Nifty 50, the inventory market index from NSE, has crossed 20,000, the primary time ever. And but, it doesn’t encourage confidence. As if, one thing is about to go fallacious.

I communicate to Amey Kulkarni, one of many most interesting buyers and thinkers, on how he sees the present market and what method is sweet for buyers at this stage.

VK: Amey, let me take the bull by the horns. What’s your take available on the market? Ought to I withdraw cash or make investments extra?

AK: Let me inform you a narrative from 2016.

Donald Trump received the US elections and it was broadly opined that this isn’t good for the inventory markets. This was additionally the time round demonetisation in India and there was a number of uncertainty. I had a dialogue with considered one of my closest pals and my first consumer. Regardless that I mildly opined in opposition to it, my buddy ended up promoting part of his mutual fund portfolio as a matter of warning. And the inventory markets simply saved going up and actually, smallcaps had an exceptional run in 2016-17 and fell in 2018.

Come circa March 2020, Covid hit us.

I used to be cautious and circumspect. The one factor I knew was this isn’t the time to promote your shares / mutual funds. By this time, my buddy had developed. He was busy along with his work and hardly regarded on the inventory market. He rapidly realised that this was a good time to purchase. When he referred to as me as much as have a dialogue, I instructed warning and prudence as the longer term appears to be like too unsure from this vantage level.

Being outdoors the market, he was capable of assess the state of affairs and act on his conviction. He wager closely in March and April 2020 on mutual funds and made a good-looking return.

The joke is that right this moment, I preserve reminding each one which March 2020 was the most effective time to purchase and my buddy simply retains quiet and doesn’t remind me that in March 2020, I used to be not as certain.

My take available on the market?

- 10% of the occasions is a bear market

- 10% of the occasions it’s a bull market

- 80% market makes certain, we’re confused

Regardless that we can’t predict the inventory market, most of us can simply inform whether or not we’re in a bull market or a bear market.

What’s the studying above?

- Nobody can predict the inventory markets

- Inventory markets will at all times shock us – both on upside or on draw back

- The one factor we will do is make investments extra money when the inventory markets fall

VK: Let me push this additional. On the one hand,Nifty 50 is in any respect time excessive of 20000. Alternatively, there are information / rumours about an upcoming recession particularly within the USA. I really feel confused as an investor. What’s your take?

I’m additionally confused.

However let me lay out the funding situation as I see it.

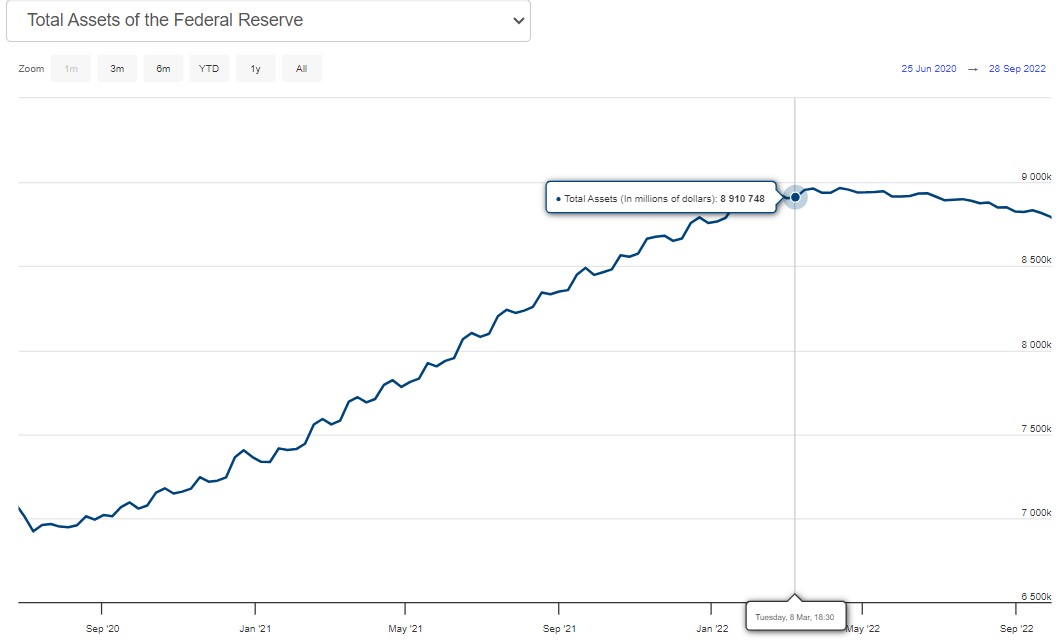

Rates of interest within the US have gone up from 0% to five.25% after being virtually zero for 12 years since 2009. The Federal Reserve has additionally began financial tightening.

Complete Fed property have lowered from $ 8.9 Tr in mid-2022 to about $ 8.1 Tr in Sep 2023.

The bubble in tech corporations and cryptocurrencies has already burst within the US and there may be most likely extra to come back.

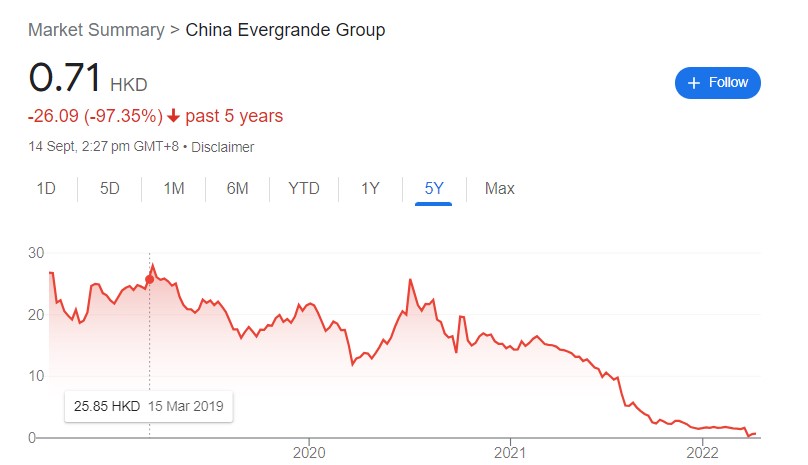

As regards China, information from their property market is just not good. Their two largest property builders Evergrande and Nation Backyard (that are many occasions larger than DLF) are each in monetary hassle. When the complete developed world is rising rates of interest to regulate inflation, China is slicing rates of interest to spice up their actual property sector.

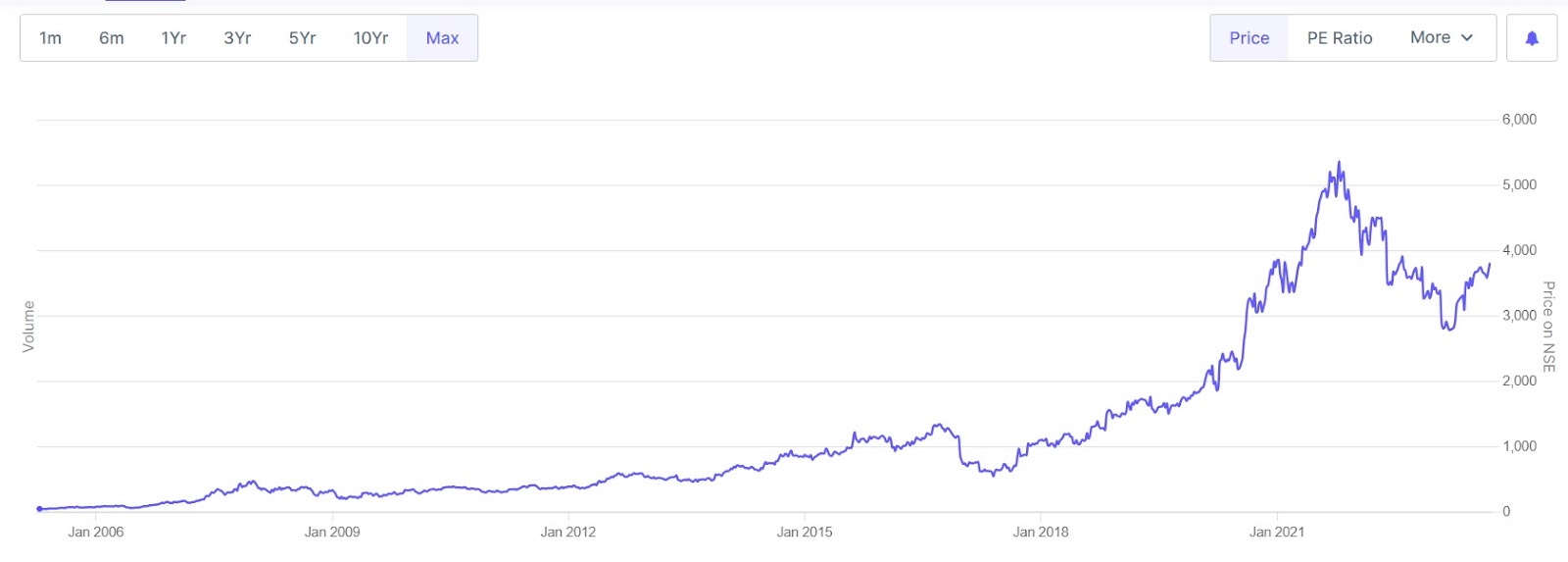

Inventory Worth – Nation Backyard (Property developer in China)

Inventory Worth – Evergrande (Property developer in China)

Possibly the wild bubbles that existed in 2021 have already gone bust within the US / Europe / China.

What about India?

India is in a candy spot.

We now have entered the interval the place we now have a big working age inhabitants and this demographic dividend benefit will play out for us until about 2050.

Working age inhabitants is shrinking all over the place else on the earth (besides Africa).

This similar demographic dividend performed out for England within the 1800s, for the US in late 1800s and early 1900s, for Japan in Fifties and Sixties, South Korea in Nineteen Seventies and Eighties and for China in Nineteen Nineties and 2000s.

Additionally, the template for financial development in Asia has been nearer financial ties with the US for the final 70 years – Japan, South Korea, Singapore, China have all grown by way of nearer financial ties with the US, it’s now our flip.

Inflation is steady in India since about 2016.

Main reforms have been carried out – GST, RERA, chapter code and so on.

Main push by the federal government by way of CAPEX in roads, railways and PLI schemes

We’re the one giant economic system the place the developed world needs to speculate. China’s time is up – when it comes to incremental international capital inflows.

If international funds wish to put money into rising markets particularly since their native inventory markets appear to be unattractive, India is the one giant nation which appears to be like promising.

So what’s the bottomline?

Developed world is in hassle, however India is trying good.

VK: Let me try to see if historical past is a information right here. In case you had been to check right this moment’s market state of affairs with one thing related up to now, what can be the closest one?

AK: Allow us to have a look at knowledge.

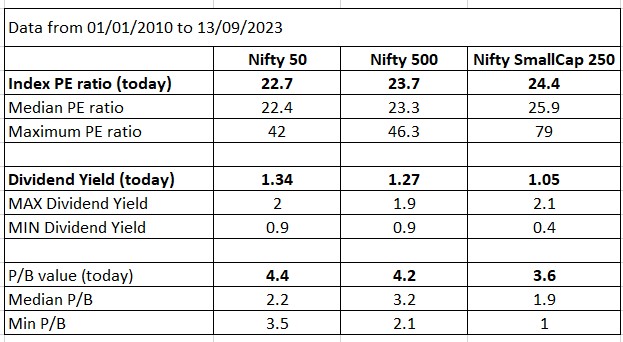

I’ve taken knowledge for Nifty50, Nifty500 and Nifty SmallCap 250 indices from 1st Jan 2010 until thirteenth Sep 2023.

(Word – Nifty SmallCap 250 index was launched in Jan 2016)

If we have a look at PE ratio or dividend yield, in combination the Nifty indices don’t look very costly. Nonetheless, P/B worth for all of the indices is excessive.

Additionally, within the final 6 months since March 2023 that small and midcap shares have gone up so much and that’s the reason there may be unease amongst most worth buyers.

Yet another knowledge level to contemplate is the Nifty VIX (volatility)

The Nifty volatility index is at an all-time low. Traditionally inventory returns have been unstable. A low VIX index warrants some warning.

VK: Which interval in historical past can we loosely evaluate right this moment’s market with?

AK: A pair, truly.

Interval – 2000s

US inventory market returns had been mediocre particularly after the large tech bubble burst in Mar 2000. Nonetheless, the inventory market returns in India and China had been outstanding.

Interval – Nineteen Nineties

At one time limit, it was predicted that Japan might overtake the US to develop into the biggest economic system. The Japanese bubble burst in 1990. It didn’t have a lot of an impression on different Asian markets or the US inventory markets. Most Asian markets have phenomenal returns between 1990 and 1997 when the Asian foreign money disaster occurred.

So, it’s fairly potential that even when there’s a recession within the US / developed world, India might proceed to do nicely – each when it comes to financial development and inventory market returns.

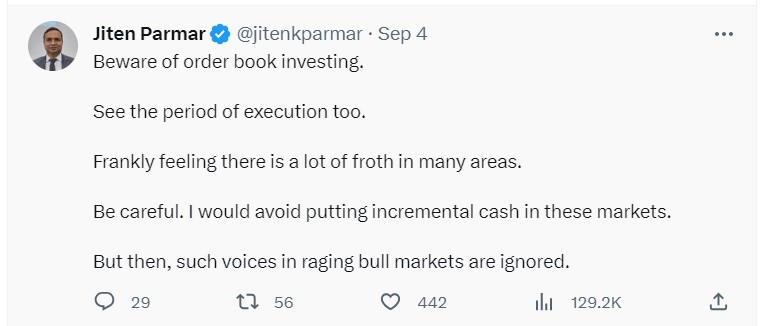

There’s a variance of opinion amongst experiences worth buyers

Supply – Tweet from Jiten Parmar

Supply – Interview quote from Prashant Khemka – Whiteoak Capital

Nonetheless, there are additionally bullish experiences buyers on the market.

Supply – Tweet from Ravi Dharamshi – ValueQuest

VK: So what ought to my portfolio technique be?

AK: I can solely inform you what I do with my portfolio.

- 80% of my networth is invested in fairness

- My mutual fund SIP continues regardless of any market circumstances

- I don’t promote shares in worry of the market happening.

- I’m cautious in shopping for new shares in my portfolio for the final 8-10 months

- I’m additionally discovering it tough to seek out new concepts within the present market

- All my incremental earnings are including to my dry powder

- I’m affected person. Ready out my time to seek out nice new alternatives to purchase

- I’ll get alternatives both as a result of I found new shares which look enticing from development / valuations perspective or the markets fall so much

VK: Would you say that the following few years might be muted when it comes to returns?

AK: April 2020 to now has been a dream run for shares markets

Returns within the subsequent 3 years are positively going to be lesser than within the final 3 years

Yearly doesn’t yield constructive returns.

Since we have no idea which yr goes to be a damaging return yr, we now have to carry on and be affected person.

The choice to carry / promote / purchase must be made on a inventory particular foundation.

VK: Mid and small cap funds are witnessing report inflows. There appears to be a way of bubble on this phase. How ought to an investor method this market cap for now? Is it time to guide some earnings?

AK: Smallcaps and midcaps, as a class, positively transfer in cycles (doesn’t apply to particular person shares). There are durations when midcap and smallcap shares are within the zone of pessimism and at different occasions they’re in a zone of exuberance. What time is it now?

Nifty SmallCap 250 index returns from

- Sep 2013 to Sep 2023 = 20% CAGR

- Sep 2014 to Sep 2023 = 13% CAGR

If we have a look at line 1, we might conclude we appear to be in a zone of exuberance.

Nonetheless, line 2 above suggests perhaps occasions are optimistic, will not be exuberant

I deal with direct inventory investing and mutual fund investing fully in a different way.

Mutual fund investing is all about self-discipline and consistency – SIP over lengthy durations of time.

Direct inventory investing must be opportunistic.

Each must have a very long time horizon, nonetheless in case of shares, we don’t must compulsorily make investments each month. We now have to attend for the suitable inventory on the proper value after which reap the benefits of the mispricing within the inventory markets to wager closely.

Going by the present market situation, one must be cautious when allocating extra to midcap / smallcap mutual funds. In case your allocation to smallcap / midcap mutual funds could be very excessive, you may wish to have a rethink. It is because a mutual fund by design invests in a number of (50+) shares and a extreme market decline will find yourself testing your conviction and endurance. It pays to be cautious. We find yourself making extra money in the long term.

Having stated this, funding made within the appropriate inventory at an affordable or an inexpensive sufficient value will ship good returns regardless of what the index does.

VK: Ought to an investor put in extra money through SIPs? And, is giant cap house a greater possibility to speculate for now? Or, ought to one play far more safely and use actual property, gold, and so on.

AK: I don’t suppose when it comes to maximization of returns. It’s simply not possible to foretell which asset class goes to present the most effective returns over the following 1/2/3 years.

Over the following 5/7/10 years, fairness is the asset class which can in all probability give the utmost returns.

SIP in mutual funds is without doubt one of the most secure, best and hassle-free methods of investing in equities regardless of the market sentiment / stage.

If and when the markets fall so much, one can and should get extra aggressive on direct shares.

About different asset lessons:-

Gold is just not an funding. Take pleasure in gold jewellery.

Actual property – most of us have sufficient actual property. There isn’t any level in shopping for your third or 4th home. In both case, over the long run 10+ yrs, actual property returns hover round inflation.

VK: If I’m an investor with a big lump sum with a 20 yr horizon, ought to i make investments all the pieces now or do it progressively?

AK: What must be performed instantly is to suppose and resolve the next

- Which asset do I wish to put money into?

- Who will my advisor be?

- What funding philosophy / technique I’m not snug with?

- How a lot will I be bothered with volatility in returns?

- How far more financial savings will I’ve within the subsequent 5 years?

After getting discovered solutions for all of the above questions, and it could take some effort and time to seek out solutions to the above, regardless of the markets you need to go forward and implement the technique.

If in case you have chosen a conservative advisor, he’ll himself take a cautious and gradual method to deploy the lump sum corpus.

VK: You realize, typically, as people and buyers, if we find yourself doing a number of work or analysis, we develop a way of compelled motion. That we now have to take some motion now else it is going to all be futile. And that will not be the case. Do you wrestle with that too? What’s a great way to cope with this concern?

AK: I’ve struggled so much with this concern.

Luckily, with expertise I wrestle a lot much less now.

One great way of coping with that is to be what S Naren – the CIO of ICICI mutual fund says – “ a part-time investor”.

Individuals like me find yourself spending a number of time studying about corporations and being up to date concerning the inventory markets. Nonetheless, having further curricular actions / pursuits is essential. It places issues in perspective.

I’ve lately began to be taught swimming together with my son. I learn books not associated to investing and inventory markets and interact myself in such different non-investing pursuits.

One of many different tips I exploit is to try to not have a look at day by day inventory value actions (although I’m not very profitable at that).

Have a look at the long run value chart for Divis Lab – 450 bagger inventory in 20 years

Observe carefully

- Zero returns between Dec 2007 and Sep 2013 – 6 lengthy years

- 50% fall in inventory value round March 2016

- 60% fall in inventory value in 2009

If one is monitoring the “markets” too carefully the investor will simply get scared out of his / her holding in a superb firm.

VK: Let me ask you one thing extra private. How have you ever modified / grown as an investor Within the final 5 years? What number of investing concepts that you just labored on ended up getting the cash?

AK: There was a number of studying within the final 5 years for me personally as an investor.

If I mirror again, the areas through which I’ve improved are the next

- I’m extra snug with uncertainty

I don’t know whether or not I’ll generate income in ‘a’ inventory or not. However, if I’ve performed my analysis nicely, I’m not involved concerning the inventory value motion

- I’ve develop into extra affected person.

I do know that success is inevitable within the inventory markets if the method is in place. Nonetheless, shares by no means transfer on the timelines that we envisage.

- I’m extra snug with remorse

Remorse is inevitable when investing in shares.

“I ought to have invested extra money in April 2020”

“I ought to have invested extra money on this inventory which turned 4X”

“I ought to have by no means invested on this share – no inventory value development since 3 years.”

“I ought to have invested on this in 2021 as an alternative of placing cash in 2018”

“I missed investing on this inventory despite doing analysis on it”

Cash is just not made by making many selections.

Cash is made by ready for the proper alternative after which having the braveness to wager large. Inventory market doesn’t reward exercise – it rewards endurance and knowledge.

For stability of the portfolio and lesser volatility, one should put money into mutual funds.

VK: Implausible. Let’s learn the way you add to your information. Would you wish to suggest a couple of books or another sources that buyers can profit from?

AK: I’d extremely suggest Pulak Prasad’s – “What I realized about investing from Darwin”

Pulak Prasad is the founding father of a Singapore primarily based fund named Nalanda Capital.

The explanation I like to recommend this guide is due to the readability of thought that Pulak has. He has it sorted – what’s his funding model and technique, what kinds of investments is he going to move, what’s he going to keep away from.

Video: Circle the wagons – Mohnish Pabrai

Mohnish analyzes excessive success – why some buyers like Rakesh Jhunjunwala and Warren Buffet made phenomenally a lot better than everybody else.

Watch this video to develop the mindset required to make giant sums of cash in shares.

–

Thanks Amey, this was extraordinarily useful. I don’t really feel anxious anymore. I hope that the readers too get the identical sense of calm.

Disclaimer:

Amey Ashok Kulkarni is a SEBI registered funding advisor. The above publish is solely instructional in objective and intent. Please seek the advice of your funding advisor earlier than taking any selections.

Registration granted by SEBI, membership of BASL and certification from NISM on no account assure efficiency of the middleman or present any assurance of returns to buyers. Funding in securities markets are topic to market dangers. Learn all of the associated paperwork fastidiously earlier than investing