Exploring property funding traits

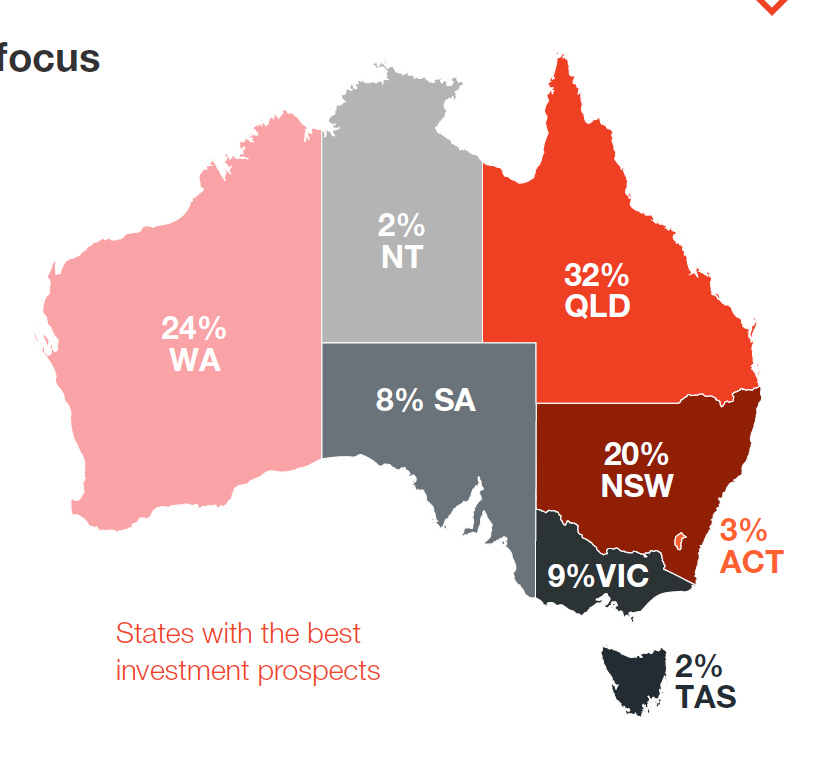

Over the previous 12 months, Queensland, Western Australia, and New South Wales have solidified their positions because the main property markets for traders, capturing the eye of three-quarters of survey respondents within the Australian Property Investor’s (API) Property Sentiment Report for Q1 2024.

These three states have eclipsed different areas, with a very notable shift in Western Australia, which has seen its recognition amongst traders double from 12% to 25% in simply 12 months.

Brisbane’s property market continues to thrive, with the median home worth surpassing $900,000 for the primary time after 15 months of consecutive progress.

This progress is additional complemented by the robust efficiency of regional Queensland, the place interstate migration is pushing up competitors and driving dependable returns, significantly for unit values, that are outperforming the nationwide common by three to 4 occasions.

“The 75% determine for the highest three mixed exceeds the 58% of respondents who say they’ve funding properties in these markets and the 68% who reside in these cities, suggesting a powerful curiosity in interstate funding,” the report stated.

Rates of interest and funding methods

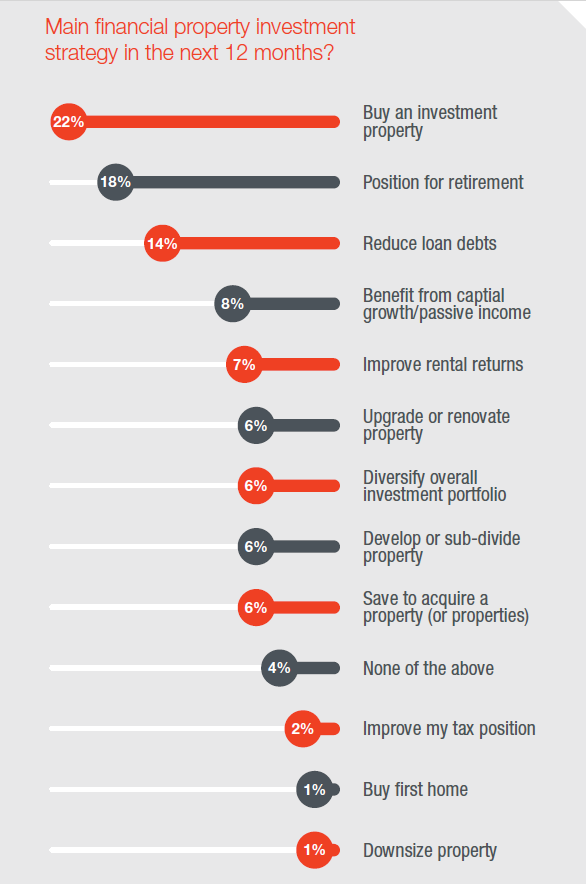

Regardless of ongoing issues about excessive rates of interest, the proportion of traders prioritising the acquisition of latest properties has elevated considerably, the API report discovered.

The primary quarter of 2024 noticed a surge within the variety of respondents aiming to reinforce their rental returns, almost doubling in simply three months to 7%. This shift is happening in a context the place rental worth progress exhibits little signal of slowing, influenced by a nationwide rental disaster and escalating property values.

“On this local weather of rising property costs and excessive investor exercise, the variety of individuals centered on lowering debt is declining in proportion to the quantity trying to purchase an funding property,” the report stated. “Spending moderately than saving is the main focus.”

Positioning for retirement continues as a key focus amongst respondents, barely lowering this quarter to 18% from 19%, however nonetheless considerably increased than a 12 months in the past when it was below 5%, and 6 months in the past at 12%.

Market resilience amid fee uncertainties

The API survey revealed that whereas rates of interest are an important concern – probably influencing over half of the shopping for (54.5%) and promoting (51.7%) choices – traders are exhibiting a level of resilience.

This resilience is showcased by the steady but cautious method to property funding, regardless of the Reserve Financial institution’s indications that inflation might not align with their targets till late 2025.

The share of respondents indicating that rates of interest influenced their determination to purchase jumped from 29% to 36% in simply three months. Equally, for sellers, the determine rose considerably from 11% to fifteen%.

Shifting preferences: Homes vs. items

Funding preferences amongst Australians have seen important shifts; indifferent homes have regained recognition over items, regardless of the robust efficiency of the latter in latest months.

By the tip of This autumn 2023, 45% of respondents favored homes over items, although this desire barely adjusted to 39% by Q1 2024, reflecting ongoing capital beneficial properties within the unit market.

Regional markets gaining floor

Whereas capital metropolis markets have historically led in efficiency, regional markets have proven stronger progress charges within the latest quarter, difficult the long-standing dominance of city facilities.

This pattern suggests a rising investor confidence within the potential of regional property markets alongside the steadfast capital metropolis markets, API reported.

Get the most well liked and freshest mortgage information delivered proper into your inbox. Subscribe now to our FREE each day e-newsletter.

Associated Tales

Sustain with the newest information and occasions

Be part of our mailing record, it’s free!