A reader asks:

Ben, I really like studying your work. Shares, bonds, and money are the classes to match nevertheless it hit me as a “boomer” retired, what about dwelling possession as a comparability? Keep heat!

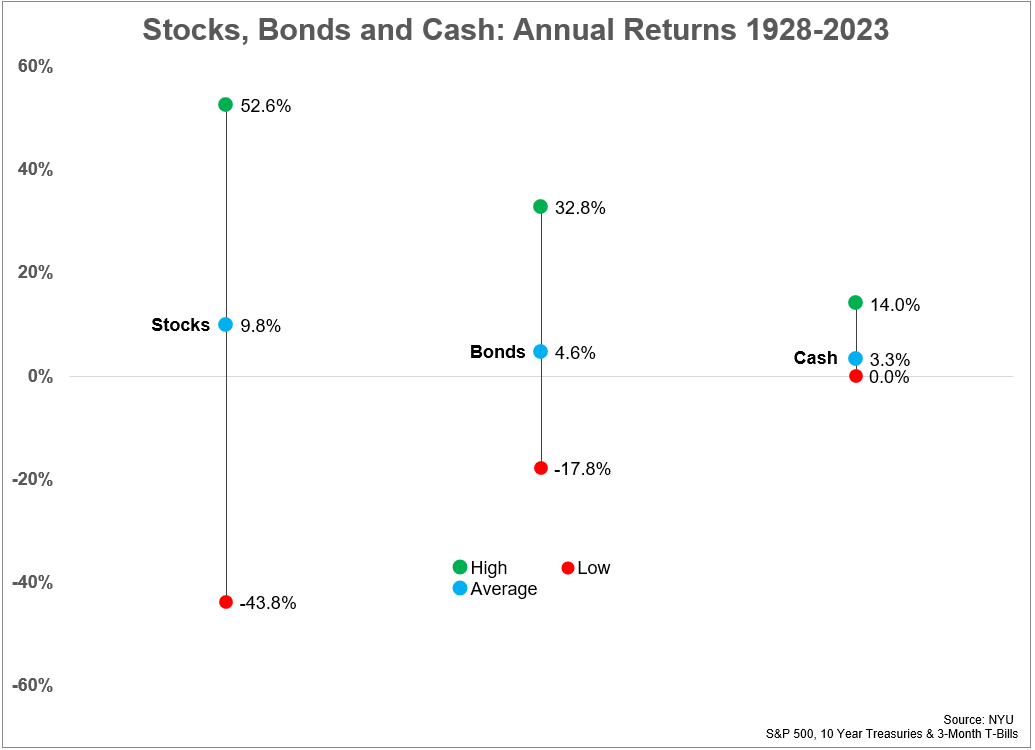

This query was in response to my latest piece on the historic returns for shares, bonds and money:

There are usually a good variety of requests for different asset courses each time I submit this type of information.

As luck would have it, my favourite useful resource for historic asset class returns just lately added housing (and gold) to the combo. These are the annual returns from 1928-2023 for shares, bonds, money, housing and gold together with the annual inflation quantity:

- Shares +9.8%

- Bonds +4.6%

- Money +3.3%

- Actual Property +4.2%

- Gold +4.9%

- Inflation +3.0%

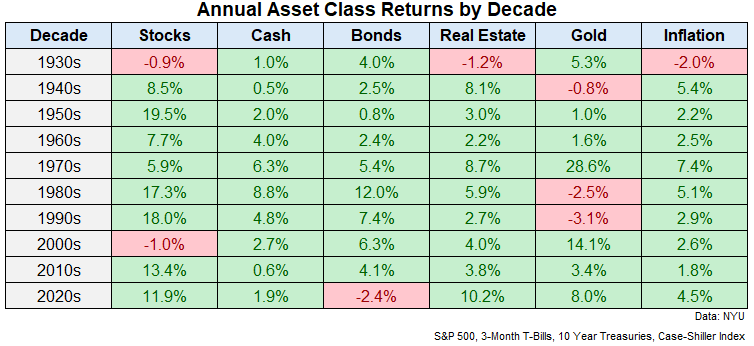

Now right here they’re damaged down even additional by decade:

The 2020s have been an aberration for housing returns. Housing costs are already up almost 50% in complete simply 4 years into the 2020s. That’s already higher than the full returns for your complete a long time of the Nineties, 2000s and 2010s.1

The historic returns for shares have crushed actual property returns whereas bonds and gold have performed barely higher than proudly owning a house.

So does this imply housing is a awful funding?

Not essentially.

The Case-Shiller Index does job of monitoring housing costs on a nationwide foundation however that doesn’t imply it’s proxy for returns on housing.

Calculating returns on shares, bonds, money, and gold is pretty easy. You’ve the start value, the ending value and any money flows that have been earned alongside the best way.

None of those historic returns embody charges or taxes however charges are so low lately with the arrival of ETFs and index funds that frictions aren’t an enormous deal anymore.

Housing is probably the most distinctive of all monetary property in a variety of methods.

To begin with, there may be the leverage part. Positive, some individuals pay money for his or her dwelling however most individuals borrow cash to make the most important buy of their life.

Let’s say you place 20% down on a $450,000 home. Then it subsequently rises 25% in value so your home is now price $562,500.

Gross of all prices what’s your return?

Is it 25%? Or is it truly 125%?

The worth went up $112,500 however your preliminary funding was solely $90,000. That’s a return of 125% in your preliminary funding.

So possibly housing is an excellent higher funding than most individuals assume?

It relies upon.

Over the lifetime of your mortgage you need to pay curiosity bills, insurance coverage, property taxes, upkeep and maintenance. Plus, many owners refinance their loans which prices cash. Individuals renovate (additionally costly).

Bid-ask spreads for ETFs are infinitesimally small. That’s not the case within the housing market the place frictions are huge. Once you purchase a house there are transferring prices, closing prices, inspections, title insurance coverage and different charges the banks seemingly make up. Promoting your home requires many of those identical charges together with realtor prices.

Confused but?

And even should you stored observe of all these bills in a spreadsheet to tally up your true price of dwelling possession, there may be the truth that you need to reside someplace. Should you weren’t paying your mortgage you’d be paying hire someplace, which has an inflation part to it.

Does anybody actually know the way far more they’re spending (or possibly saving) by proudly owning versus renting?

Add all of it up and I don’t assume there’s a single individual in America who can confidently state what the return is on their dwelling. That’s why I don’t assume there’s a reliable technique to gauge the true historic return for housing like there may be for the opposite asset courses.

The numbers from Robert Shiller are in all probability proper directionally from a value perspective, however that claims nothing of the particular return most householders obtain.

Now, should you’re shopping for and promoting rental properties, it’s a lot simpler to account for the ROI from a price perspective by way of the asset’s price, how a lot you’re bringing in each month in hire, and the way a lot you’re shelling out in prices.

However most individuals don’t absolutely grasp what the return is on their dwelling.

For some individuals, it’s in all probability significantly better than they assume relying on timing and site. For others, it’s seemingly worse than they assume.

And that’s OK!

We shouldn’t be evaluating the roof over your head to an S&P 500 index fund. Vanguard doesn’t present you shelter once you purchase an index fund. It’s unimaginable to compute the psychic revenue you get from proudly owning a house within the neighborhood and faculty district you need.

If I needed to guess the precise returns on housing in America are in all probability nearer to the inventory market than the bond market due to the leverage concerned. Housing costs principally go up and infrequently fall. Even a small regular return once you’re solely placing 20% or much less down could make for an exquisite return over the lengthy haul.

However housing is way too circumstantial to place a quantity on it with out making a ton of assumptions.

I like to think about my home as extra of a house than a monetary asset nevertheless it does present a pleasant hedge in opposition to inflation and the flexibility to borrow in opposition to it if want be.

For most individuals, it’s a type of pressured financial savings, which is much more necessary than the precise return.

Both manner, I don’t assume it is smart to match your home to shares, bonds, gold, crypto, or some other asset class.

Housing is probably the most emotional asset you possibly can personal.

We mentioned this query on the most recent version of Ask the Compound:

Kevin Younger joined me once more immediately to reply questions on proudly owning shares with large losses, paying off scholar loans vs. shopping for a brand new home, making a will for your loved ones, and the way a lot you possibly can truly put into your varied retirement accounts every year.

Additional Studying:

There’s No Index Fund for the Housing Market

1The Nineteen Seventies was by far the most effective decade for housing returns, up greater than 130% in complete however that was aided largely by sky-high inflation.