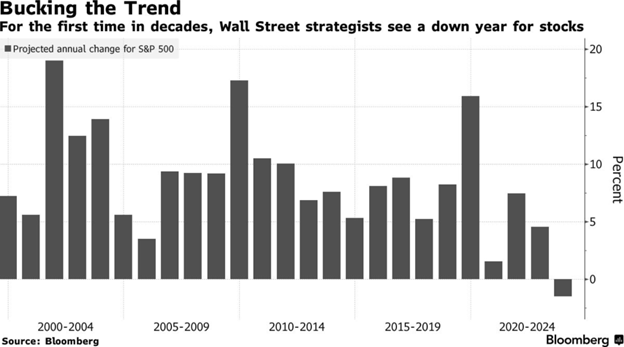

Effectively, seems like nobody on the massive Wall Road corporations bought their 2023 predictions right, in reality (under) most predicted that the S&P 500 would find yourself decrease in 2023 than 2022. And no, these usually are not cartoons.

Seems, the S&P 500 ended up at 4770 and posted a blockbuster 26% whole return for the yr (rounded).

Think about this yet one more reminder that forecasts are nothing greater than guesses and within the context of portfolio technique, meaningless. Enjoyable? Certain! We did them in the beginning of 2023 for enjoyable and spoke about them on our market recap podcast. (Talking of: Our 2023 Recap + 2024 Outlook podcast drops subsequent week – don’t overlook to subscribe!)

However let’s overview in what I’ll try and be a truncated format. Since all of us KNOW what occurred, I’ll simply spotlight it with out a ton of element:

- Most forecasters on Wall Road analysts affiliated with the big-name corporations forecasted a adverse yr for the market in 2023. Please reference that plus 26% return on the S&P. Finish of knowledge. Any extra commentary must be inferred whereas picturing me with a smirk. The perfect forecast is that endurance and self-discipline will drive your future investing success. You may write that down.

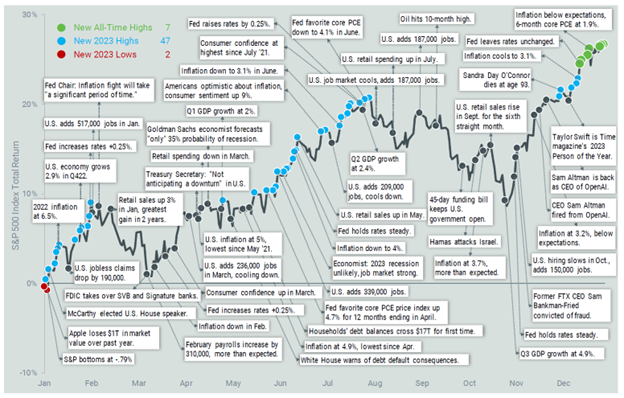

- An in depth second place to the inaccurate forecasting for market returns was the expectation that disaster after disaster would proceed to drive the market down in 2023. There was no scarcity of doom and gloom on the tv as information similar to a banking disaster, the prediction of the demise of the US greenback, a debt downgrade, a authorities shutdown, a constitutional disaster within the Home, in addition to loads of mini disaster’s created continuous adverse information commentary and house for whole jackasses to foretell the tip of the world. I imply, simply take a look at this graphic whereas remembering the 26% whole return on the S&P 500. (Hat Tip: American Century Investments)

- By the best way, by the tip of 2023, not solely did all that stuff occur within the above chart, however in extra to shares ending up close to an all-time excessive, gold was at an all-time excessive, properties had been nonetheless hovering close to all-time highs, bonds had been up 5% after two full years of shit returns, private web value was at or close to all-time highs and debt to earnings was NOT at an all-time excessive.

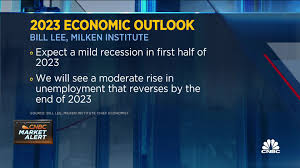

- Now let’s speak about that recession. You recognize the one which by no means materialized? The fixed requires a recession had been unrelenting. Not solely was there no recession after forecasters typically agreed that GDP can be adverse for all the yr, however we truly noticed an actual after-inflation GDP development of about 2.6%. As Jeff Spicoli stated in Quick Occasions at Ridgemont Excessive, “Not. Even. Shut. BUD!” None of those folks under had any info concerning the future (as a result of, say it with me), “They don’t exist.”

My novel thought: What in the event you IGNORED THEM ALL and simply centered on having the money it’s essential reside on for a yr or two safely tucked away and the remainder was invested in a effectively allotted portfolio for long term? - Now, that stated, I’ll admit that I used to be not within the camp that believed the Fed would obtain a tender touchdown however up to now it seems like they pulled off the not possible. Inflation has come down, the financial system is undamaged, and the inventory market mirrored each of these issues. Inflation is now hovering round a standard historic studying, unemployment remains to be under 4%, and by the tip of 2023 the market was hovering close to and all-time excessive. Please direct me to anybody who predicted that in January of 2023 as a result of I wanna ship them a Monument branded Yeti espresso mug.

- Wait…what about inflation? This may occasionally have been the one subject I may have been accused of pounding the desk on. I had a couple of completely different weblog and video postings together with some podcast commentary going out on a limb suggesting inflation COULD BE correcting sooner than consensus and insinuated the market would react positively to that discovery. I wasn’t making a name (learn: I used to be, however I gave myself an out) however I used to be asking anybody who listened to CONSIDER what would occur. Like everybody above, I had/have NO FACTS ABOUT THE FUTURE besides I do have conviction and right here it’s: Having money to reside out of throughout selloffs and staying invested is the easiest way to handle portfolios for individuals who have to develop wealth. Under is the quilt of June 2023 difficulty of The Economist adopted by a snapshot of a paragraph from my August 2023 Weblog titled “Why is Everybody Nonetheless Twisted-Up About Inflation? Let’s Have a look at the Terminology”. (Extra ideas on this in my 2024 part under).

- Bond costs had been CRAY CRAY! Do you know that from 2001 to 2021, bonds often had round 10 days in every year the place their costs moved by greater than 1/2 of a p.c or extra? AND – do you know that in each 2022 and 2023, bonds averaged about 66 days the place costs moved by 1/2 of a p.c or extra? That’s a variety of volatility and nobody was anticipating it. Bond rates of interest are yielding ranges I’ve not seen since I began within the enterprise they usually warrant consideration. Additionally, in the event you say you don’t like bonds at their present yields, simply go forward and admit you’ll NEVER like bonds and go determine the right way to safely assemble a 100% fairness portfolio that works for you, and simply OWN IT.

In fact, there was much more to 2023, however these are the issues I assumed had been fascinating sufficient to have some enjoyable writing about.

What About 2024?

First, in spite of everything this, are you interested by what we stated LAST yr right now? Right here you go. However right here’s a spotlight:

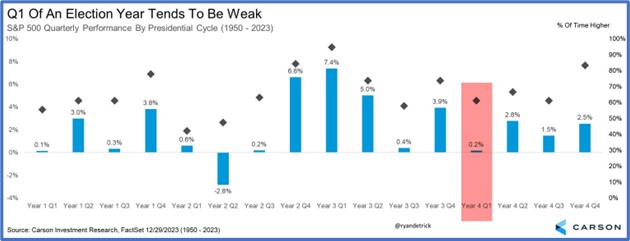

Second, the primary quarter of an election yr has traditionally been weak with the remainder of the yr doing effectively. Be ready for that if it materializes. Under

(It’s kinda minimize off however the diamond within the chart represents the share of time that the market is increased – Hat Tip @RyanDetrick).

Third, however hooked up to the second level, my intestine tells me that January 2024 may very well be unstable simply primarily based on the truth that folks will diversify out of some positive aspects they’d in 2023 and to offer them 16 months to cope with the tax invoice. Institutional portfolio managers will reset asset allocations by promoting winners and allocating to different lessons which are underweight primarily based on efficiency. That is NOT for motion; I’m simply passing alongside a intestine feeling.

Right here’s the Actual Secret

Some issues in investing by no means change: Investor overconfidence, feelings (each concern and greed), recency bias (I wrote about that right here and right here), loss aversion, psychological accounting and affirmation bias (I wrote about that right here). Particularly affirmation bias…individuals are on a endless quest to seek out the investing data that aligns with their beliefs.

However right here’s the actual secret…the actual edge…the REAL alternative…

None of it issues. All the data folks search or suppose they’ve is already priced in. There are six billion folks on this planet, and there’s no (legally) actionable data or mental edge that exists or actually issues.

Simply ask this man…he’s a billionaire who runs the biggest hedge fund on this planet. He could carry more cash in his pocket than I’ve to my identify, however he doesn’t have any extra info concerning the future than I’ve.

Look I’ll not know shit concerning the future, however to one of the best of my information, no Monument portfolios had been down -7.6% final yr, both. And individuals are probably paying this hedge fund man 2% per yr administration charges on their belongings on prime of surrendering 20% of earnings above some threshold.

So, what’s my level? The actual edge in investing comes from chopping wooden and carrying water – the onerous, unglamorous, repetitive, mundane chores that should be carried out.

Grasp the fundamentals as a result of the fundamentals aren’t truly fundamental. Simplify shit, perceive shit, and be a greater investor.

What’s Vital to Know About Us

In a world centered on niches, our area of interest is working with people who find themselves sick and bored with getting unhealthy recommendation from monetary salespeople who sound and speak like timeshare salespeople.

Giving folks unfiltered opinions and simple recommendation is our worth proposition. It’s no extra sophisticated than that.

Oh, effectively, we additionally love canine within the workplace, so whenever you work with us, you get that worth too. Search for them on our Instagram account @monumentwealth.

Preserve trying ahead and let’s have an awesome 2024,