Our new Structure is now established, and has an look that guarantees permanency; however on this world nothing may be stated to make sure, besides dying and taxes.

— Benjamin Franklin, in a letter to Jean-Baptiste Le Roy, 1789

I learn Tax the Wealthy!: How Lies, Loopholes, and Lobbyists Make the Wealthy Even Richer by Morris Pearl and Erica Payne on the Patriot Millionaires. They’re a group of over 200 “excessive internet price people with annual incomes over $1 million and/or property over $5 million who’re dedicated to elevating the minimal wage, combatting the affect of huge cash in politics, and advancing a progressive tax construction.” They imagine that the tax system ought to be reformed in order that the wealthy pay their fair proportion of taxes. Are the Patriotic Millionaires appropriate?

This text is split into the next sections:

Media Bias

Taxes are an emotionally and politically charged matter and misinformation is plentiful. Media Bias / Truth Verify is “devoted to educating the general public on media bias and misleading information practices.” Their methodology charges sources based mostly on Bias, Factual Reporting, and Credibility Score. The Patriotic Millionaires is rated Left-Middle with Excessive Factual Reporting and Excessive Credibility. On this article, I select media sources which might be rated by Media Bias / Truth Verify as Excessive Factual Reporting and Excessive Credibility to guage the impression of taxes throughout the wealth teams.

“Tax The Wealthy!” has an attention-grabbing chapter on ten “lies” that the authors understand as misinformation. Lie #6 is about wealthy individuals’s charity for which they supply some information:

The twenty richest Individuals donated about $8.7 billion to charity in 2018 – lower than 1% of their internet price. Take away Invoice Gates and Warren Buffet, essentially the most beneficiant of the highest twenty, and the opposite eighteen ended up giving simply $2.8 billion, or 0.32% of their whole internet price. That’s lower than the nationwide common – 0.33% of family price.

Patriotic Millionaires

United Press Worldwide printed Tons of of Millionaires, Billionaires Urge Politicians at Davos to Tax Their Wealth describing 268 millionaires and billionaires from seventeen nations that urged world leaders at The World Financial Discussion board to tax their wealth. Their letter said that the explanations they thought they need to pay extra in taxes have been:

- Proud to pay extra to deal with excessive inequality.

- Proud to pay extra to assist cut back the price of residing for working individuals.

- Proud to pay extra to raised educate the following technology.

- Proud to pay extra for resilient healthcare programs.

- Proud to pay extra for higher infrastructure.

- Proud to pay extra for a inexperienced transition.

- Proud to pay extra taxes on our excessive wealth.

Patriotic Millionaires was one of many organizations supporting the letter. The article describes a survey carried out by Survation on behalf of Patriotic Millionaires, which polled over 2,300 respondents from G20 nations who maintain multiple million {dollars} of investable property. It discovered that 74% of millionaires assist larger taxes on wealth to assist deal with the cost-of-living disaster and enhance public providers.

Among the methods the authors of “Tax the Wealthy!” describe the tax system favoring the wealthy are:

- Carried Curiosity: “The Billionaires’ Loophole”

- The Property Tax: How We Created an American Aristocracy (Between 35% and 45% of all wealth in America is inherited.)

- Sidestepping Taxes: The Stepped-Up Foundation (80% of the profit goes to the Prime 0.1% of households.)

- Annuity Trusts: Don’t Belief This System

- Let’s Play Swap and Swap: The 1031 Like-Type Alternate

- Assist the Wealthy by Pretending to Assist the Poor: Alternative (for Wealthy Folks) Zones

- Simply Passing By way of: The Go-By way of Deduction (A NBER “paper suggests that almost 75% of all pass-through earnings is admittedly simply regular private earnings funneled by way of a shell enterprise…” “85% of the “the pass-through earnings goes to the highest 20% of taxpayers, and greater than 50% goes to the highest 1%”).

Composition of Federal Taxes

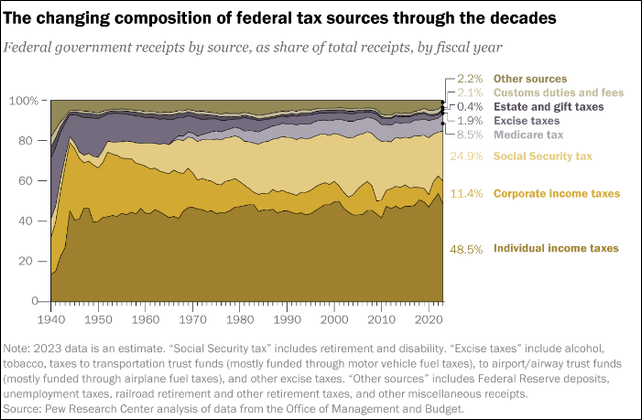

The next chart is from Who Pays, and Doesn’t Pay, Federal Earnings Taxes within the U.S.? by the Pew Analysis Middle which reveals that over the previous forty years particular person earnings, Social Safety, and Medicare taxes have elevated whereas company and excise taxes have declined as a share of Federal taxes.

Determine 1#: Supply: Altering Composition of Federal Tax Sources

Inequality

In response to the St. Louis Federal Reserve FRED web site, the wealthiest 0.1% of households (roughly 131,000) personal $19.7 trillion {dollars} (13.8% of whole family internet wealth) in comparison with $9.3 trillion (6.5% of whole family internet wealth) for the underside 50% of households (roughly 65,000,000). The web price of these within the Forbes 400 Checklist is $4.5 trillion or over 3% of all family internet wealth in America. The web price of the richest 20 within the Forbes 400 listing is $1.9 trillion or 1.3% of the overall family internet wealth in America.

In response to 6 Information About Financial Inequality within the U.S. by the Pew Analysis Middle earnings inequality within the U.S. is the best of all of the G7 nations and the wealth hole between America’s richest and poorer households greater than doubled from 1989 to 2016.

American Perceptions

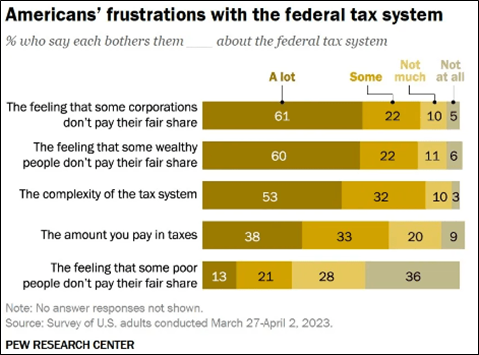

The Pew Analysis Middle discovered that over 60% of respondents to a survey imagine that companies and the rich aren’t paying their fair proportion of taxes. Only a few assume the poor aren’t paying their share of taxes. Democrats and Democratic Leaners strongly really feel (77%) that companies and rich individuals don’t pay their fair proportion. Against this, 43% or extra Republicans and Republican Leaners really feel that the rich and companies aren’t paying their fair proportion of taxes. That is per surveys by GALLUP and Reuters/Ipsos.

Determine 2#: Survey of American’s Frustration with the Federal Tax System

Wealth vs Earnings

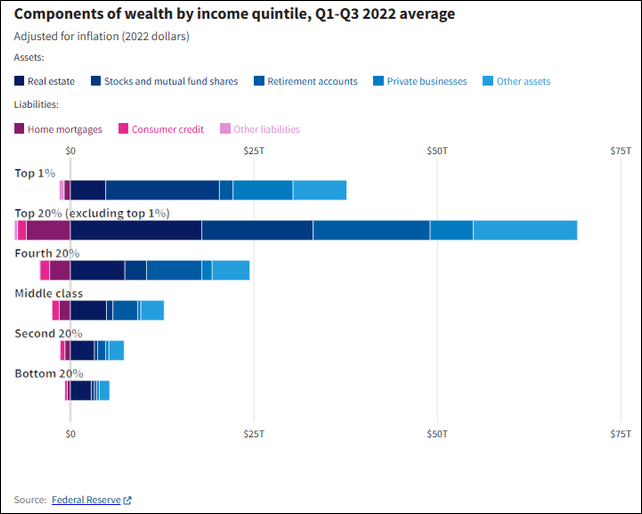

USA Information produced this fascinating chart of earnings versus wealth beneath. The wealth of the Backside 60% by earnings group is usually held in actual property (residence), different property (i.e. autos, home equipment, and many others.), and retirement accounts whereas the wealthiest earnings teams more and more personal shares and mutual fund shares and personal companies.

Determine 3#: Parts of Wealth by Earnings Inequality

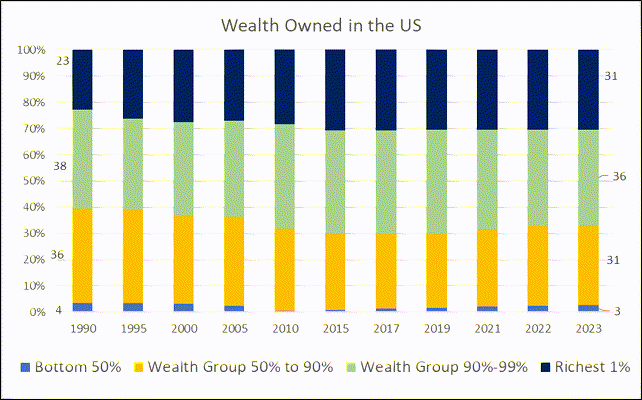

I created the next chart from the Board of Governors of the Federal Reserve System Distributional Monetary Accounts to point out how the distribution of wealth has modified over time. The share of the wealth of the wealthiest 1% grew from 23% to 31% through the previous three a long time whereas the share of the wealth of the 50% to 99% teams has fallen from 73.6% to 66.9%.

Determine 4#: Share of Wealth Over Time

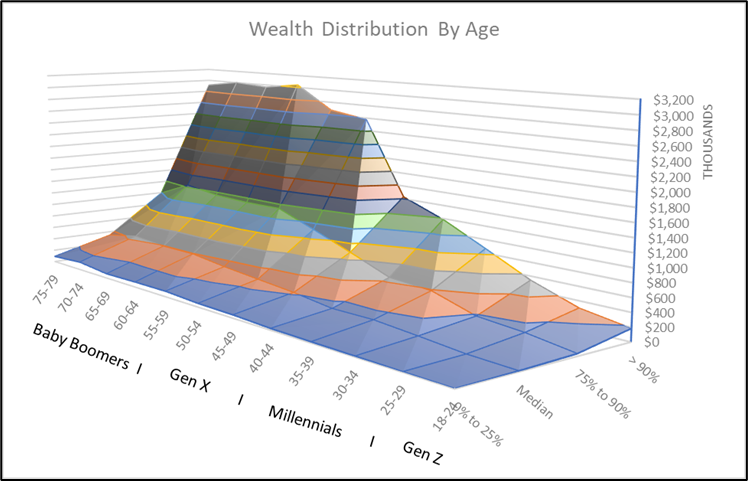

I created the following chart from knowledge offered by the Federal Reserve Survey of Shopper Funds to point out the wealth distribution by age. The Child Boomers and older Gen X are the wealthiest Individuals (Prime 90%).

Determine 5#: Wealth Distribution by Age

Capital Features and Wealth Taxes

Some advocate having a wealth tax as a result of inventory may be held tax-free till offered when it’s taxed on the decrease capital features price of 20%. Against this, these working for wages or wage have their incomes taxed on the progressive charges for atypical earnings. In response to “Tax the Wealthy!”, 69% of capital features are earned by the wealthiest 1%. They suggest progressive tax charges on capital features for these with incomes over $1 million.

Inventory Purchase Backs

President Biden carried out a 1% excise tax on share buybacks. John Foley at Reuters explains the controversy over share buybacks in Biden’s Buyback Tax Reveals Who Actually Runs America which I summarize as:

- “Whereas dividends are taxed as earnings, shares offered in a buyback incur capital features tax that applies solely to the proprietor’s total revenue.”

- International buyers, together with hedge funds based mostly in tax havens just like the Cayman Islands, usually pay no U.S. tax on capital features, however a 30% tax on dividends. International buyers maintain round 30% of U.S.-listed inventory.

- If corporations had paid out $882 billion as dividends reasonably than in shopping for again inventory the federal government would have gained as much as $80 billion in further tax income.

- Biden’s reforms did not deal with the largest downside with share buybacks, which is that they permit very rich Individuals to amass fortunes and cross them on to their heirs whereas sheltering from tax.

IRS Audits

In Developments within the Inside Income Service’s Funding and Enforcement, the Congressional Price range Workplace stated the IRS estimates that the annual tax hole is a number of hundred billion {dollars} per yr. Between 2010 and 2018, inflation-adjusted funding for the IRS fell by 20% adjusted for inflation. The authors of “Tax the Wealthy!” say that “From 2001 to 2019, the proportion of millionaires who have been audited dropped from 12% to simply 3%, whereas fewer than 1% of all companies are actually audited annually.”

The Related Press reported that the IRS has recovered $462 million in again taxes over the previous two years from delinquent millionaires. The IRS management attributed it to elevated funding below the Inflation Discount Act.

Tax Distribution

Federal Tax Charges

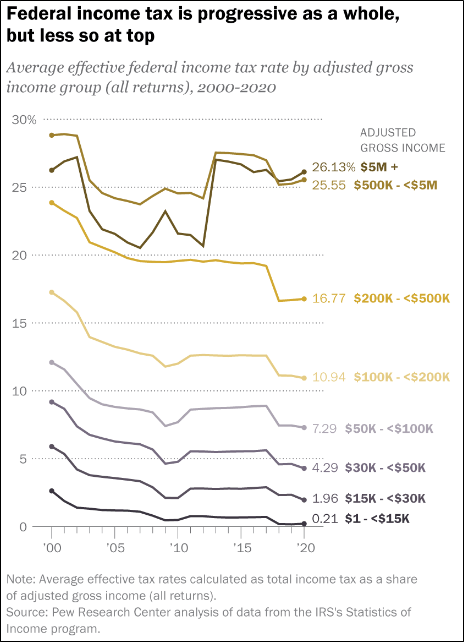

The Pew Analysis Middle analyzed knowledge from the IRS’s Statistics of Earnings Program to supply the next chart. It reveals that the majority earnings teams had a discount within the common efficient federal earnings tax price through the previous 20 years.

Determine 6#: Federal Earnings Tax Is Progressive as a Complete, However Much less So on the Prime

The Tax Basis printed Abstract of the Newest Federal Earnings Tax Knowledge, 2023 Replace describing that the “prime 1 p.c of taxpayers (AGI of $548,336 and above) paid the best common earnings tax price of 25.99 p.c—greater than eight instances the speed confronted by the underside half of taxpayers.”

Whereas taxes paid can fluctuate, 25.99% paid by the Prime 1% is considerably beneath the 42% from the Nineteen Fifties when the debt to GDP ratio was excessive after World Conflict II.

The Congressional Price range Workplace printed Developments within the Distribution of Family Earnings From 1979 to 2020 that reveals that previous to 2020, the Prime 1% paid about 25% of the Federal taxes together with particular person earnings taxes, payroll taxes, company earnings taxes, and excise taxes, and the following 19% pay roughly 45%.

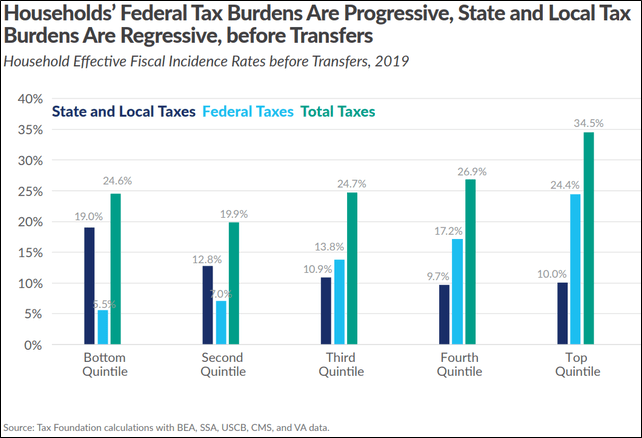

State and Native Burdens

The next chart from the Tax Basis estimates common Federal and state/native tax burdens in 2019 by family earnings ranges. State taxes are typically regressive having a larger impression on decrease earnings teams. Common whole Federal, State, and Native earnings tax burdens are 24.6% for the underside earnings group and 34.5% for the Prime earnings group.

Determine 7#: Family Federal and State/Native Tax Burdens

Company Taxes

The wealthiest 1% personal over half of all shares. The Patriotic Millionaires in “Tax the Wealthy!” listing 5 strategies that companies use to scale back their taxes:

- Multinational Cash Video games: Worldwide Revenue Shifting

- Giving Away the Retailer: Our New Territorial Tax System

- Over There, Over There: Relocating Property Abroad

- Stocking Up on Loopholes: Inventory Choices for Executives

- Look Quick! Oh, You Missed it: Accelerated Depreciation

In response to S&P Dow Jones Indices, in 2018 roughly 29.1% of the income of the businesses within the S&P 500 got here from worldwide sources. CBS Information reported 60 worthwhile corporations in 2018 that paid no Federal taxes. For 2020, the Institute on Taxation and Financial Coverage listed that “55 of the biggest companies in America paid no federal company earnings taxes of their most up-to-date fiscal yr regardless of having fun with substantial pretax earnings within the United States.” They add that “it seems to be the product of long-standing tax breaks preserved or expanded by the 2017 Tax Cuts and Jobs Act (TCJA) in addition to the CARES Act tax breaks”.

Yellen Says 100,000 Companies Have Joined a Enterprise Database Geared toward Unmasking Shell Firm House owners by the Related Press describes that 100,000 companies have joined a brand new database that collects “helpful possession” info on corporations as a part of a “new authorities effort to unmask shell firm homeowners.” The Nationwide Bureau of Financial Analysis printed Worldwide Tax Avoidance by Multinational Companies that states that in keeping with current estimates, “near 40 p.c of multinational earnings — earnings booked by corporations exterior of their headquarters’ nation — are shifted to tax havens.”

Tax Reform

The Patriotic Millionaires supply six options to reform the tax system:

- Equalize Capital Features and Bizarre Earnings Tax Charges for Incomes Over $1 Million

- Finish the Bracket Racket: Create Plenty of Brackets at A lot Greater Charges

- Tax The Wealthy!: Implement a Wealth Tax

- Cease Letting Buyers Delay Tax Funds on Capital Features: Mark-to-Market Taxation

- Make Firms Pay Taxes The place They Actually Make Their Earnings: Finish Revenue Shifting

- Make Positive They Really Pay: Fund the IRS

The Organisation for Financial Co-operation and Growth (OECD) printed Abstract Financial Impression Evaluation World Minimal Tax in January 2024, describing a 15% World Minimal Tax (GMT) on multinational enterprises with revenues above EUR 750 million wherever they function. It was agreed to by over 135 member jurisdictions in October 2021. “Since then, the implementation of the GMT has progressed with round 55 jurisdictions already taking steps towards implementation and with the principles coming into impact in 2024.”

Closing Ideas

Are the Patriot Millionaires appropriate? My evaluation of the information leads me to agree with the Patriot Millionaires that aligning the tax system to be fairer to the employed wage earner is suitable. I’ve signed up for the Patriotic Millionaires publication to obtain updates.