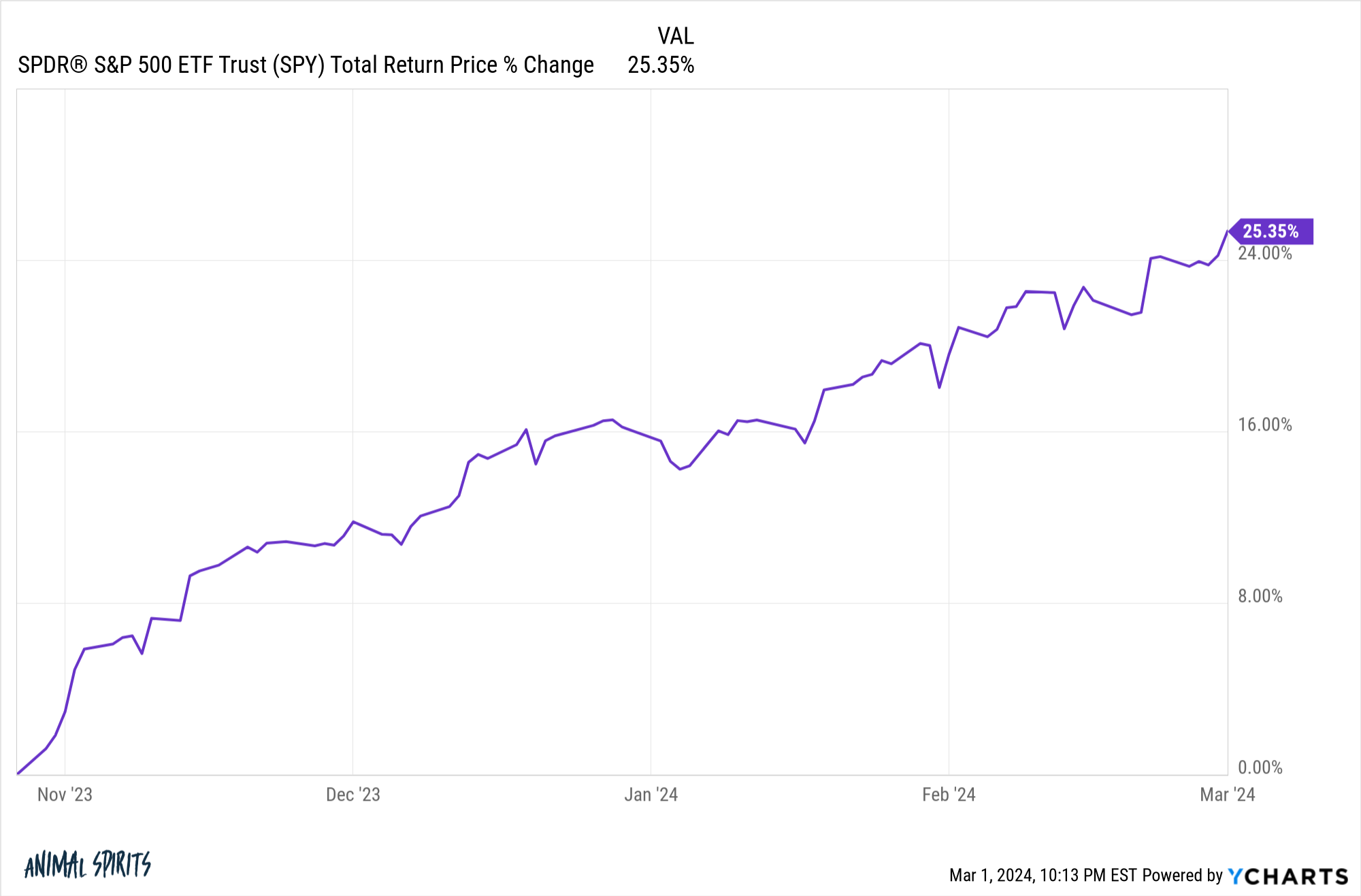

From the underside of the short 10% correction in late-October of final yr, the S&P 500 is up greater than 25%:

Markets typically transfer quick which is why timing them might be so tough. The market clearly can’t sustain this tempo ceaselessly.

New highs within the inventory market are likely to result in extra new highs however typically the inventory market wants a breather, even in a bull market.

Nobody can predict the timing or magnitude of corrections within the inventory market. It’s far too unpredictable for that.

However it does really feel like a correction can be wholesome in some unspecified time in the future. I do know corrections by no means really feel wholesome within the warmth of the battle however they are often useful to keep away from complacency and provides traders a greater entry level.

Traders concentrate on the crashes and bear markets for good motive — they’re painful to dwell by.

However what if we take out the large downturns and concentrate on the corrections as a substitute? , the wholesome ones.

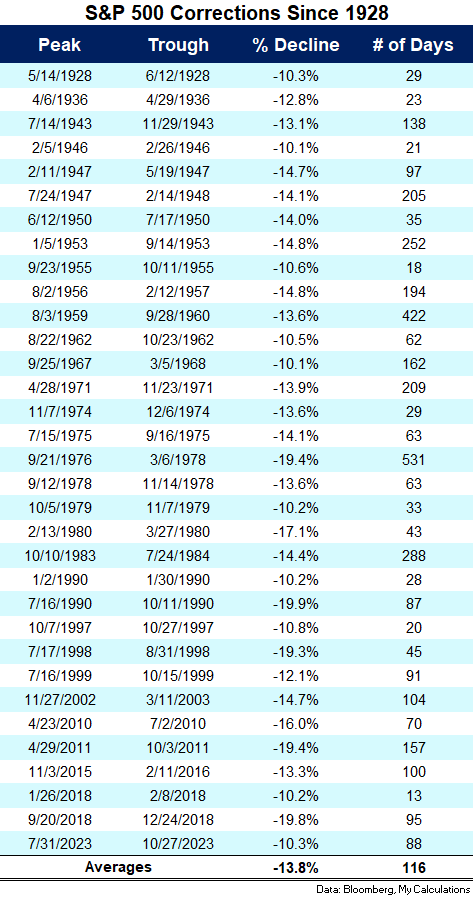

Right here’s a take a look at the double-digit corrections that by no means bought to the bear market degree (down 20% or worse) since 1928:

By my depend we’re 33 corrections over the previous 97 years. The typical wholesome correction was a lack of 13.8%, lasting 116 days from peak-to-trough, on common.

I’m positive most of those corrections felt like they had been going to show right into a bear market on the time however a wholesome correction is extra possible than a crash more often than not.

Unhealthy markets happen throughout dangerous instances however shorter-term downtrends can even happen throughout longer-term uptrends.

The 2010s was a superb run for the S&P 500, but you continue to had 4 double-digit corrections.

The late-Nineteen Nineties is among the finest stretches of positive factors in historical past:

- 1995: +37%

- 1996: +23%

- 1997: +33%

- 1998: +28%

- 1999: +21%

Regardless of these insane returns, three separate double-digit corrections had been sprinkled into this five-year interval.

The Fifties is probably the most underappreciated bull market of all-time.1 The U.S. inventory market was up practically 20% yearly on the last decade. There have been 4 corrections throughout these positive factors together with a minor bear market close to the tip of the last decade.

The S&P 500 is up round 70% in whole (13.5% annualized) within the 2020s to date although we’ve skilled two bear markets.

Two steps ahead, one step again.

I’m by no means going to attempt to predict a inventory market downturn as a result of I don’t have the flexibility to do this.

Nonetheless, you will need to put together your self for the truth that corrections are a pure a part of the inventory market, in good instances and dangerous.

A wholesome correction within the coming months may be a superb factor if it helps stave off an unhealthy correction down the road.

Additional Studying:

How Usually Do Bear Markets Happen?

1Primarily as a result of nobody was actually invested in shares on the time. The Nice Despair crash was too scary.

This content material, which incorporates security-related opinions and/or info, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There might be no ensures or assurances that the views expressed right here might be relevant for any explicit info or circumstances, and shouldn’t be relied upon in any method. It’s best to seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “put up” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital property, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding advice or supply to offer funding advisory providers. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding resolution. Previous efficiency will not be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from varied entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or suggest endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the danger of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.