Agency presents two options

The resilience of Australia’s property market is examined as Lismore struggles to get better from the 2022 floods, with land values halving and creating challenges in saleability and monetary stability, in accordance with a brand new report from PointData.

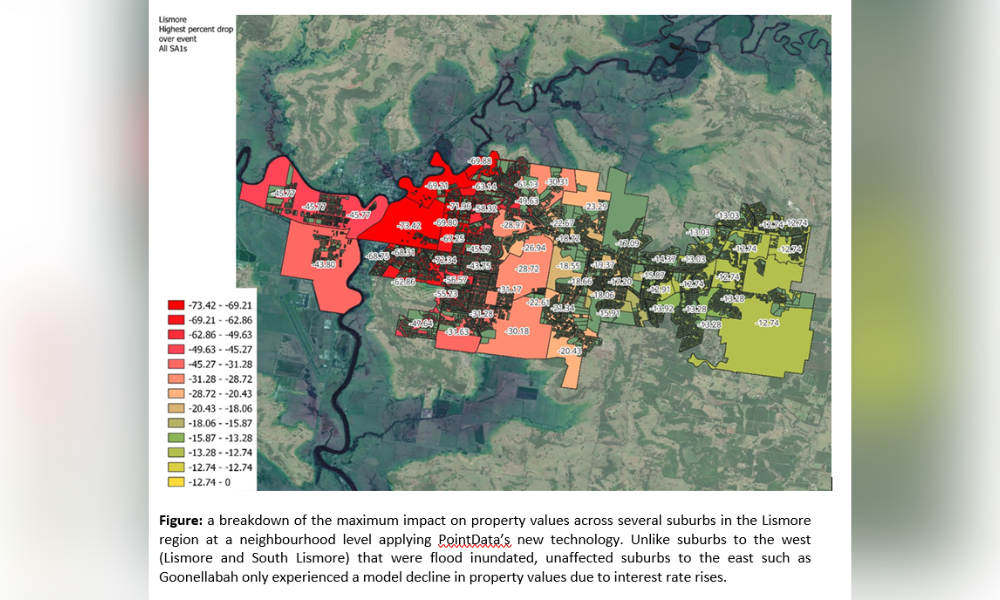

PointData’s local weather danger modelling uncovered the long-term devaluation of properties in Lismore, using AI and machine studying to distinguish between speedy and prolonged impacts on property values.

Monetary sector below risk

George Giannakodakis (pictured above), founding father of PointData, mentioned the compounded devastation attributable to local weather occasions and market fluctuations, notably highlighting the drastic worth drop in Lismore’s flood-affected areas and the next dangers to the monetary sector.

Regardless of restoration initiatives just like the NSW authorities’s Lismore Flood Restoration Planning Bundle, property values in North and South Lismore stay considerably diminished.

“The flow-on impression is that whole postcodes or suburbs are sometimes then labeled as ‘no go’ zones by banks and insurers, as the chance of additional flooding, or climate-related occasions stays,” Giannakodakis stated.

PointData’s improvements

In a media launch, PointData stated its granular know-how now identifies places inside suburbs much less weak to flood danger, separating them from higher-risk areas.

The corporate has developed two options accessible to each shoppers and monetary establishments:

- An evaluation of constructing danger on the property stage for all residential properties, which contains mitigation methods by planning overlays and constructing codes for brand spanking new constructions and developments. Utilizing international digital elevation knowledge, LIDAR, and authorities information, PointData can exactly calculate a property’s footprint and construction in areas affected by local weather occasions.

- A climate-adjusted LVR ratio instrument for banks, designed to precisely talk the possible dangers on the property stage to the monetary sector.

“As an business, we have to discover options that unfold the chance of climate-related occasions to mitigate the potential for ‘local weather ghettos,’” Giannakodakis stated. “Innovation and know-how ought to be on the centre of the answer to allow protections for owners, whereas mitigating the chance for banks and insurers.”

Get the most popular and freshest mortgage information delivered proper into your inbox. Subscribe now to our FREE every day e-newsletter.

Sustain with the most recent information and occasions

Be part of our mailing listing, it’s free!