Yves right here. That is the second publish now we have run of late that questions the thesis that peak oil will set in earlier than 2030. Right here the argument is that key sources of total vitality demand have been ignored, and that demand will perpetuate fossil gas use. Individually, the powers that be are attempting to extend using electrical energy from photo voltaic panels with out having addressed wanted grid investments or how you can tackle base load wants. This planning failure can even sluggish the shift away from oil and gasoline.

By David Messler, an oilfield veteran, just lately retired from a serious service firm. Throughout his thirty-eight 12 months profession he labored on six-continents in discipline and workplace assignments. He presently maintains an unbiased coaching and consulting apply, and writes on vitality associated matters. Initially printed at OilPrice

- The IEA predicts peak oil demand in 2028 because of the shift in direction of cleaner vitality applied sciences.

- OPEC disagrees, forecasting rising oil demand pushed by rising vitality wants in rising economies.

- Two key elements typically neglected in oil demand forecasts are the expansion of the center class in rising economies and the vitality demand for synthetic intelligence.

It’s pretty widespread these days to see comparatively near-term estimates for a degree at which demand for petroleum-based fuels begins to say no. The time period typically used to explain this “tipping level” is Peak Oil Demand. After I say “close to time period,” I imply proper across the nook in case you have a look at an estimate printed final 12 months by the Worldwide Vitality Company-IEA, an intergovernmental company headquartered in Paris, France, and initially established after the Oil Embargo of 1973 to assist cushion towards future oil shocks. This company has expanded its mission to a reasonably broad remit over time since, and it’s not the aim of this text to element all its endeavors. One function we are going to spotlight is that of the one it performs in gauging and advising member governments on vitality safety and vitality sources for the approaching years.

In that capability, the IEA in a report entitled, Oil 2023, and printed final 12 months settled on 2028 because the 12 months previous which using petroleum fuels will start to say no.

“Progress on the planet’s demand for oil is ready to sluggish nearly to a halt within the coming years, with the excessive costs and safety of provide considerations highlighted by the worldwide vitality disaster hastening the shift in direction of cleaner vitality applied sciences, based on a brand new IEA report launched at the moment.”

This view is essentially shared, notably with respect to liquid motor fuels, by different companies and organizations that produce lengthy vary estimates. The U.S. Vitality Data Company-EIA, Rystad, and Det Norske Veritas- DNV, all present this class tailing off quickly within the 2030s as electrical autos assume bigger shares of passenger autos. We are going to name this the “Bear Case” for liquid fuels.

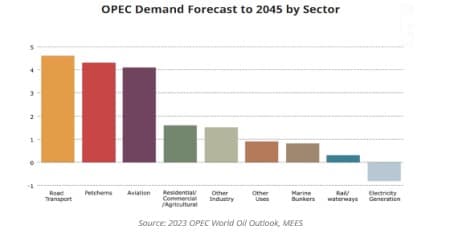

As you would possibly anticipate the Group of Petroleum Exporting International locations-OPEC, disagrees with this view. The truth is of their current report on oil demand outlook, printed in Nov 2023, they see oil demand of every kind, apart from electrical energy technology, rising from ~105 mm BOPD in 2025, to 116 mm BOPD in 2045. This forecast present use of oil as a street gas persevering with to be the most important supply of demand improve for this era.

The report notes that “the divergence between the IEA and OPEC outlooks is essentially resulting from assumptions concerning the velocity at which inside combustion engine autos can be changed by electrical autos.”

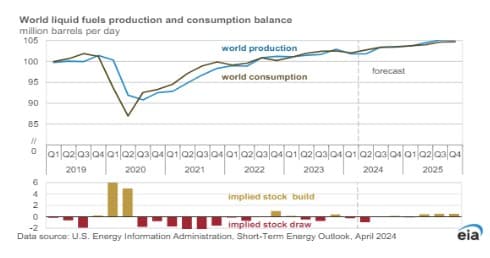

What’s fascinating is that it is extremely tough, if not unattainable, to see a manufacturing development being established that will help the bear case. Within the U.S., we’re pumping at a charge of over 13.2 mm BOPD and nonetheless importing ~6.7 mm BOPD to feed our almost 22 mm BOPD day by day behavior. The U.S. Vitality Data Company-EIA forecasts of their month-to-month Quick-Time period Vitality Outlook-STEO that by the tip of 2025, world manufacturing and demand fall into a reasonably tight steadiness at 105 mm BOPD. That definitely isn’t a long-term development, however as is usually mentioned, the long-term development is made up of a bunch of short-term ones. In my view, I’d say that the development line within the STEO graph beneath matches the OPEC estimate extra intently than the opposite three.

Each of those notions can’t be true. Which is the proper assumption about future oil demand? Or are they each fallacious? What are two elements these two disparate views of oil demand are usually not bearing in mind?

The primary reply lies in the way you interpret the expansion of the center class in China, India, and Africa when it comes to vitality demand and the ultimate type it should take. The second is the arrival of vitality demand for Synthetic Intelligence (AI), a completely new supply of demand that’s simply now beginning to seem in vitality demand forecasts. I mentioned one attainable final result of this demand for U.S. pure gasoline in an article in March 2024.

To be clear, I’m not arguing that AI demand will instantly impression crude oil demand as a main supply. Most analysts are factoring renewables and pure gasoline to fulfill AI demand. What is going to impression demand for WTI and different baskets of crude is the connection to gentle oil manufacturing within the U.S. and the related gasoline that’s produced together with it. We are going to go away that dialogue for a future article and refocus on our fundamental subject. What may oil demand really be when accounting for progress in presently underserved however upwardly aspiring decrease lessons?

Then there’s the Bull Case for oil. Arjun Murti, a well known vitality commentator and companion at vitality analyst agency Veriten, in addition to a former Goldman Sachs vitality analyst, mentioned future vitality demand in a current podcast on his Tremendous-Spiked weblog. Within the episode titled, “Everyone seems to be Wealthy,” Arjun posits what the impression on world vitality demand could be if everybody was as energy-rich because the “Fortunate,” 1.2 billion those that reside within the Western World. Extra particularly, Arjun asks what it could imply for the opposite 7 billion folks in China, India, Asia, and Africa to have the life-style that Individuals, Canadians, Europeans, and some different international locations get pleasure from. The reply he comes up with on an absolute foundation, 250 mm BOPD, utilizing a reference level of 10 bbls a 12 months!

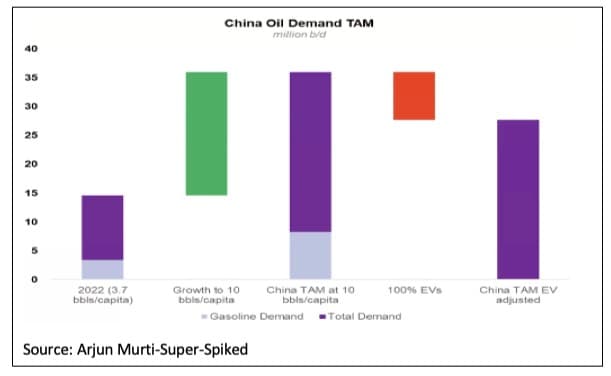

The place are we now? The U.S consumes ~22 bbls of oil yearly per capita whereas China consumes 3.7 bbls per capita. Indians use simply 1.3 bbls each year. That’s a reasonably extensive hole, and as Arjun notes, “financial progress and vitality progress are one and the identical. You don’t get financial progress with out ample vitality.”

One of many arguments put ahead by the Peak Oil crowd is that effectivity progress Gross Home Product (GDP), and vitality substitution will bend the curve on oil demand, as famous within the 2030’s, and spell the twilight of fossil fuels. Arjun factors out that there’s merely no proof that is taking place utilizing knowledge compiled by Goldman Sachs by 2019. Effectivity positive factors by no means decrease the quantity of vitality wanted to supply an extra greenback of GDP, above 2.7% GDP progress. A degree hardly ever hit in trendy occasions. To shut that hole and attain progress you want extra vitality inputs. Oil.

Taking a look at Arjun’s graph beneath, which makes use of China for instance, we are able to see with their current demand of three.7 bbls per capita which equates to about 15 mm BOPD. With 10 bbl each year added on for progress within the center class, you get to 35 mm BOPD to fulfill Chinese language vitality demand. Even when China attains 100% Electrical Car-EV penetration, not one thing Arjun (or I) imagine is feasible, you continue to have 27 mm BOPD of oil demand. In response to SP World China produces about 4.1 mm BOPD, leaving a spot of about 11 mm BOPD they have to import to fulfill present-day demand.

A degree that leads me to what Arjun famous as the final word demand limiter and why, though international locations that can certainly want to extend their oil utilization is probably not in a position to take action. Geopolitical limits to imports. Quoting Arjun, “There isn’t any precedent for international locations importing 20-30 mm BOPD” to fulfill their vitality wants. The U.S., earlier than the arrival of shale manufacturing was importing over 10 mm BOPD as just lately as 2005. That’s what we all know is feasible.

It needs to be famous that India is in the same repair and for it to fulfill Arjun’s 10 bbl per capita customary for being wealthy, they have to import 35-45 mm BOPD. We simply don’t know if this may be finished from each a logistical and sheer capability of provide foundation. Because the EIA graph above highlights world oil manufacturing has elevated solely about 3 mm BOPD since 2019. To ensure that the world’s poor to turn out to be richer, an excellent deal extra oil must come to market.

Your Takeaway

The message of the expansion of the center class globally typically will get misplaced within the fixed blare of local weather change and vitality transition noise. The very fact stays that the world we reside in at the moment and the one more likely to exist at mid-century, runs on oil.

The notion that the world can shortly and painlessly transition to different types of vitality has developed some, not holes, however gaping craters in current occasions. Offshore wind farms are being canceled as prices mount. Automobile producers are delaying implementation of EV rollouts resulting from lack of curiosity from customers. Communities impacted by siting of photo voltaic farms are pushing again on land use as they suggest to gobble up massive tracts for this function.

Roger Pielke, one other well-known vitality commentator and writer, in a publish in his Substack, The Trustworthy Dealer, cites a White Paper by Vaclav Smil that discusses our vitality transition progress to this point-

“All now we have managed to do midway by the meant grand world vitality transition is a small relative decline within the share of fossil gas on the planet’s main vitality consumption—from almost 86 % in 1997 to about 82 % in 2022. However this marginal relative retreat has been accompanied by a large absolute improve in fossil gas combustion: in 2022 the world consumed almost 55 % extra vitality locked in fossil carbon than it did in 1997.”

Balanced towards this lack of progress in substituting oil for different types of vitality is the truth that the world’s vitality provide is in a good steadiness with demand at current. If the poor of the world make even modest progress towards Arjun’s 10 bbl each year prognostication within the coming years, the Bull Case for oil will definitely asset itself.