the Playing cards for Maxed‑Out Debtors,” Federal Reserve Financial institution of New York Liberty Avenue Economics, Might 14, 2024, https://libertystreeteconomics.newyorkfed.org/2024/05/delinquency-is-increasingly-in-the-cards-for-maxed-out-borrowers/.

Disclaimer

The views expressed on this submit are these of the writer(s) and don’t essentially mirror the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the duty of the writer(s).