How can we precisely measure adjustments in residing requirements over time within the presence of value inflation? On this put up, I focus on a novel and easy methodology that makes use of the cross-sectional relationship between revenue and household-level inflation to assemble correct measures of adjustments in residing requirements that account for the dependence of consumption preferences on revenue. Making use of this technique to knowledge from the U.S. suggests probably substantial mismeasurements in our accessible proxies of common progress in client welfare within the U.S.

These insights and outcomes are based mostly on my current analysis paper coauthored with Xavier Jaravel of the London College of Economics, which is forthcoming on the Quarterly Journal of Economics.

Background

Financial concept reveals that we will approximate adjustments in residing requirements utilizing simple formulation referred to as value and amount indices. These indices mix noticed knowledge on adjustments within the portions of what we devour and the costs of these objects, and are extensively utilized by statistical workplaces around the globe to assemble measures of total inflation in the price of residing and progress in residing requirements. Nevertheless, this strategy hinges on an important assumption—that the composition of what we wish to purchase doesn’t shift when our incomes do (see, for instance, Diewert 1993). Sadly, this simplifying assumption, referred to as homotheticity or revenue invariance, doesn’t match up with a number of real-world proof on the dependence of consumption patterns on client revenue, going way back to the work of Engel (1857). Current proof on inflation inequality—the robust relationship between revenue and household-level measures of inflation—underscores the significance of this drawback.

Perception and Technique

A conceptually coherent method to measure residing requirements is to repair a set of costs and calculate the financial expenditure wanted, below these costs, to realize any degree of client welfare because it adjustments over time. Allow us to seek advice from this idea as actual consumption, to differentiate it from the nominal expenditure of the patron below altering costs. As an example, think about a case the place all costs rise on the similar 2 p.c fee from one yr to the subsequent resulting from normal inflation. Right here, a client whose nominal expenditure has risen by 5 p.c solely experiences a 3 p.c improve in actual consumption, if we repair the costs within the preliminary or the ultimate yr. The important thing query is calculate the corresponding measures of inflation and actual consumption progress in real-world settings wherein adjustments in costs fluctuate throughout totally different items and providers.

If client preferences are income-invariant, everybody consumes the identical basket of products and providers no matter their revenue degree. Over time, households regulate whether or not to devour kind of of every good or service based mostly on how its value adjustments relative to others, however these changes are the identical for everybody. Standard value indices inform us common these value adjustments utilizing the expenditure shares of various items and providers, and concept tells us we have to deflate the expansion in nominal expenditure based mostly on the worth of this common, which is the usual measure of inflation.

In actuality, households select totally different baskets of products and providers that systematically rely, amongst different issues, on their revenue. Due to this fact, we discover totally different inflation measures for various households once we compute the worth indices utilizing every family’s personal expenditure shares, one thing that ought to not occur below the traditional assumption of revenue invariance. Within the knowledge, we regularly discover decrease inflation measures for richer households, which means that costs rise extra slowly for luxuries—i.e., objects which are extra closely bought by richer customers (see, for instance, Hobijn and Lagakos 2005, McGranahan and Paulson 2006, Jaravel 2019, Avtar et al. 2022, and Chakrabarti et al. 2023). Due to this fact, these things have gotten comparatively cheaper than the others over time. This means that, if we repair the preliminary costs as our foundation for measuring actual consumption, households that have rising revenue will likely be shifting their consumption towards objects which are accumulating relative value declines. In different phrases, sustained inflation bias towards requirements—items and providers favored by poorer households—signifies that we want comparatively decrease charges of progress in nominal phrases to keep up the identical fee of progress in actual consumption. Thus, when revenue is rising, customers are literally higher off than that advised by all accessible measures of actual consumption. The standard measures of inflation and actual consumption miss this mechanism altogether. That is even true of the more moderen work on inflation inequality, partially cited above, that depends on household-specific value index formulation however doesn’t explicitly account for revenue dependence.

Because it seems, there’s a comparatively straightforward repair for this drawback. We are able to right for the results of this revenue dependence in preferences just by estimating the connection between family revenue and household-specific value indices. The slope of this relationship results in a correction issue that we have to apply to the nominal expenditure progress after it’s deflated by the family’s personal value index. This technique is pretty straightforward to implement and solely requires entry to extensively accessible surveys of consumption expenditure on the family degree. Furthermore, it may be generalized to increase to different family traits, akin to age, household dimension, and training, that (1) matter for the composition of their consumption expenditure, and (2) probably fluctuate over time on the family degree.

Software to the U.S. Knowledge

Within the paper, we apply our strategy to knowledge from the US and quantify the magnitude of the bias in typical measures of actual consumption progress that ignore the results of revenue dependence in family preferences. We construct a brand new linked dataset offering value adjustments and expenditure shares at a granular degree from 1955 to 2019, throughout the totally different percentiles of family (pretax) revenue. This dataset combines a number of knowledge sources, primarily drawing from disaggregated knowledge collection accessible from the Client Value Index (CPI) and the Client Expenditure Survey (CEX). This new linked dataset permits us to offer proof on the inequality in inflation over a very long time horizon, thus extending prior estimates which have targeted on shorter time collection.

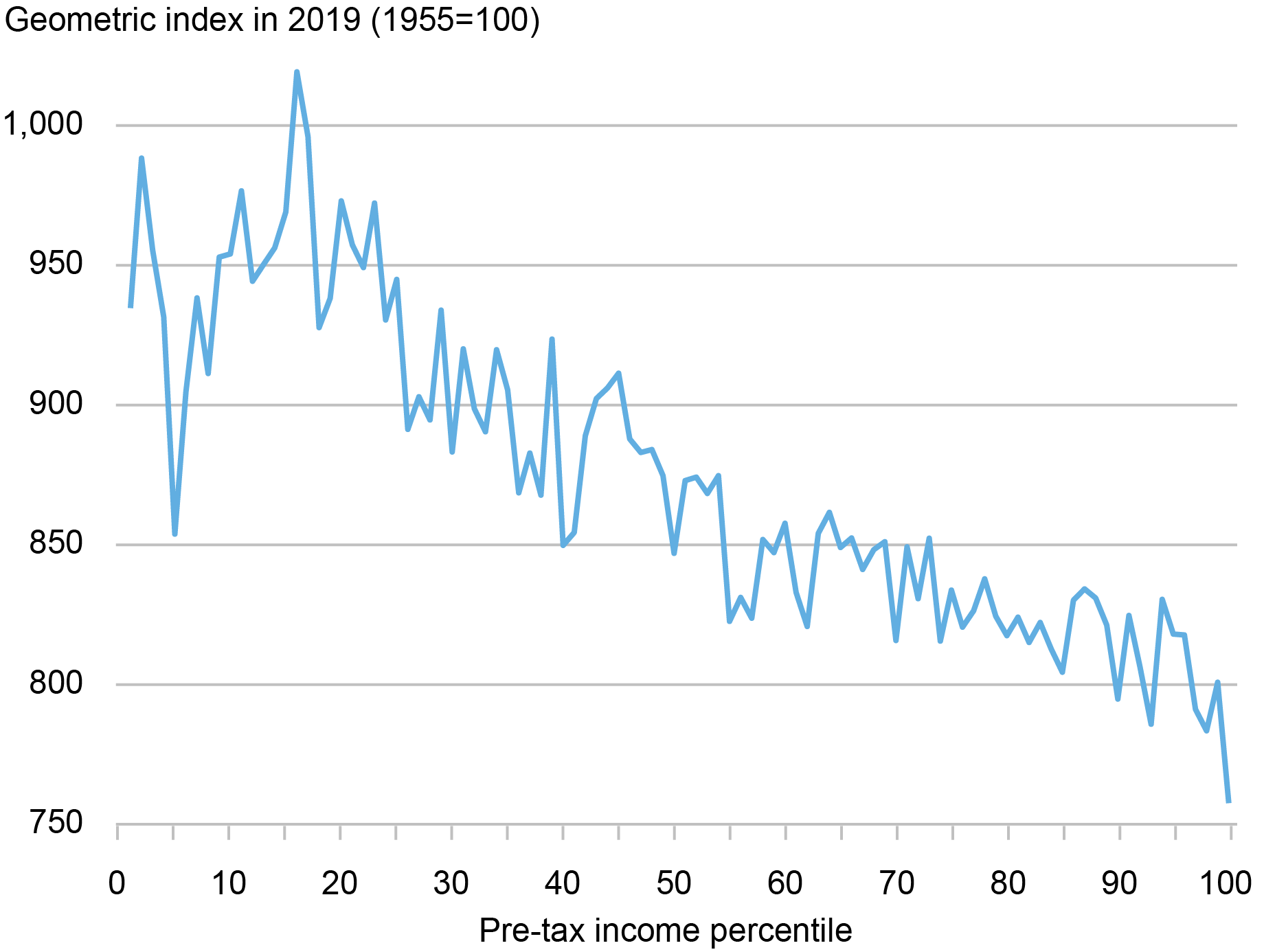

Computing inflation utilizing income-percentile-specific value index formulation, we discover that inflation inequality is a long-run phenomenon. As an example, because the chart under reveals, we discover that cumulative inflation from 1955 to 2019 varies considerably for households with totally different ranges of revenue: whereas costs have inflated by an element of round 10 for the underside revenue teams, they’ve inflated by an element nearer to eight on the high of the revenue distribution. The hole in inflation skilled by totally different revenue percentiles is sizable when in comparison with the general dimension of inflation over the interval. As such, once we look into the previous from the attitude of at this time’s costs, we observe that (1) households had been on common poorer sixty-five years in the past—that’s, they’d stronger preferences for requirements; and (2) requirements had been cheaper relative to luxuries. These empirical patterns suggest that client welfare was increased sixty-five years in the past when accounting for the dependence of preferences on revenue.

Inflation Inequality over the Lengthy Run

Supply: Creator’s calculations based mostly on the historic linked CEX-CPI knowledge.

Notes: This chart reveals the patterns of inflation inequality within the knowledge. It reveals the cumulative inflation charges between 1955 and 2019 by pretax revenue percentiles.

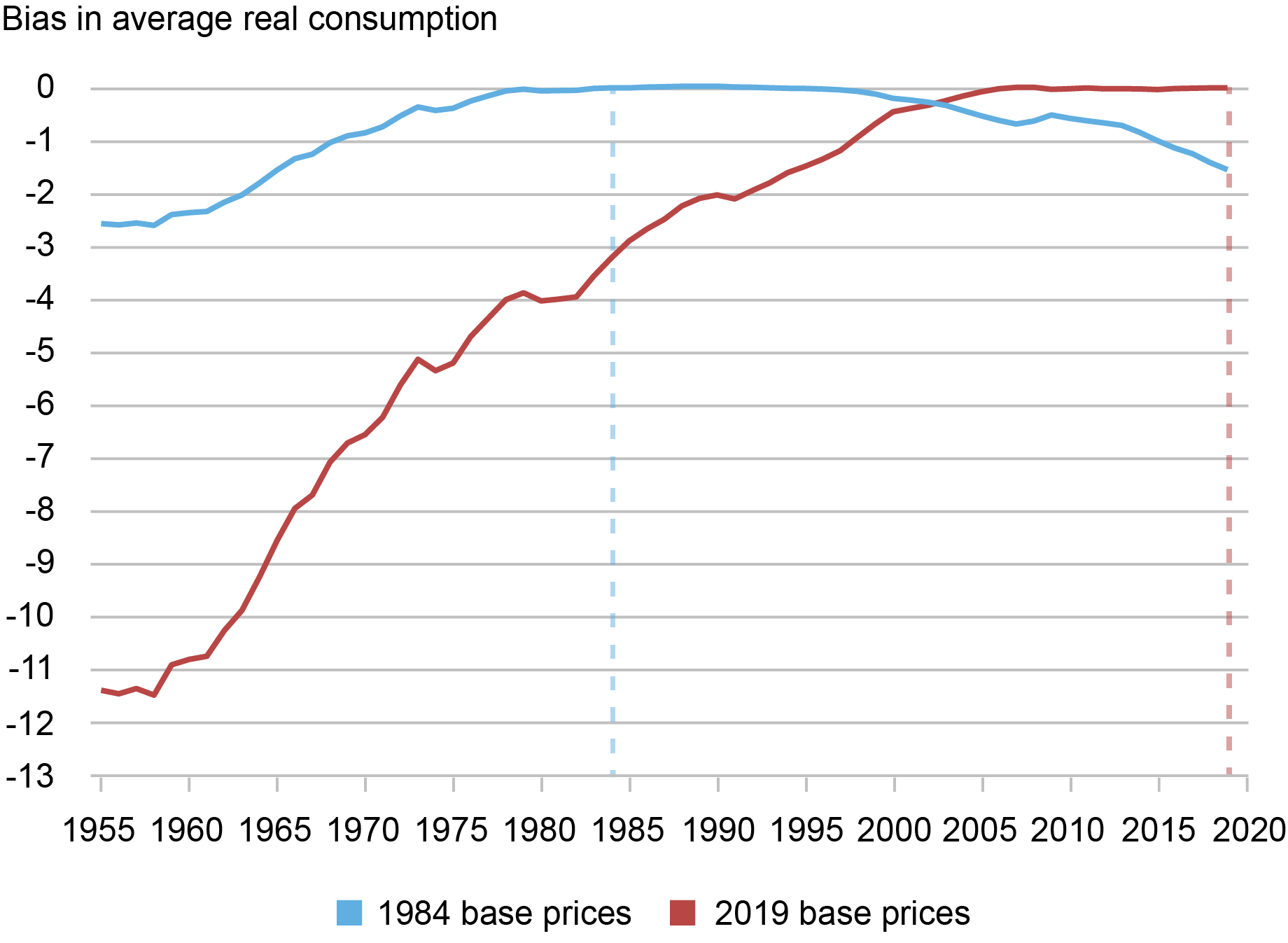

After we apply our new technique to this knowledge, we discover that the magnitude of the correction in measured welfare progress because of the impact of income-dependent preferences could be massive. For instance, as the chart under reveals, by fixing costs in 2019 as the idea of defining actual consumption, we discover that the uncorrected measure underestimates common actual consumption (per family) in 1955 by about 11.5 p.c. Word that, by definition, the error is zero within the base yr and accumulates over time as we transfer in time—on this case backward—away from the bottom yr. For comparability, we additionally present the outcomes if we repair costs in 1984. On this case, the bias is smaller just because it accumulates over a shorter time interval, as we transfer away from the bottom yr in our knowledge.

Bias in Standard Measures of Common U.S. Actual Consumption (1955-2019)

Supply: Creator’s calculations based mostly on the historic linked CEX-CPI knowledge.

Notes: This chart studies the biases within the degree of common actual consumption per family in typical measures of actual consumption, when put next in opposition to the corrections implied by our technique, below two selections for the fastened costs as the bottom for calculation of actual consumption: costs in 1984 and in 2019.

In fact, bias in measuring the extent of actual consumption results in corresponding biases within the estimated progress. Because the chart above already signifies, if we repair costs in the latest yr (2019), the traditional estimates overestimate the speed of progress in common actual consumption because of the unfavourable bias within the ranges. Specifically, the uncorrected measure of cumulative actual consumption progress is 270 p.c over your entire 1955-2019 interval, or 2.07 p.c progress yearly. In distinction, with our correction for revenue dependence and below 2019 base costs, cumulative consumption progress falls to 232 p.c, or an annualized progress fee of 1.89 p.c per yr. Thus, on this case we discover that the annual progress fee from 1955 to 2019 is lowered by 18 foundation factors (2.07 p.c − 1.89 p.c).

Word that, because the typical measure all the time underestimates the degree of actual consumption, the signal of the error in measured progress of actual consumption is determined by the selection of the bottom costs. As an example, if we as a substitute repair 1984 costs as our base, the chart reveals that the traditional measures the truth is underestimate the expansion in actual consumption between 1984 and 2019. In different phrases, since preferences are income-dependent, measured progress in actual consumption ought to in precept rely upon the selection of fastened costs to specific the measure.

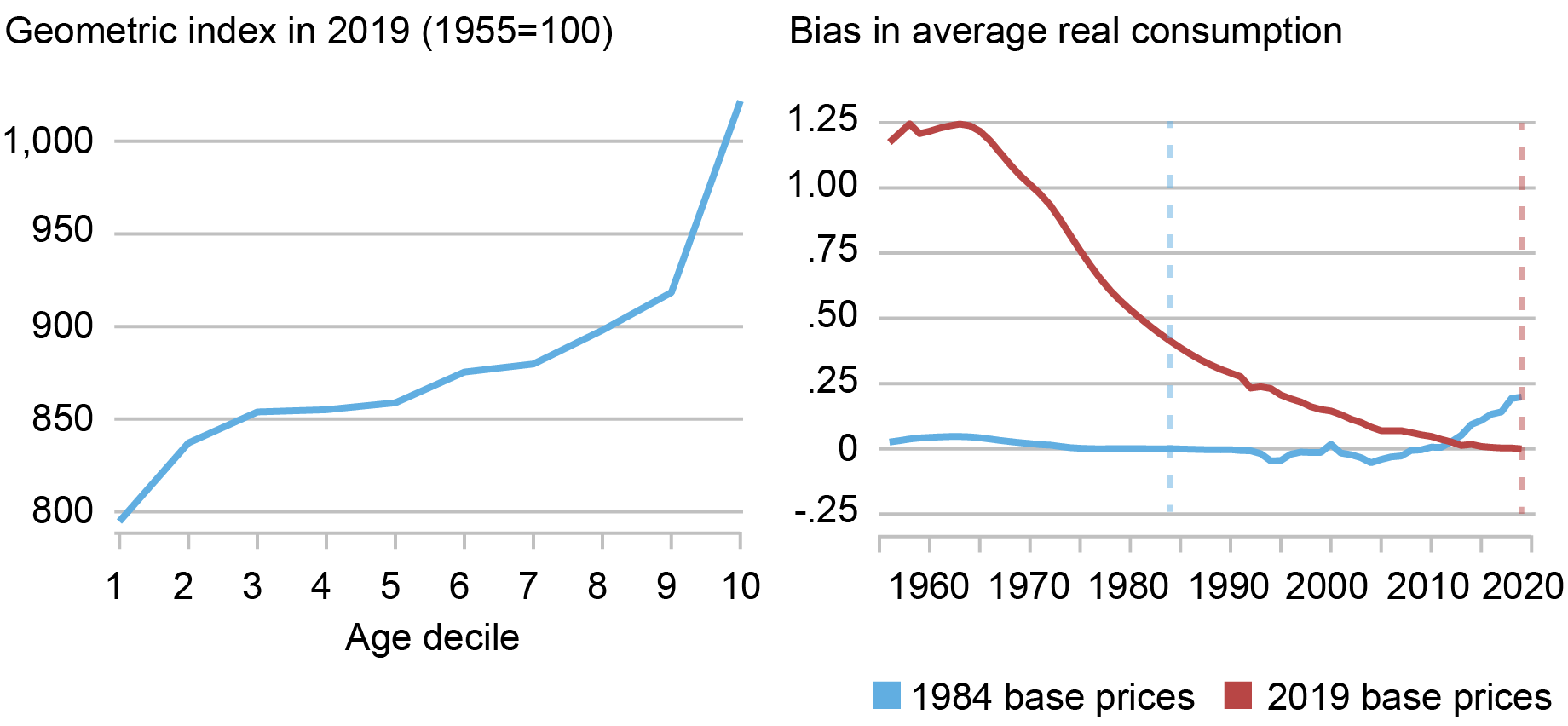

Lastly, we additionally apply our generalized technique to quantify the adjustment to common actual consumption implied by client getting older in the US. On this case, we reconstruct our measures of inflation by deciles of age and revenue by, first, defining ten deciles of the (pretax) revenue and, then, computing ten age deciles inside every revenue decile. Utilizing this knowledge, because the chart under illustrates, we doc a powerful constructive relationship between client age and inflation, which alters the measurement of actual consumption as a result of the typical client age will increase over time. We discover that the implied changes to actual consumption are economically significant however a lot smaller than the correction resulting from revenue dependence, which justifies our deal with the latter.

Client Growing old and Actual Consumption (1955-2019)

Sources: Creator’s calculations based mostly on the historic linked CEX-CPI knowledge.

Notes: The left panel of the chart studies the cumulative inflation in the US, from 1955 to 2019, for every decile of age. The best panel studies the implied bias within the common degree of actual consumption per family in typical measures of actual consumption, when put next in opposition to the corrections implied by our technique resulting from getting older, below two selections for the fastened costs as the bottom for calculation of actual consumption: costs in 1984 and in 2019.

Conclusion

Our outcomes could have vital implications for the best way wherein nationwide statistical businesses around the globe assemble measures of inflation and actual financial worth. Specifically, the empirical outcomes offered above recommend an strategy that the Bureau of Labor Statistics (BLS) can use, based mostly on already accessible knowledge, to assemble improved measures of actual consumption progress and inequality within the U.S. Along with enhancing the measurement of long-run progress and inflation inequality, our new strategy can have vital coverage implications, such because the indexation of the poverty line and a extra environment friendly focusing on of welfare advantages. This strategy additionally offers a blueprint for distributional nationwide accounts (Piketty et al. 2018) that account for inflation inequality and revenue dependence in family preferences.

Danial Lashkari is a analysis economist in Labor and Product Market Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

The best way to cite this put up:

Danial Lashkari, “Measuring Value Inflation and Progress in Financial Effectively-Being with Revenue-Dependent Preferences,” Federal Reserve Financial institution of New York Liberty Avenue Economics, January 8, 2024, https://libertystreeteconomics.newyorkfed.org/2024/01/measuring-price-inflation-and-growth-in-economic-well-being-with-income-dependent-preferences/.

Disclaimer

The views expressed on this put up are these of the creator(s) and don’t essentially replicate the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the duty of the creator(s).