Following the Nice Monetary Disaster, there was a fear the approaching tsunami of retiring child boomers was going to result in a retirement disaster of epic proportions.1

Their portfolios have been down dangerous. Housing costs had crashed. They didn’t save sufficient cash. Folks have been fearful about Social Safety. Everybody was predicting decrease returns for monetary property going ahead. There are far fewer pensions today.

Issues seemed bleak.

Whereas we haven’t fairly solved the retirement equation for everybody, the image seems a lot brighter at this time than it did again then.

Monetary market returns have been higher than anybody might have anticipated within the early-2010s. The pandemic triggered housing costs to skyrocket. Folks have been capable of refinance at generationally low mortgage charges. Folks paid off their properties.

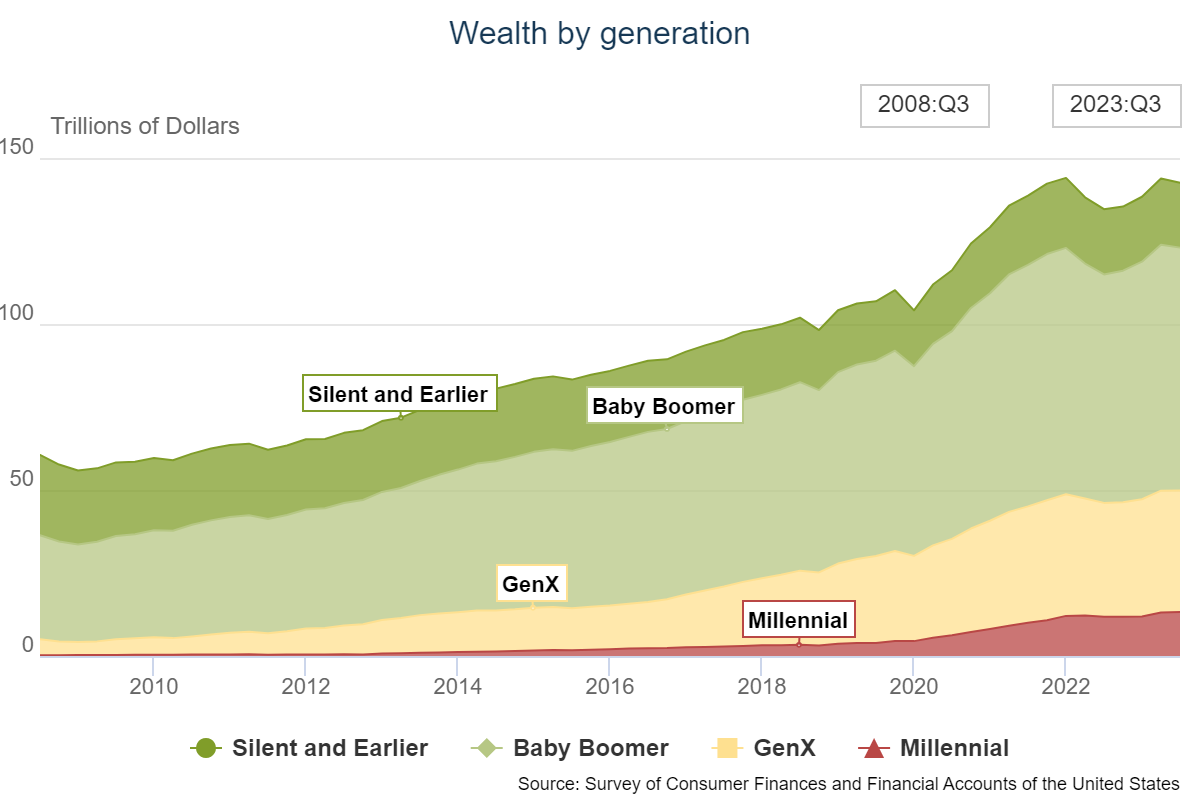

Child boomers and the silent era (plenty of that cash will get handed all the way down to the boomers) now management almost $93 trillion of wealth. That’s 65% of the wealth on this nation:

They’re doing simply positive and feeling positive as effectively.

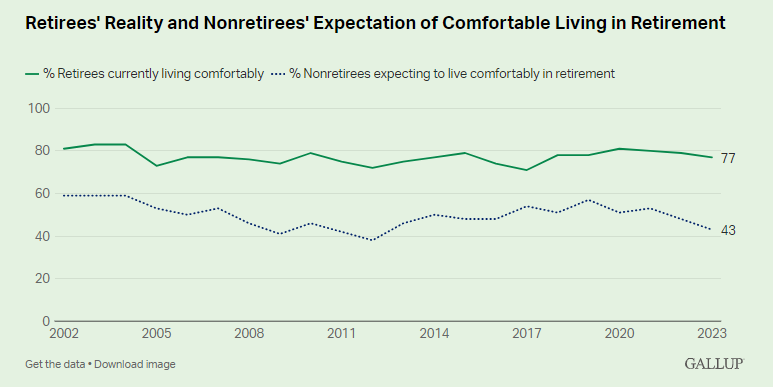

In keeping with a Gallup ballot, simply 43% of non-retirees anticipate a financially snug retirement whereas 77% of retirees say they’ve loads of cash to dwell comfortably:

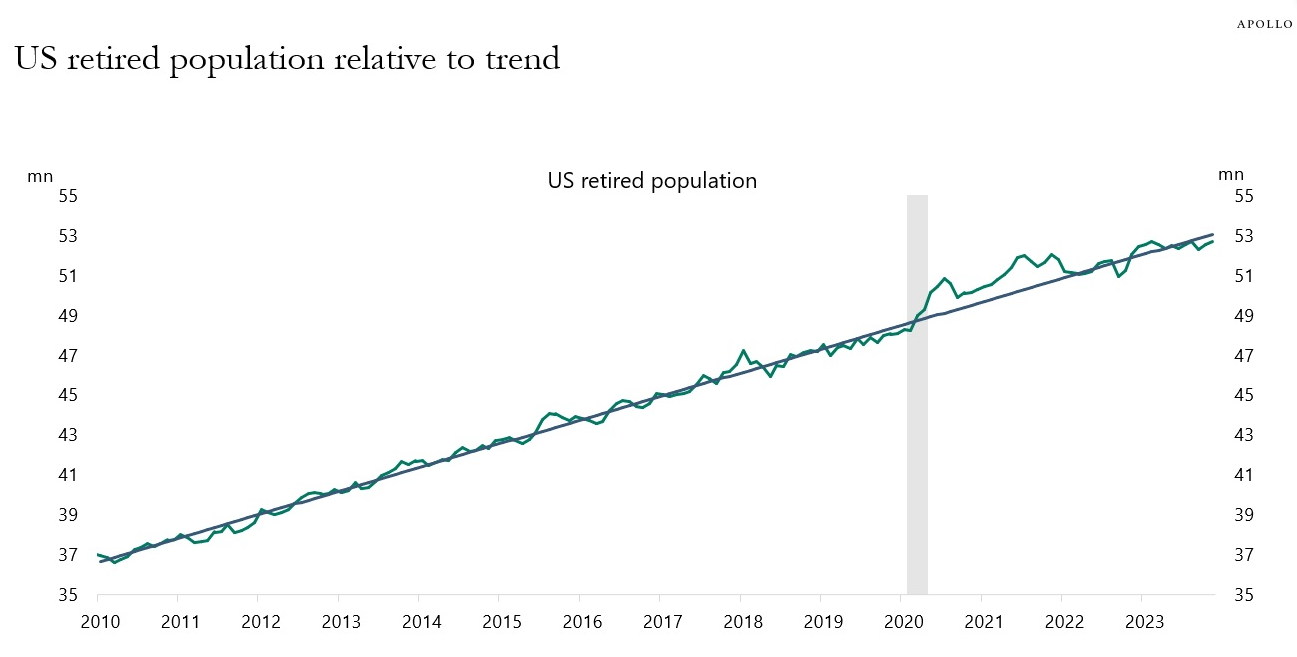

And that is even if the retired inhabitants in the US has grown considerably over the previous decade and alter:

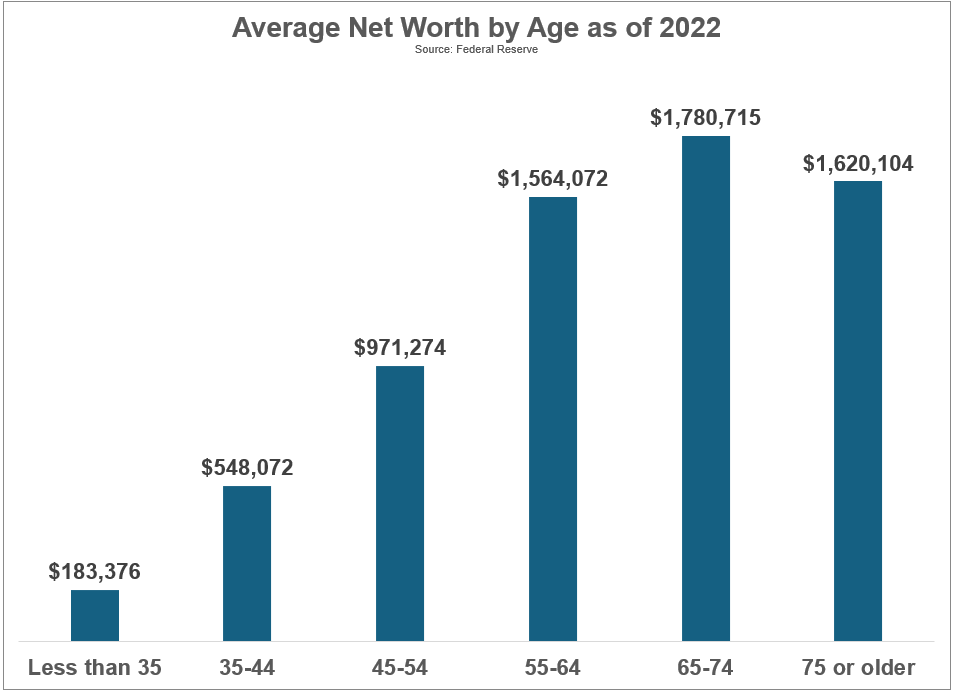

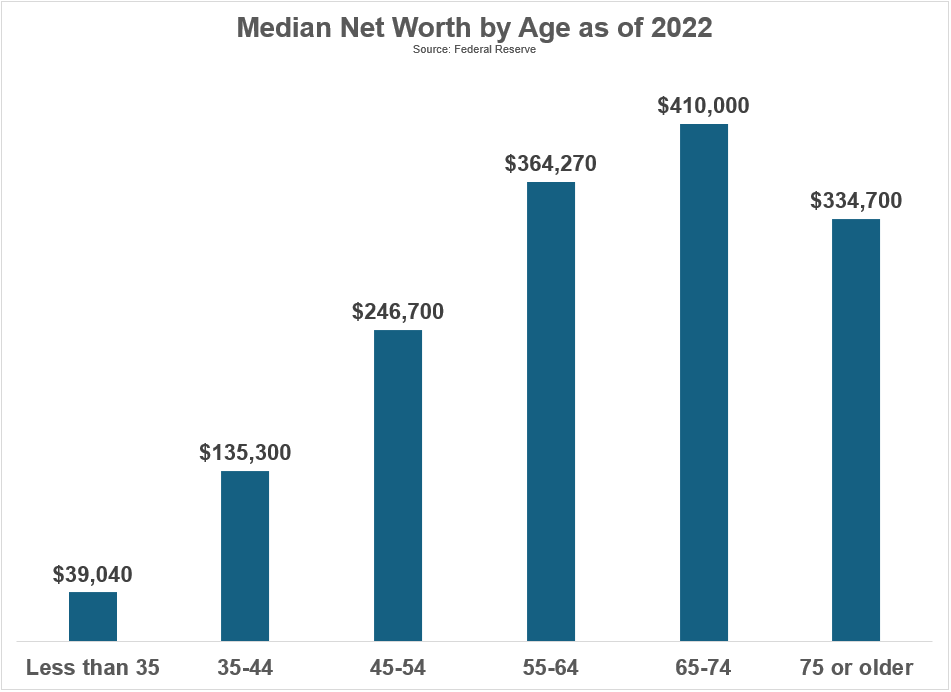

That is the common web price by age bracket courtesy of the Federal Reserve as of year-end 2022:

Not dangerous for older Individuals, proper?

Clearly, these averages are skewed by the wealthiest households.

The median numbers present a greater image of the monetary well being of most Individuals:

I do know this may not appear like a lot to some individuals however these numbers are approach greater than they have been within the early 2010s when individuals have been nonetheless licking their wounds from the 2008 monetary disaster.

This cash goes additional than you assume.

Many retired individuals now have their properties paid off.

Social Safety offers a mean good thing about greater than $1,800 a month. That’s almost $45,000 a yr for a married couple. And keep in mind, that revenue is listed to inflation.

You even have to recollect taxes are decrease in retirement for most individuals. You don’t have to economize for retirement anymore.

Take away all of those bills and now that annual retirement revenue takes you a large number additional.

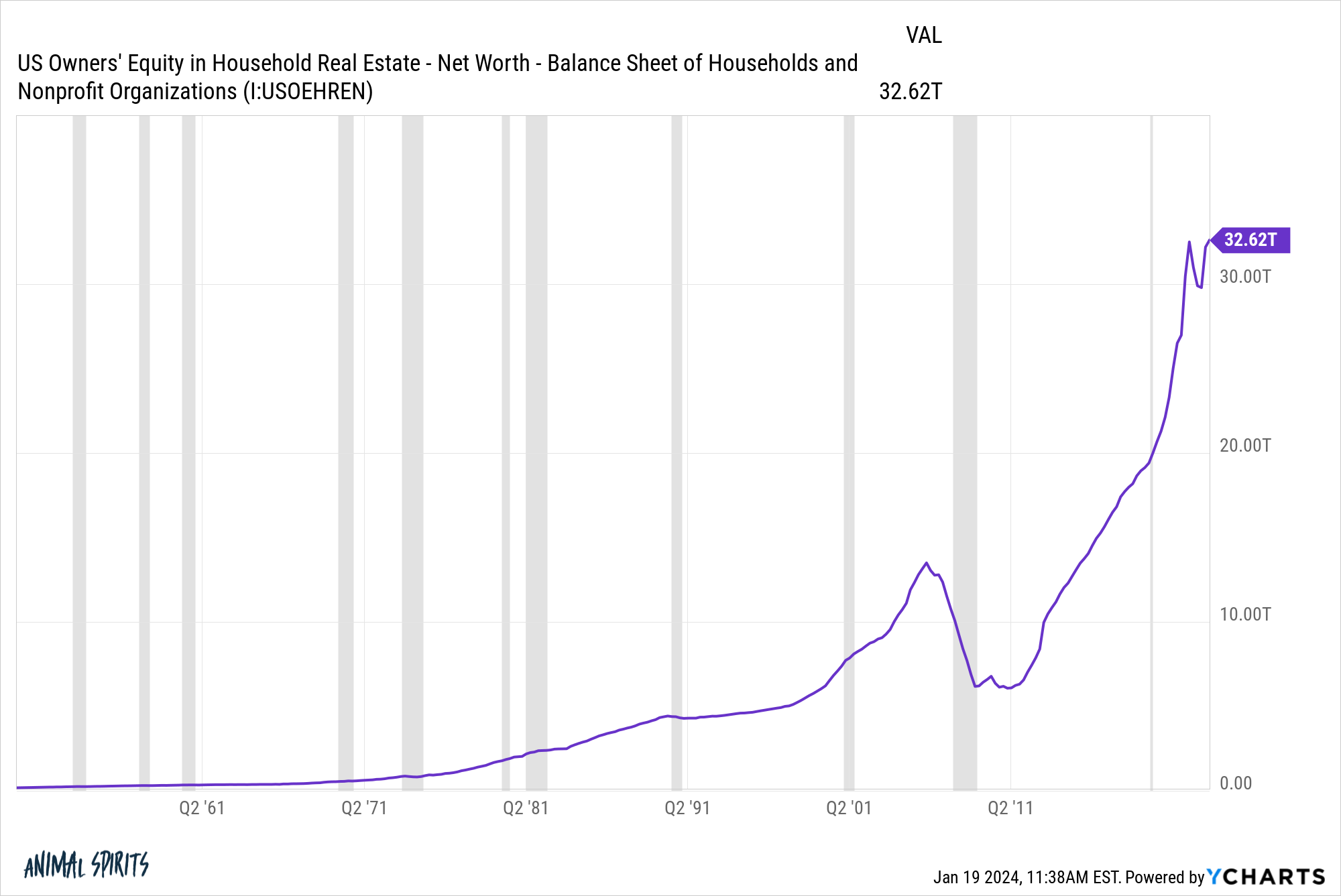

Plus, child boomers have an insane quantity of residence fairness to faucet in retirement. A home is the largest monetary asset for almost all of the center class. The pandemic housing growth added a ridiculous quantity of fairness for householders.

Some mixture of Social Safety, residence fairness, and retirement financial savings means most individuals are going to be simply positive in retirement. This doesn’t imply everybody will get to dwell an opulent life-style however we’re not speaking breadlines right here both.

The U.S. inhabitants ages 65 and above has gone from 9% within the Sixties to just about 18% at this time. That quantity will proceed to develop.

Individuals are dwelling longer so retirement planning has by no means been extra vital than it’s at this time.

Some may must work longer, delay taking Social Safety or use their residence fairness as a piggy financial institution. However that’s a much better state of affairs than the catastrophe we have been gazing popping out of the Nice Monetary Disaster.

There are at all times going to be individuals who wrestle however the retirement disaster everybody was predicting within the 2010s didn’t come to fruition.

Michael and I talked concerning the retirement disaster and rather more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

Now right here’s what I’ve been studying:

Books:

1I’ve been writing about it too.

This content material, which accommodates security-related opinions and/or info, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There could be no ensures or assurances that the views expressed right here will likely be relevant for any explicit details or circumstances, and shouldn’t be relied upon in any method. It is best to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “submit” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital property, or efficiency information, are for illustrative functions solely and don’t represent an funding advice or supply to supply funding advisory providers. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding determination. Previous efficiency just isn’t indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and will differ or be opposite to opinions expressed by others.

Wealthcast Media, an affiliate of Ritholtz Wealth Administration, receives cost from varied entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or indicate endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the danger of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.