I write lots about bear markets.

Right here’s a random assortment of my biggest hits in recent times:

I deal with corrections, bear markets, and crashes as a result of these are the actually essential instances for buyers. Success as an investor comes out of your actions in the course of the dangerous instances.

These items are all in regards to the inventory market as a result of there haven’t been many downturns within the bond market traditionally. Bonds are boring, they usually’re not as unstable because the inventory market…more often than not.

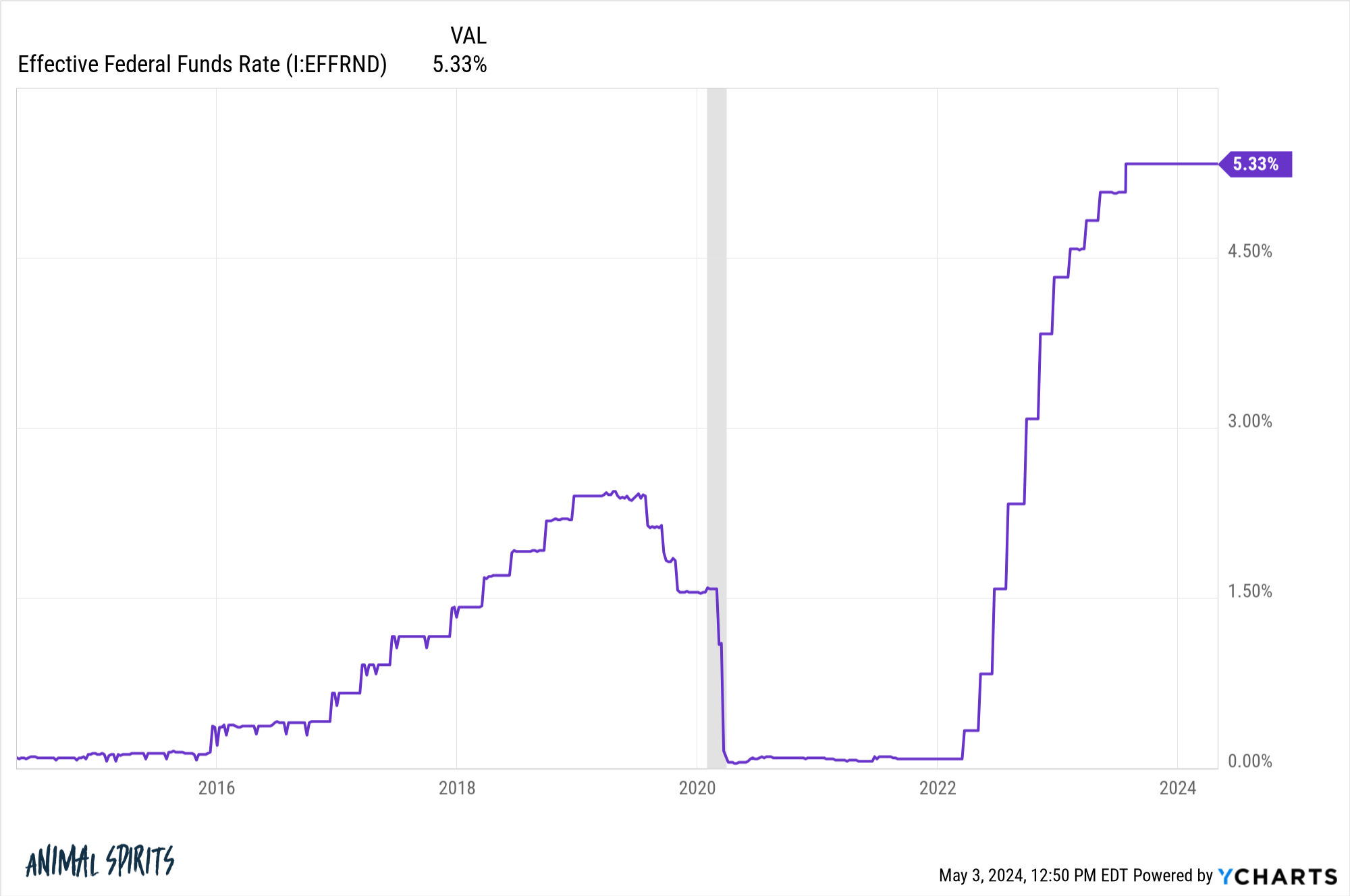

The Fed took rates of interest from 0% within the pandemic to five% in a rush as inflation accelerated:

As rates of interest rise, bond costs fall. When charges rise rapidly, bond costs fall rapidly.

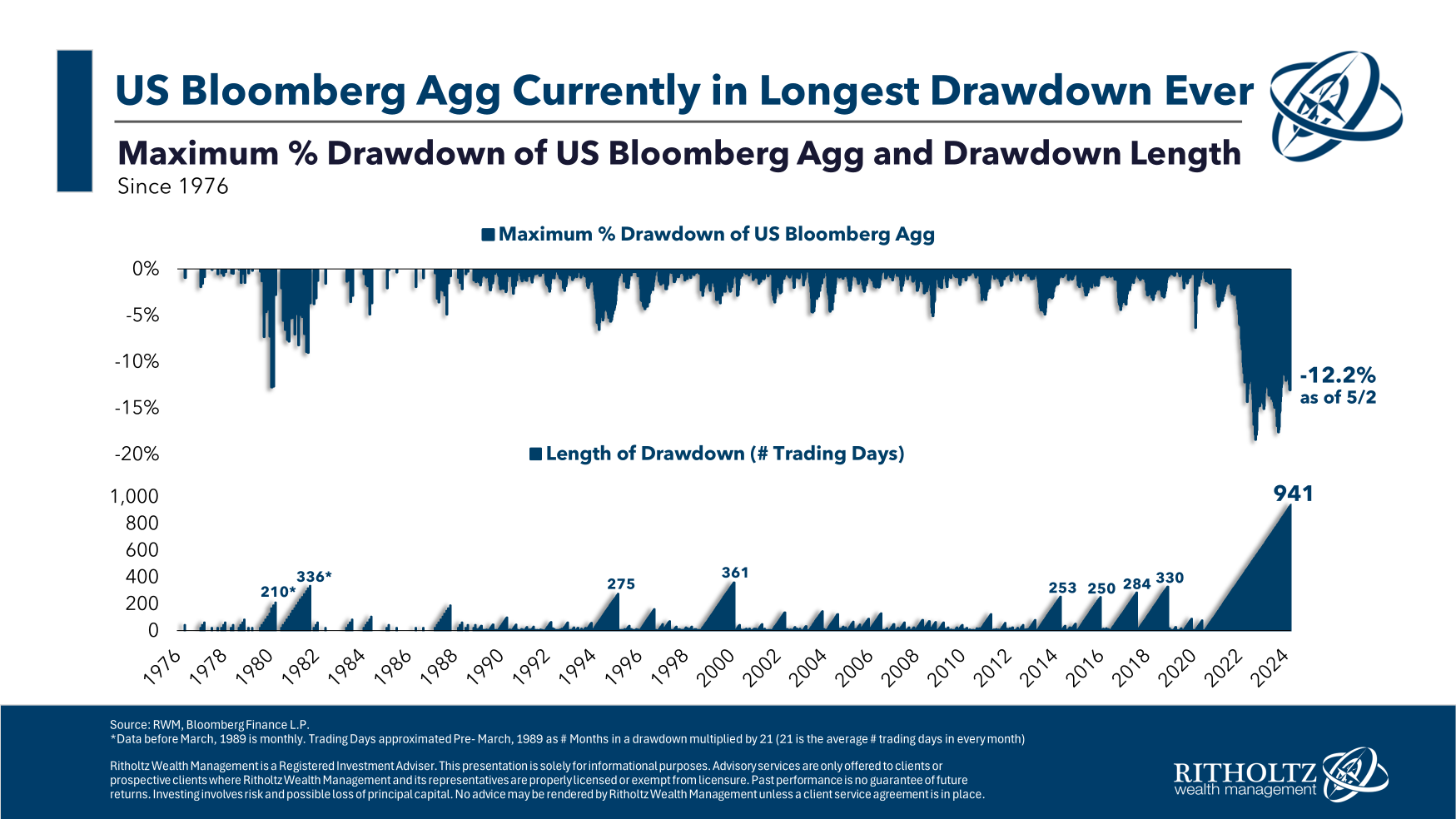

The Bloomberg Mixture Bond Index is at the moment experiencing its largest drawdown since its inception in 1976 by way of each magnitude and size of time:

At its nadir, the Agg was down greater than 18%. It’s nonetheless down double-digits.

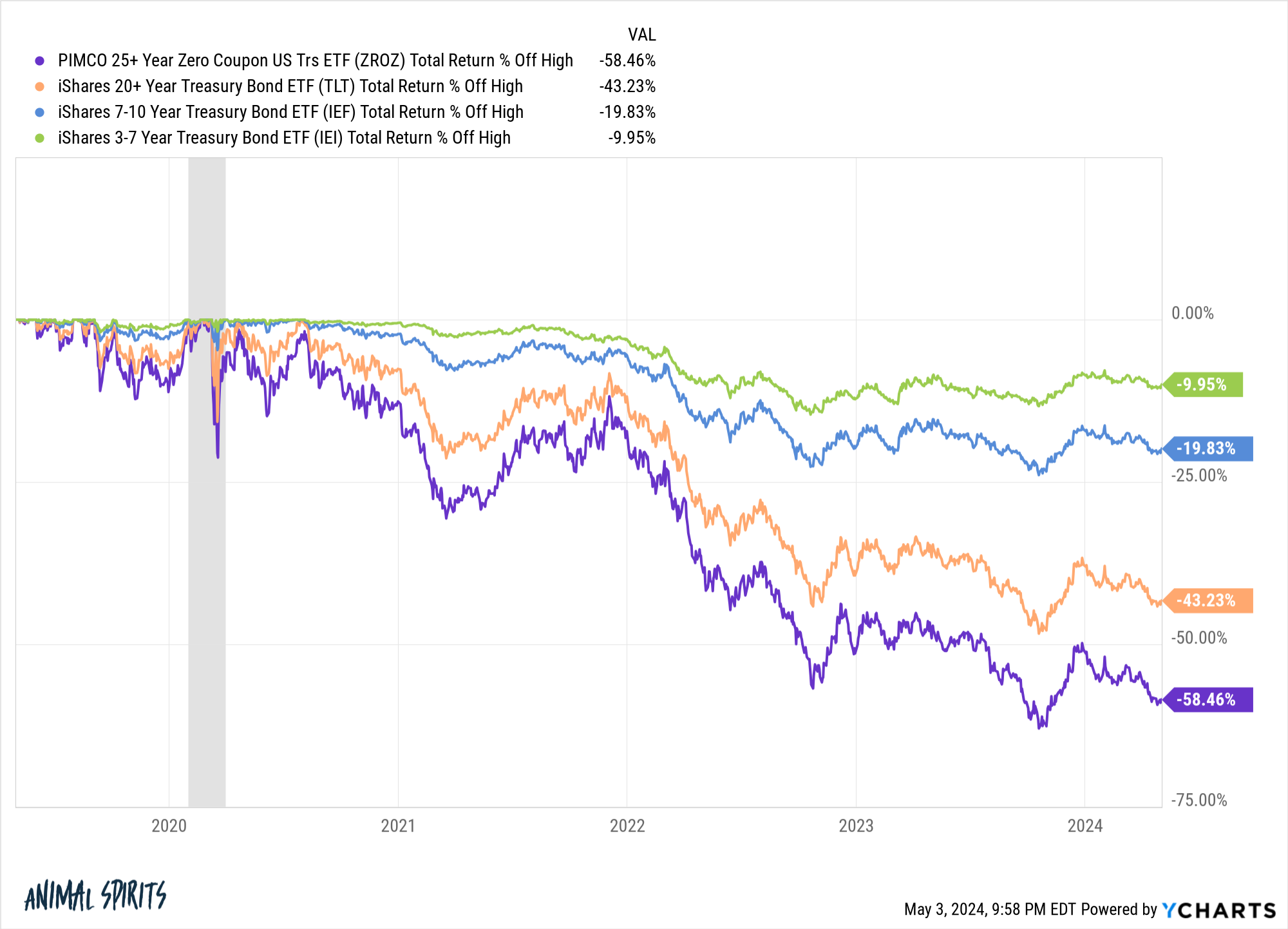

Different areas of the bond market are nonetheless within the midst of even worse drawdowns:

Zero coupon bonds, that are basically long-duration bonds on steroids, are nonetheless down virtually 60%. Lengthy-term Treasuries are nonetheless down greater than 40%. Even 7-10 yr Treasuries are down 20%.

All of those numbers embody curiosity nevertheless it’s even worse than it appears as a result of inflation has taken one other 20% or so off the highest.

So why aren’t buyers freaking out extra?

Are you able to think about if we had been 4 years right into a inventory market crash and the losses had been nonetheless within the 40-60% vary?

There could be limitless headlines within the monetary media. Traders could be freaking out.

But bond buyers appear comparatively calm. Cash is definitely pouring into long-term Treasuries regardless of the route:

A whole lot of this has to do with buyers positioning for decrease charges that haven’t come but nevertheless it’s not like persons are working for the exits.

Why aren’t extra buyers blowing a gasket out about bonds?

Some ideas:

Yield issues. Bonds have gotten killed as a result of charges rose. Now that charges have risen, yields are larger. Traders like larger yields!

The losses are the previous. The yields are the longer term.

There’s an alternate. When the inventory market crashes there are typically few locations to cover. Positive, low vol or top quality dividend shares won’t fall almost as a lot as the general market however a 30% loss as an alternative of 40% drawdown affords little comfort.

There are a lot better alternate options relating to volatility discount in fastened revenue.

T-bills have yielded greater than 4% for almost two years. Yields on extremely short-term authorities paper have been over 5% for greater than a yr.

Plus, you will have cash market funds, on-line financial savings accounts, and CDs with equally excessive yields.

There aren’t all that many buyers who’ve a excessive allocation to the areas of the bond market with the largest losses as a result of higher choices have been obtainable.

Shares and bonds are completely different. Bonds are ruled extra by math than shares on the subject of anticipated returns.

Shopping for shares when they’re down is mostly an exquisite technique however there aren’t any ensures they may come again. There’s extra uncertainty concerned throughout a inventory bear market.

Bond yields might all the time rise additional, however the beginning yields are a very good indication of long-run anticipated returns. The yield tells the story in high-quality fastened revenue.

There are extra feelings concerned with the inventory market, as nicely.

If something, the bond bear market reveals buyers, on common, proceed to get smarter with their choices.

The bear market has been painful for those who went into it with lengthy period property. However for those who had been clever about the way you make investments your fastened revenue allocation and unfold your bets, the bond bear market hasn’t been all that painful.

And now that yields are larger, the longer term appears a lot brighter from right here.

Additional Studying:

The Distinction Between Shares & Bonds